6 benefits of integrating your accounting software with your POS system

Your point of sale (POS) system is powerful on its own, assisting with securely accepting payments as well as employee and inventory management, customer relationships, and report generation.

But if you really want to give it a jump-start and simplify your accounting at the same time, you should integrate your POS with your existing accounting software.

The challenges of daily accounts management.

Normal accounting tasks are daunting. They include reconciling daily labor costs, POS system transactions, inventory costs, cash and credit balances, and taxes.

If you continue to handle this job manually by downloading records, consolidating information into one place, and manually balancing spreadsheets, you will spend a great deal of time and may fail to record the details accurately.

The good news is that technology has come to the rescue. Unlike payment apps, combining the assets of your POS with your existing accounting software can furnish your business with several compelling advantages.

1. Efficient business management.

Most if not all financial transactions take place via your POS system, which records and stores a history in its database. When you integrate your POS with your accounting software, it is possible to seamlessly transfer any data necessary to prepare taxes, manage payroll, and forecast budgets and cash flow.

2. Make tax compliance easier.

Sales tax calculations and reporting can be complex, and the price to pay for mistakes can be steep. However, integrating your POS and accounting software will take much of the guesswork out of tax compliance.

The stakes are even higher when it comes to ecommerce sales.

Integrating your systems allows you to set up custom tax amounts and reports for different destinations and receive an itemized tax breakdown for all of them.

3. Evolve with your business.

Over time, your business will grow and change. Integrating your POS with your accounting software will provide the flexibility that you need in order to adapt and pivot.

For instance, a modern POS offers customizability when you want to tailor your financial reporting and analysis. When systems are combined, you can even define rules that map data flow from the POS into your accounting software.

This makes it easy for you to tailor your accounts receivable and payable, sales, and inventory parameters to meet your changing business needs.

4. Improve the customer experience.

Combining your systems can transform a lackluster customer shopping and payment journey into a superior one. Your POS and accounting software can work in tandem to provide the optimal personalized buying experience, leading to enhanced loyalty and boosted retention.

Some of the advantages include the ability to make spending accounts for contractors or VIP customers, print and email invoice statements, manage recurring billing payments, track contracts and add delinquent payment fees when necessary, and adjust prices at checkout in the event of discounts, coupons, or rewards.

Since these functions are fully automated, you can save time and effort while reducing errors.

5. Enhance inventory management.

When your POS and accounting systems work hand in hand, you gain real-time insights into how well your inventory is selling. Information that you can gain includes reports pinpointing sales trends, automated inventory tracking and ordering, and customized inventory reports by department.

Advances in inventory management do more than just ensure that you have the merchandise quantities you require without the need for back-ordering.

They also lead to a higher level of cost-effectiveness that allows you to better allocate your funds. That, in turn, fosters boosted client satisfaction, expanded positive brand awareness, and increased referrals.

6. Regulatory compliance assurance.

Failing to enter data correctly or to record a transaction leads to reconciliation errors that can throw off your bookkeeping and require hours to correct. That in itself is bad enough, but it can also cause you to fall out of compliance with important industry regulations.

Because integrating POS and accounting software automates these processes, you are less likely to make those crucial errors. Moreover, all of your records are securely stored in the cloud, which means that you will be far less likely to lose crucial documents or receipts.

When you marry the specialized tasks of your accounting software with the real-time entry, monitoring, and data storage of your POS system, your operations will skyrocket to the next level.

Tasks including managing your business, preparing taxes, adapting to changes in the security landscape, maximizing customer experience and inventory management, and complying with financial standards and regulations can become effortless, streamlined, and traceable at every step.

In the end, both you and your customers will reap the rewards.

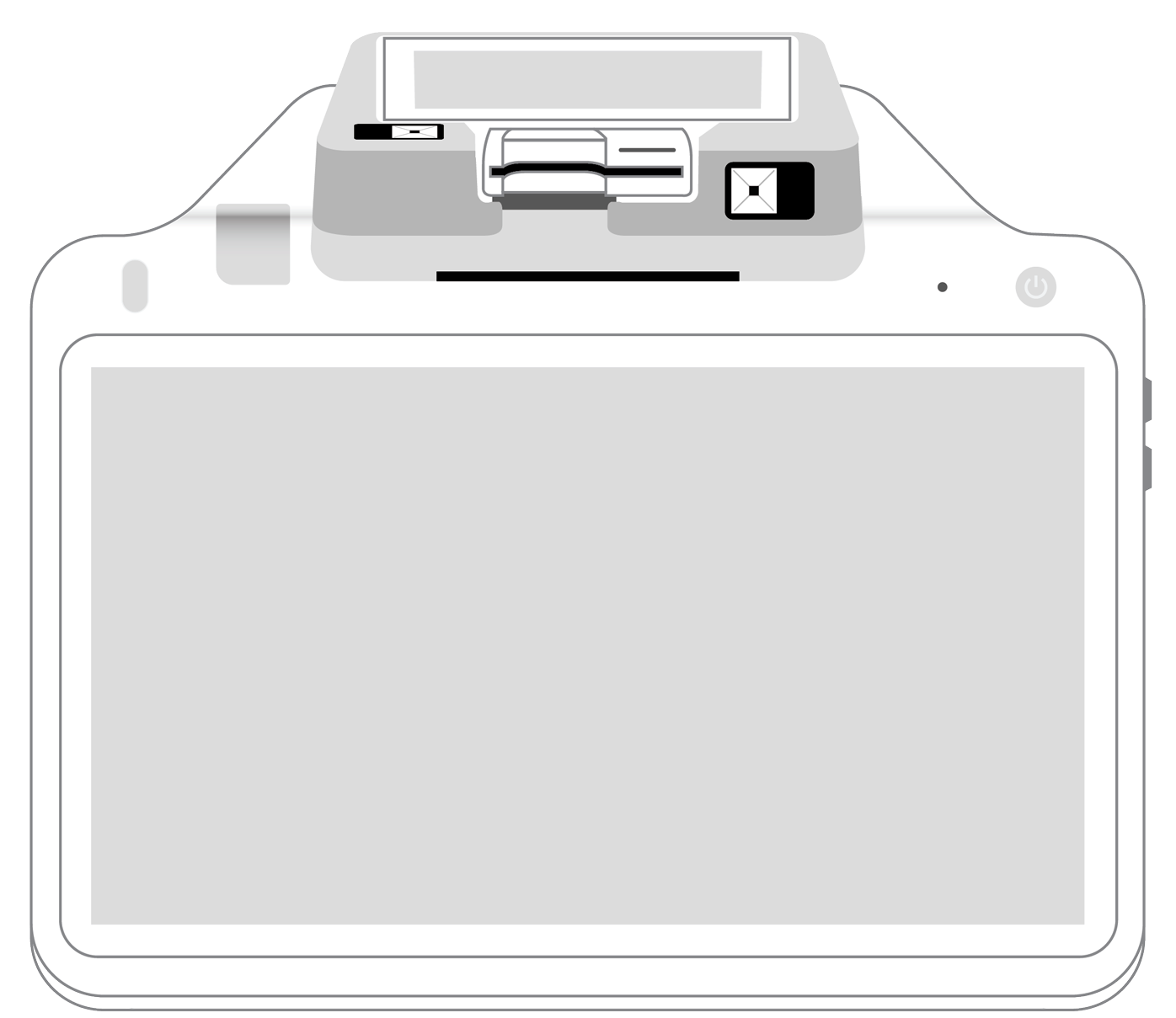

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||