20 U.S. small business statistics for summer 2024

Although corporate behemoths and big chain stores might seem to be taking over the commercial landscape, the reality is that small businesses continue to be vital in our day-to-day lives.

Whether you are just a consumer or own a company yourself, learning about the role they play is important in understanding the fabric of our current lives.

General small business statistics.

There are over 33 million small businesses in the United States. That translates into just a little less than one for every man, woman and child in the country.

Out of that 33 million, slightly under half have only existed since 2021. Considering the ravages the pandemic brought to the nation’s economy, this is a heartening statistic.

The term “small business” is somewhat misleading. In order for a company to be placed in this category, it only needs to have under 1,500 employees. That means that many seemingly medium-sized entities can actually fall into this designation.

That being said, the vast majority, 99%, had fewer than 500 workers, with the average number of staff members coming in at just under 12.

Small business finance statistics.

Although most small businesses do not employ a great number of people and may only have one physical location, that does not mean it is inexpensive to get them up and running. In fact, the average price to get started ranges from a quarter to a half million dollars.

Factors that go into that price include inventory, office space, equipment, staffing, hardware and software, security infrastructure, insurance, legal and licensing fees, and other miscellaneous expenses.

Out of the various costs listed above, labor represents by far the most significant proportion. Salary is just part of what goes into this figure. It also includes onboarding, ongoing training, health insurance, and other benefits.

A widely held myth among many Americans is that corporations and even small businesses do not carry their fair share of the tax burden. In fact, the average small business pays at a 19.8 tax rate. This means that many are sending far more than this amount Uncle Sam’s way.

Paying the high cost of benefits, particularly health insurance, can seem onerous to many entrepreneurs. However, they also reap the rewards.

This is because many workers, an estimated 40%, state that it is these benefits that provide a strong incentive to stay with their current employer.

When staff members remain loyal and productive, they become the beating heart of the places where they work. As a result, they make it possible for profits to flow in.

On a national level, these financial gains combine to pad the gross domestic product, making it possible for the U.S. GDP to grow by 44% thanks to the small businesses that help to support it.

Small business technology statistics.

Companies of all sizes have begun to rely on the advantages that technology brings. It comes in the form of point of sale systems that aid in efficient payments, inventory and employee management, customer relationships, and report generation. Furthermore, most entrepreneurs also take advantage of security software and other cloud-based storage solutions to protect the data they store, manage and transmit.

All of these systems are regulated by a significant number of state and federal regulations.

Considering that it takes knowledge, time and resources to comply with them, it is no wonder that at least half of today’s small business owners are concerned about their ability to adhere to the constantly evolving landscape of rules that have been imposed.

An estimated 95% of small business owners have now come to rely on technology platforms to enhance their efficiency.

Just in the past few years, they have come to use these automated and often wireless systems to help with invoicing, inventory monitoring and ordering, customer communications, accounting and even tax preparation.

Given the vastly increased role that technology now plays and the speed with which it is changing, the role of artificial intelligence may eventually come to be a concern for many business owners.

However, most solo business owners still believe that AI will not have a noticeable effect on their operations in the near future.

More than nine out of every 10 business owners now opt to use at least one technology platform to aid them in their company’s day-to-day functions. Even micro-businesses are finding that these automated systems can reduce the impact of human error, cut costs and save time. As a result, they can use their resources for what really matters: growing their business.

One in every three business owners have recognized the power that artificial intelligence can already wield when it comes to their information technology processes. After all, it is within IT systems where security breaches frequently occur.

Using algorithms, machine learning and social engineering, AI can detect patterns and warn entrepreneurs about potential payment-based fraud and other types of hacking events before they happen.

Small business banking and payments statistics.

It seems like it was only yesterday when cash and checks ruled the payments universe. However, they have been replaced with credit cards, bank transfers, e-wallets, and cryptocurrency virtually overnight.

Although traditional ways to pay remain preferred by a small but loyal percentage of customers, almost half of today’s entrepreneurs believe that digital payments will gain supremacy at some point in the not-so-distant future.

