5 Easy Ways to Collect Customer Payments

Your customers want faster, more convenient ways to pay, and giving them their wish also makes things easier for you. Say goodbye to clunky, expensive POS systems and lengthy online checkout forms, and bring customer payments into the 21st century with these accessible methods.

Accept Payments Online 24/7

There’s no longer any such thing as a “normal” schedule, which makes confining transactions to the time your business is open a pretty silly idea. If you’re only available to take orders for seven or eight hours out of every day, how many sales opportunities are you missing? How much extra time do you spend chasing down customers who are late with their invoice payments because you’re never around when they have time to square up with you? Don’t panic; the solution isn’t to stop sleeping so that you can pick up every phone call or answer emails in real time. Online payment gateways do the job for you with less frustration and no need for massive amounts of caffeine. With a reliable provider, you can start selling products and services right from your website and accept orders any time of day or night.

To simplify payments via invoice, use a gateway with an email invoicing feature. When your invoices arrive in customers’ inboxes, all they have to do is click the link to pay online and complete the transaction. This gives customers the option to pay before the actual due date of the invoice, gets your money to you faster, and beats having to chase down people who are notorious for being late. Here’s what every good payment gateway should offer:

- Seamless website integration

- Affordable monthly or per-transaction pricing

- Reliable security and data protection

- Easy-to-use administrative tools

Payments should either go directly to your bank account or be easy to transfer to the account of your choice at any time, without additional fees.

Allow for Guest Checkouts

Another essential feature of an online payment gateway is the choice to create an account or check out as a guest. This is especially useful for first-time customers who find your store through an online search, or who visit your site to take advantage of a seasonal sale but aren’t sure they’ll shop with you again in the future. The last thing a person in either situation wants is to be forced through an account creation process before they can buy something. Think about it. When you pop into a store because you saw a spectacular price on a particular item in their latest ad, or you’re out and about trying to finish your shopping, you want to be in and out quickly. You don’t expect to spend ten minutes filling in a multiple-page form when you check out. In fact, you’d probably just walk away if faced with such a frustration. Online customers feel the same way. Many would rather skip a purchase altogether than have to fill in a form giving a company information it can use to bombard them with marketing emails, and others are simply in too much of a hurry to bother with creating an account. A single poor shopping experience can destroy any chance of first-time shoppers becoming loyal customers, so do the smart thing and let them take the path of least resistance if that’s what they prefer. You can always include an option to create an account after the transaction is completed instead.

