4 ways to ensure safe payments.

As a business owner, nothing is more important than providing a positive overall experience to your customers. However, making sure that you get the money they owe you runs a very close second. Providing a variety of payment methods and options can go a long way toward ensuring that you achieve both of these goals. Furthermore, in a time when your employees and customers may be wary of their health and safety, offering safe payments options that promote proper social distancing should be a top priority.

Debit and credit cards.

Accepting plastic is pretty much a given these days. If you operate a physical retail store, that means obtaining a merchant account separate from your business account, as well as a point of sale (POS) system or credit card processing app that interacts with all of the other players in the authorization, verification, and payment process.

ACH payments.

Administered by the National Automated Clearing House (ACH), this payment method allows consumers to provide you with their bank account and routing numbers so that electronic payments can be withdrawn. Recurring and subscription-based businesses often employ this payment style since it saves time, improves cash flow, and makes your revenue more predictable.

Recurring billing.

Although some people are wary about providing the bank account information necessary to set up ACH payments, many are fine with initiating recurring billing. This convenient process involves having a recurring bill charged to a customer’s debit or credit card, resulting in an uncomplicated and time-saving experience for everyone involved.

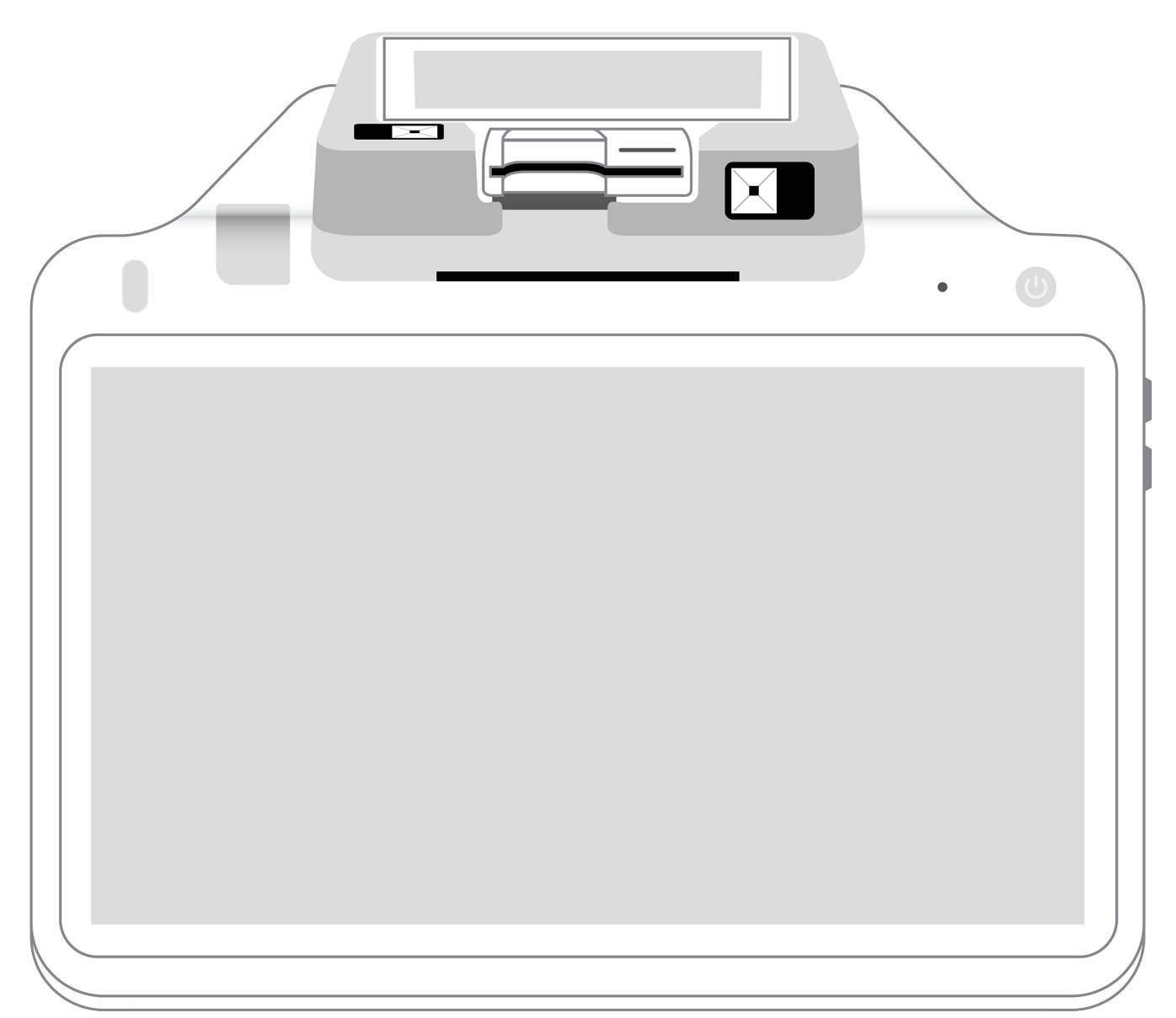

Touchless payment systems.

These days, the less contact there is between customer, merchant, and equipment, the better. Contactless equipment uses near-field communication (NFC) readers to access a customer’s payment information, which is embedded into their credit or debit card, or the digital wallet in their smartphone. The transaction is completed with a simple wave near the touchless reader, yet it is encrypted and secure at the same time. Touchless payments reduce theft, increase speed, and are made in such a way that consumers do not need to fear being contaminated by brushing against potentially virus-ridden surfaces.

Meeting the needs and priorities of your customers has never been more important than right now. When you offer a variety of payment methods, those who buy your products can stay safe and spend their money using their method of choice. Meanwhile, you can help to ensure that you get the dollars you deserve. In the end, everyone wins.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||