5 tips for accepting payments on the sales floor.

Cast your mind back to the time when payment systems for retail stores were tightly tethered to the internet via wires, imprisoning cashiers behind checkout counters. Do you remember those long lines of frustrated customers, your bleary-eyed staff, and that nagging feeling that surely there must be a better way? Thankfully, there is, thanks to mobile credit card processing that frees your associates to complete transactions more efficiently and intelligently.

What is a mobile credit card reader?

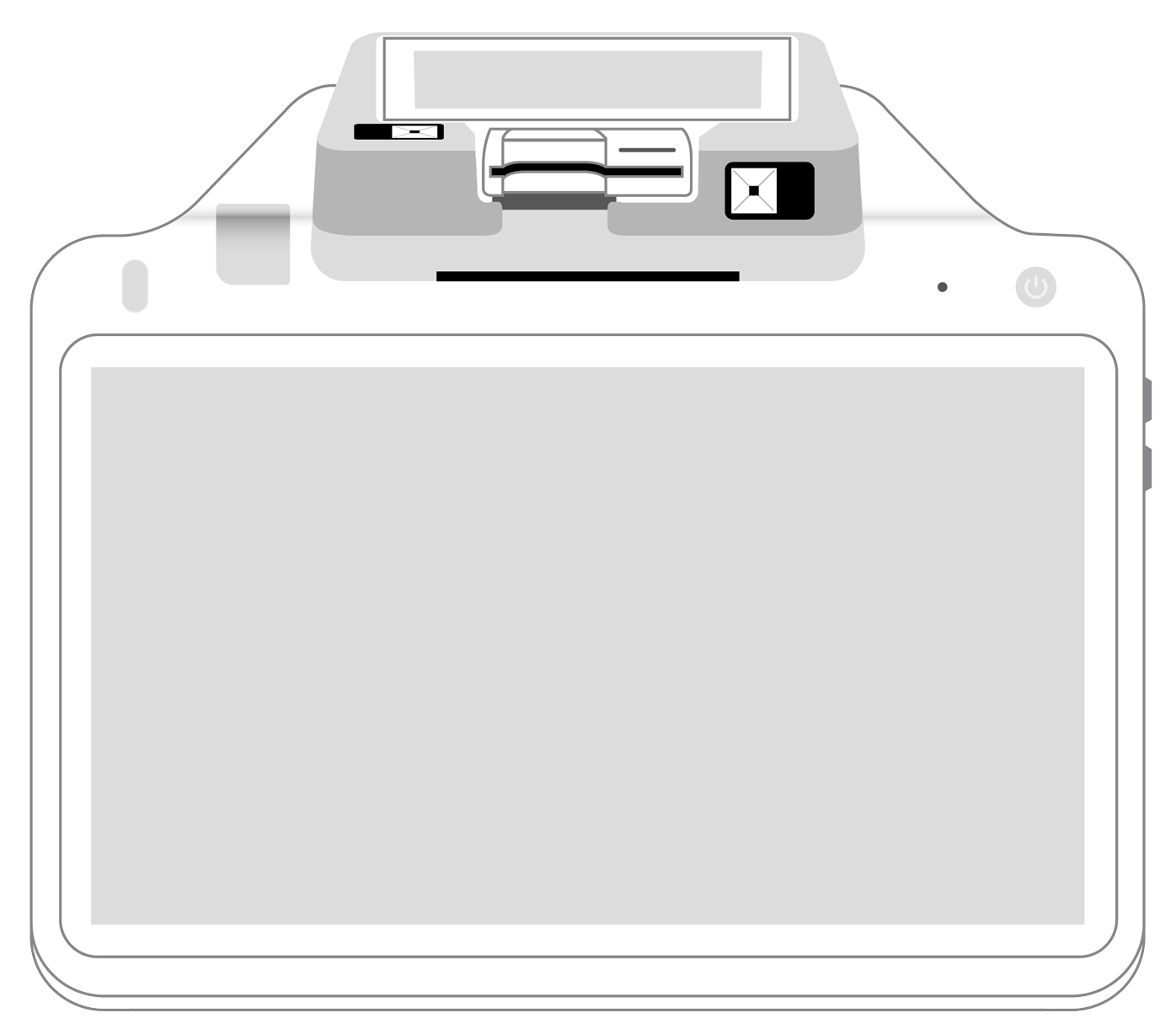

As the name implies, a mobile card reader is a portable payment device. It is small, effortlessly connecting to your smartphone’s headphone jack or charging port. Despite its diminutive size, this device is packed with features that allow you to process stripe, EMV, and contactless payments from anywhere, including right on your sales floor. Next, the data is securely transmitted right to your point of sale system for tracking and data management purposes as well as to your payment processor.

As you can see, that little mobile card reader packs a lot of punch. Now, take a few minutes to see how to use it to enhance the performance and efficiency of your sales staff.

1. Train your employees.

No doubt, you already spend time instructing new hires on your store’s culture, your brand, and how you want to treat your customers. Now that your associates will have more flexibility when dealing with purchases, you also need to be sure that they fully understand the assortment of products you sell, where they are located, and what peripheral items might be excellent accompaniments to the purchase.

This attention to detail can transform the mere swiping or tapping of a customer’s card on the sales floor into a rich dialogue where questions can be asked, information exchanged, and suggestions made. Your associates can learn what the buyer is seeking and then use their handy smartphone to tap into your database to search for helpful alternatives or additions. In the end, the shopper may end up not only with what they originally were looking for, but additional items as well. The result is more profits for you and a happy customer who will probably return and might even bring their friends.

2. Allow for easy transactions and multiple payment choices.

Whether customers are purchasing online, at the register, or on the sales floor, one fact remains: They want to use the payment method of their choice. Some shoppers may prefer to pay using a credit card; others might opt for debit or even want to cash in their loyalty points. Before you put smartphones and mobile card readers into the hands of your associates, be sure they are trained to accept the forms of payments your customers are demanding. After all, the whole idea of this setup is to make the process fast and efficient. The last thing anyone wants is for confusion and time delays.

3. Be sure all devices are secure.

The security of the payment transaction your associates conduct on the sales floor is only as good as that of the mobile phone they use. That’s why it is critically important that you have installed the latest updates to your mobile phone’s operating system. Additionally, only use apps from trusted sources. Finally, setting up strong passwords to protect your data makes it difficult for cybercriminals to hack into your smartphone.

4. Test your new payment method before rolling it out.

Even though it will involve a bit of extra time, it never hurts to do a dry run. Don’t wait to discover a glitch in the system or a gap in your or your staff members’ knowledge when a real customer is paying. Instead, test out your systems when just you and your associates are there to work out any issues and master the process.

5. Promote your new system.

Now that you have upgraded your equipment and taught your staff, you’re ready to roll out your mobile card readers on the sales floor. Prominently display signage that lets your customers know that paying will now be faster and easier than ever while continuing to uphold the strongest security measures. Once shoppers become aware that they aren’t required to take their purchases to the checkout counter but can instead complete the process right on the floor, you will find that they will quickly adopt this efficient alternative.

Incorporating mobile card readers into your retail operation is a win-win for you and your customers. Taking this step leads to happier and more engaged staff, more satisfied buyers, and more money in your pocket. If you think the time has come to revolutionize your business with mobile readers, talk to your payment processing provider about how to get started.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||