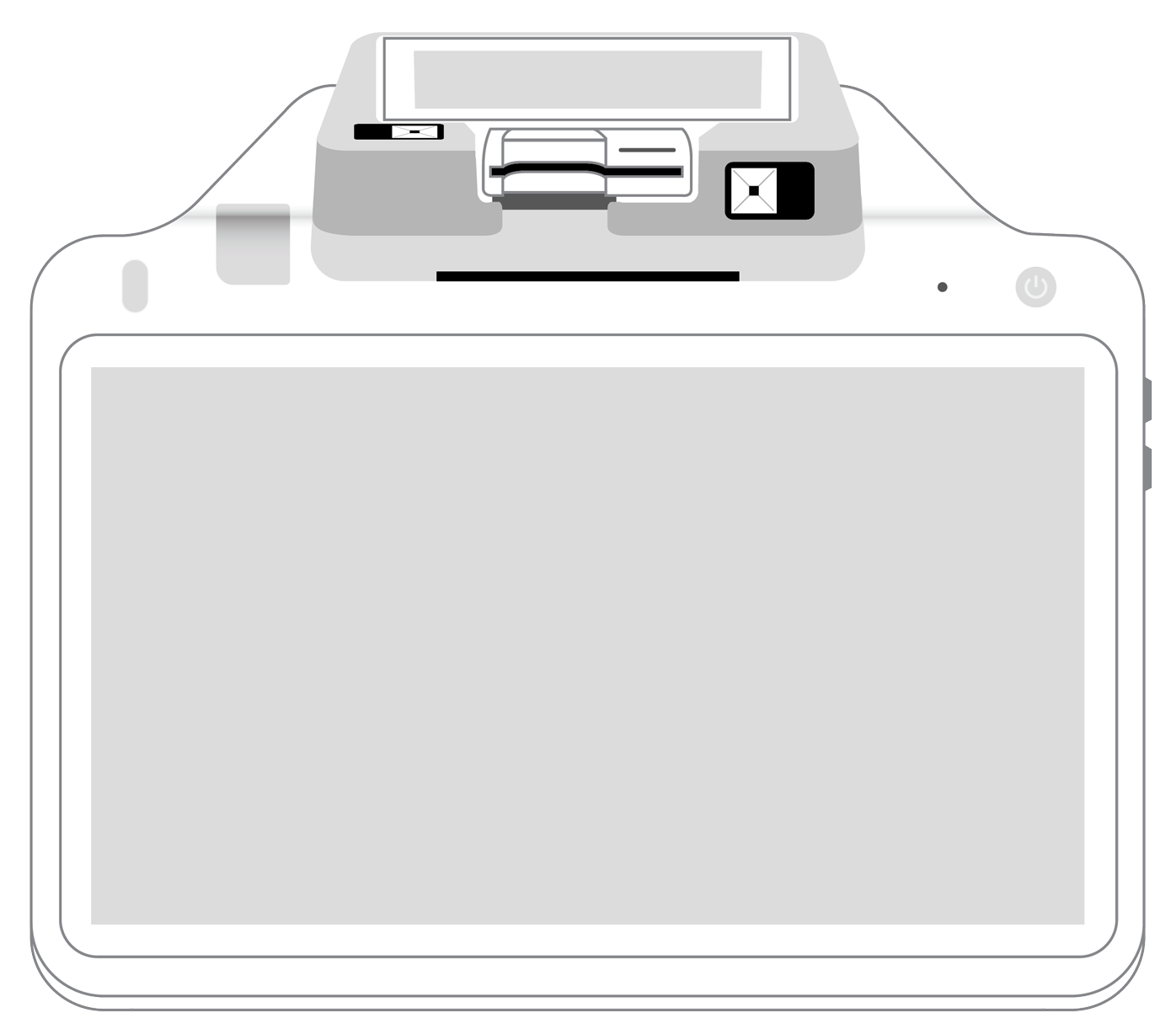

Make Your POS Mobile

Partnering with a mobile payment platform turns your smartphone or tablet into a credit card reader you can take with you anywhere. You never know when a simple conversation about what you do for a living could turn into an opportunity to make a sale, and with a mobile POS system, you can close deals on the spot. Of course, a mobile option has to be worth the price. Look for a provider with reasonable monthly or per-transaction fees, and make sure the credit card reader is compatible with your preferred device. If possible, find a POS system equipped with near-field communication (NFC) technology to allow customers to pay using their smartphones. Some platforms save customer data so that returning customers can get email receipts without the need to enter their contact information every time they do business with you. Imagine if all the people who said they’d call “later” after you gave them your business card had immediately bought a product or service from you instead. How much revenue would those sales have generated? Whether you’re a freelancer taking your personal brand and elevator pitch to a networking event, or the head of a B2B company touting your offerings at a trade show, having a mobile POS means you don’t have to wait and hope anymore. Your promotional materials won’t end up getting tossed with your customers’ weekly recycling. Instead, those who are truly interested will be able to take advantage of the option to make a purchase or enter a service agreement right away.

Mobilize Your Staff Members

Did you know you can leverage the power of mobile payments at your brick-and-mortar location? With a comprehensive POS system, employees can complete customer transactions from anywhere in the store. This means you sacrifice less space to set up static POS terminals and have more floor area to display merchandise, and your customers don’t have to haul large items to the front of the store to check out. It’s a cheaper, faster, and more streamlined way to accept in-store payments. To make this work for your business, look for a platform with robust integration options allowing for dynamic customization and seamless connectivity with existing business programs. You also want something with cross-device compatibility so that your employees can bring up the system on any device in the store. Access to CRM data makes transactions more personal and speeds up the checkout process for returning customers.

Set Up a Recurring Payment System

Sending out invoices for routine payments takes a lot of time and requires an extra step for both you and your customers. Invoices can get buried in the mail or lost in inboxes, forcing you to have to chase people down and charge late fees when payments are past due. Payment platforms solve this problem with recurring payment and invoicing tools perfect for:

- Memberships

- Subscription services

- “Subscribe and save” products

- Recurring B2B orders

Some offer additional options to cover variable bill payments or pre-approve transactions. This gives you the freedom to offer multiple recurring payment types for existing products and services or create new offerings. The system sends invoices to customers at the appropriate intervals or allows them to authorize automatic credit card payments. With this “set it and forget it” capability, you’ll never miss another recurring payment. All you have to do is fulfill orders for any physical products offered on a subscription basis and follow through on in-person services. Whether payments are weekly, monthly, or yearly, the charge shows up on your customers’ credit card statements, and the money goes to your business bank account without hassle. The cost of recurring payments varies by platform. Some providers charge only when a payment goes through; others have a flat monthly fee. Make sure you understand exactly how much you’ll have to pay before committing to a particular platform, and decide whether to adjust your subscription prices to compensate. Don’t forget to investigate how providers handle security, too, since recurring payments require sensitive customer information to be stored and transmitted. Turbo charging payments with one or more of these options makes everything from one-time checkouts to monthly subscriptions easier for you and your customers. You can stop worrying about losing sales because your ancient POS system can’t make its way through the simplest transaction, or your online payment gateway forces every customer to provide a long list of information before authorizing a transaction. Instead, customers get to choose the most convenient way to pay, and you get your money on time, every time.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||