Even so, there are still a few store owners who remain reluctant to put cash and checks behind them. An even smaller number still obstinately refuse to invest in the hardware and software required to accept digital payments. Some cite the cost, which can hover close to $2000 for the equipment.

However, the tide of consumer preference is inexorable. At this point, eight out of 10 adult shoppers have access to credit cards, which provide them with a convenient and secure way to pay for merchandise.

In many cases, these individuals will spend more when using plastic than they would with cash, furnishing both them and the retailer with an indisputable benefit.

Although some payment hardware can represent a monetary hit for financially strapped business owners, almost everyone can afford the cost of the card readers and point of sale apps that can be integrated into an owner’s iPhone or Android.

These systems provide secure, efficient ways to take payments using familiar equipment that most people already possess, enabling consumers to have added choices and representing the chance of greater profits for retailers.

The internet continues to play an ever-growing role in the business landscape. Two out of every 10 purchases are made online, underscoring the importance of a website that is secure, comprehensive and easy to navigate regardless of a company’s product offerings or size.

Embed This Infographic

Click the button below to copy the embed code to your clipboard.

document.getElementById('copyButton').addEventListener('click', function() {

var textarea = document.getElementById('embedCode');

textarea.select();

document.execCommand('copy');

alert('Embed code copied to clipboard!');

});

