5 Unusual Business Write-Offs

Business owners need to be aware of all possible deductions in order to minimize their tax liability. The IRS does not provide a list of tax deductions for businesses, but it does have a list of items that cannot be deducted. That list includes illegal things like traffic tickets.

Business owners need to be aware of all possible deductions in order to minimize their tax liability. The IRS does not provide a list of tax deductions for businesses, but it does have a list of items that cannot be deducted. That list includes illegal things like traffic tickets.

Business tax declaration forums list broad categories for deductions that are acceptable, which are referred to as “ordinary and necessary” expenses. The last description on the list of items the IRS allows businesses to deduct is “other deductions,” which includes many overlooked write-offs, most of which you may be able to deduct from your own business.

Here are the five most common but overlooked potential deductions.

1. Pet food. If an animal is involved in your businesses and does not serve only as a family pet that occupies office or store space, you may be able to write off costs related to it. This could include food, vet bills, training costs, and anything else associated with the animal and its needs.

2. Body oil and sunscreen. If they can be considered protective gear for employees, these products can be considered deductions.

3. Lawsuit settlements. It is possible to write off settlement costs and legal fees if your business is sued and loses. For example, an accountant was allowed to deduct legal fees as a business expense when charged with embezzlement.

4. Payments to family members. Hiring your children under the age of 18 means you avoid payroll tax liability. Hiring your significant other can also lead to a write off. You will need to issue a W2 or 1099 and determine whether the person hired is considered an employee or contract worker.

5. Landscaping and housekeeping. This applies to business owners with home offices. You can deduct the cost of a housekeeper who helps with the upkeep of your office space. You can also deduct some landscaping costs if you meet clients at your home office on a regular basis.

Think about the potential deductions you can make as a business owner. Remember that if the cost was incurred in order to perform the business, it probably qualifies as a business deduction. It is important, as always, to keep receipts and other payment records. You will need to prove the business intent for any deductions you plan to make. It is also advisable to meet with a tax professional for more information and clarification on business deductions.

The information contained on this website does not constitute legal advice or tax advice. The information contained within this website is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax, or financial advice from a professional tax planner or attorney. Its authors make no claims about its accuracy, completeness, or up-to-date character and that applies to any site linked to this website as well. No author or owner of this website is acting as your attorney. Legal rules and tax rules change frequently, therefore, we cannot guarantee that any information on this website is accurate or up to date.

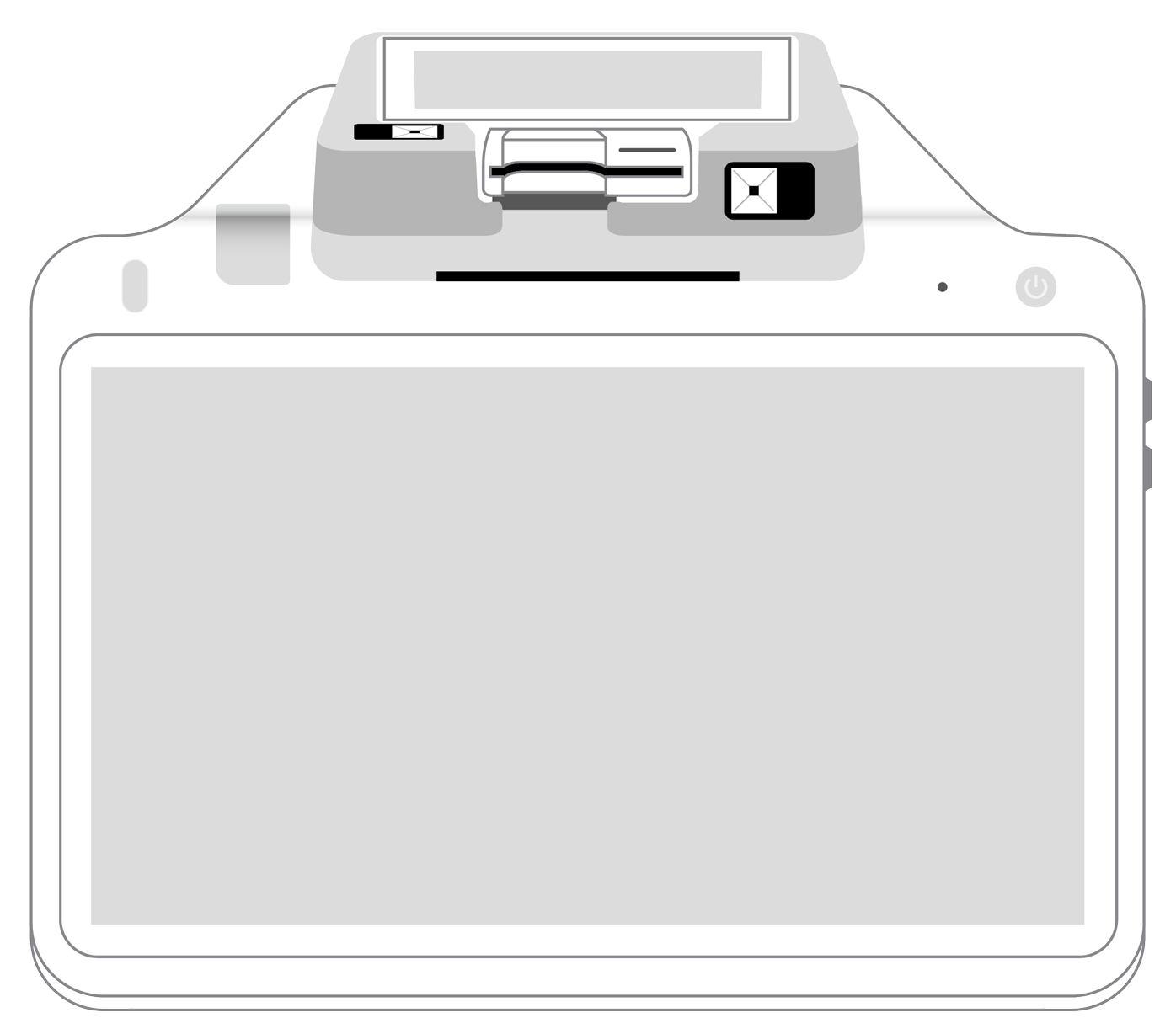

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||