Related Reading

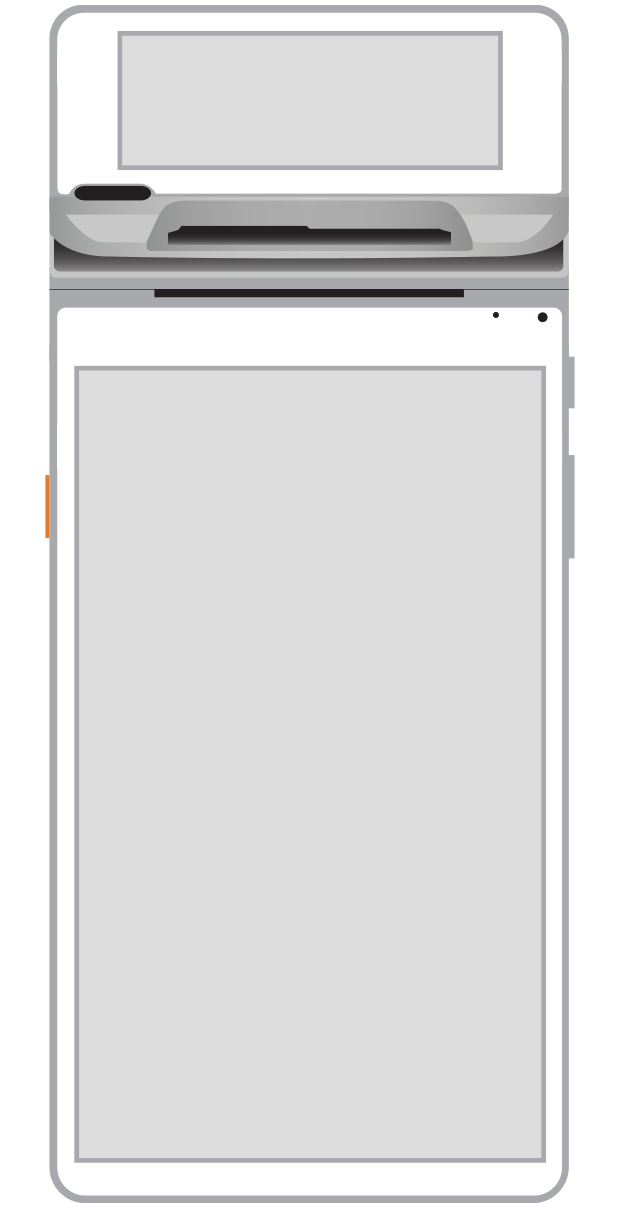

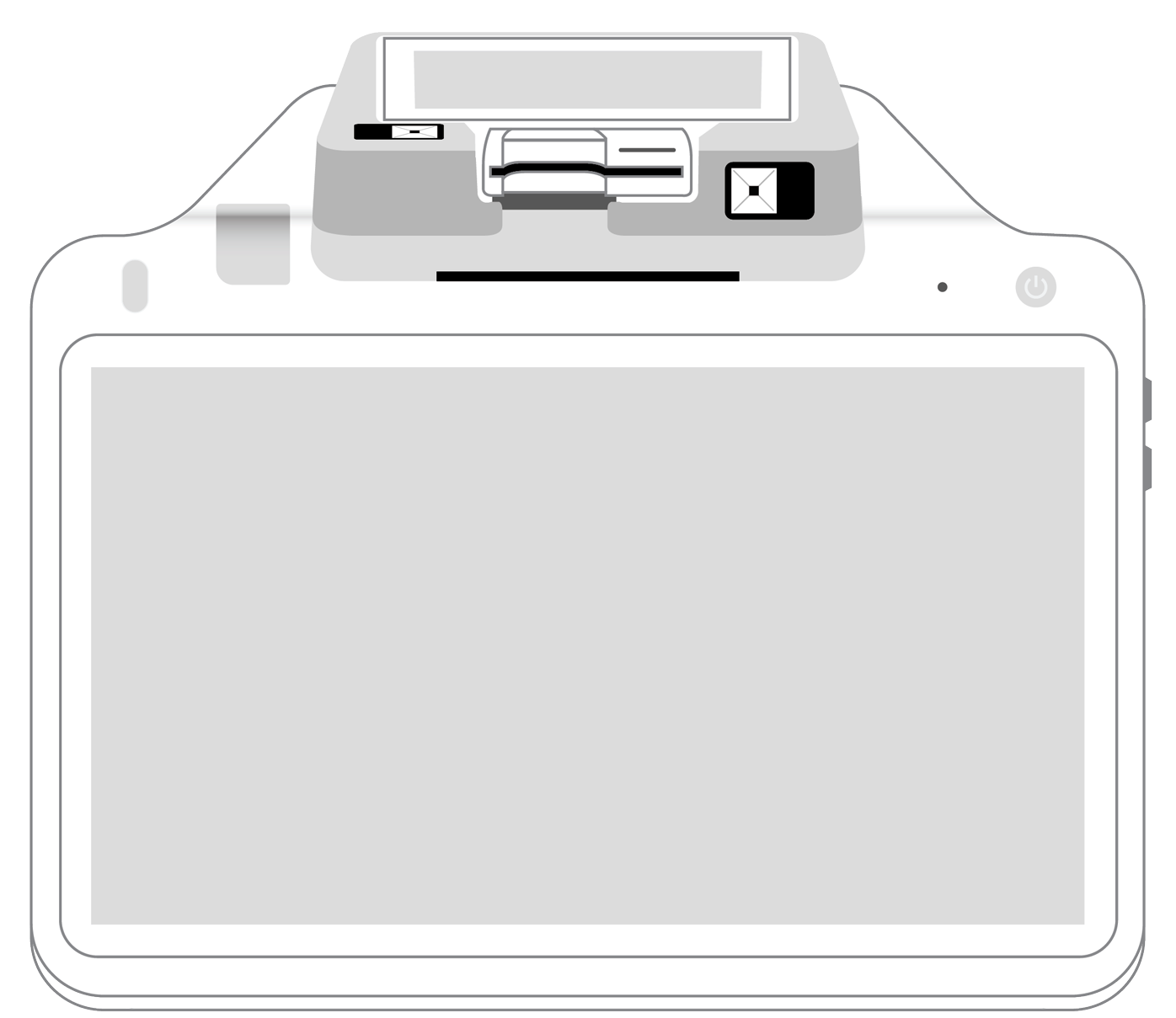

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||