7 unexpected factors that affect your bottom line.

Long before your business became a physical reality, you spent countless hours making plans. You brainstormed about the perfect suite of products or services, evaluated your customer base, and came up with a marketing strategy that would get information about what you had to offer out to the people who would buy it.

Next, you determined where and how you would be selling your goods and services and went through the arduous tasks of buying or renting a property, organizing your store layout, hiring staff, designing a website, and so much more. As you laid the groundwork, you also recognized that there would be fluctuations in your profit margins, often depending on whether people responded to your sales campaigns and made online or in-store purchases. What you may not have realized, however, is that there are many unforeseen events that can drastically affect the success of your business. Doing your best to plan for the unplanned can help protect your bottom line.

Interruptions in your cash flow.

As all entrepreneurs quickly discover, the funds you have on hand that are available to you (your cash flow) are not the same as your profit margin. Failure to keep this in mind can leave you short of capital just when you need it most. One of the biggest causes of disruptions in cash flow comes when customers fail to pay their bills on time. This is particularly damaging when they purchase big-ticket items. Demanding payment in full at the time of purchase is tempting, but many buyers will be unable to meet this requirement and will simply take their business elsewhere.

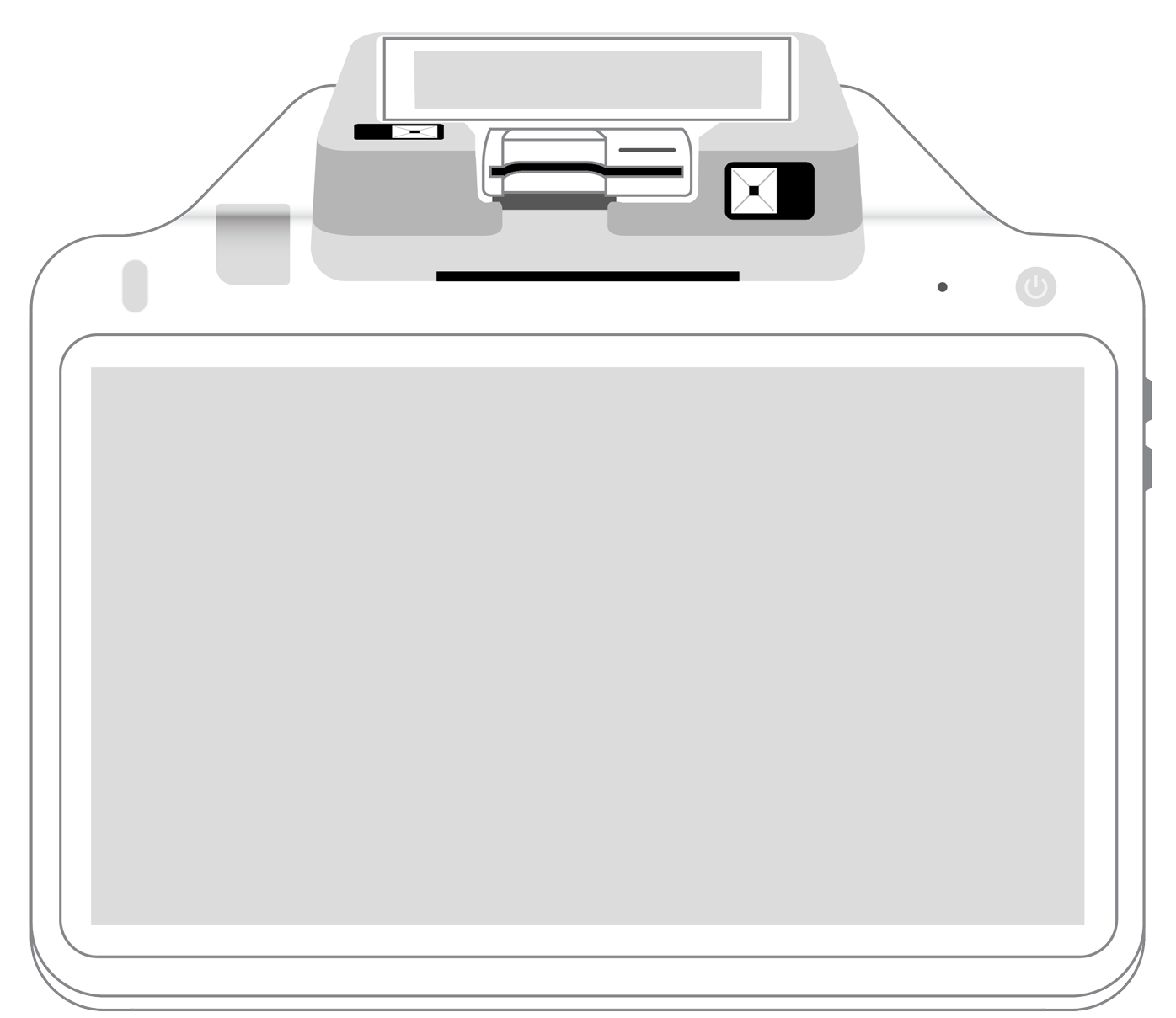

For that reason, most retailers have no choice but to offer the courtesy of sending an invoice. Consumers and companies do not usually deliberately decide not to pay on time. More often than not, they simply forget. Having credit card processing equipment that also provides customer relationship and invoice management capabilities will allow you to receive payments in a more timely fashion. They’ll also help you remind delinquent customers that they owe you money. A proper invoicing solution should also give people a number of payment options, including recurring billing, credit card, and ACH that make the process fast and frictionless.

Another blow to your cash flow can occur if you incur an unexpected expense. These can take many forms, including the sudden need to replace equipment that has broken down, not to mention the cost of replacing stolen or damaged products. Furthermore, you might experience an unplanned drop in revenue if a new competitor arrives on the scene.

Cash emergencies are hard to predict, but you can pretty much assume that they are going to happen in some form or another. For that reason, your best strategy in protecting yourself against the unforeseen is to have a “rainy day” fund that you can tap into when you run short of capital.

Personal injury lawsuits.

Many entrepreneurs mistakenly believe that their company is not vulnerable to this form of litigation. They may have no employees or just a couple of workers, or their line of work might not involve machinery or manual labor of any kind, making the concept of someone being hurt on the job extremely difficult to fathom. Even so, personal injury lawsuits can affect any business owner at any time. Consider the following examples:

- A home-based tax preparer who has a delivery driver slip on their icy porch.

- A nail salon owner sued by a customer who falls ill after breathing chemical fumes while getting a manicure.

- A coffee shop owner is sued by an employee who slips and falls while bringing order to a customer’s table.

There are an infinite number of ways for injuries to happen to your employees or guests, which could result in extremely high costs to you that often run into the five and even six figures. For this reason, it is wise to do all you can to make your work environment as safe as possible. Train staff thoroughly in all procedures designed to protect their welfare and that of your customers and make all signage readable and easy to understand. To safeguard your business, also consider obtaining personal injury litigation insurance and when applicable, require your customers to sign waivers that protect you from liability.

Intellectual property lawsuits.

How could your small business possibly fall prey to this type of lawsuit, you might ask. After all, neither you nor your staff ever deliberately steals the creative output of other individuals or companies and you are very ethical when it comes to avoiding plagiarism. The reality is that many people cross the line and inappropriately use other people’s intellectual property without even realizing it. That image that you pasted into your blog, that piece of copy describing a product or a snippet from an article that you inserted into an Instagram post are all, technically speaking, the property of the people who wrote them. As such, you should not use them without permission, as doing so opens you up to the possibility of expensive and emotionally distressing litigation. The best way to prevent this from happening is to check your work several times, making sure to do the same for that of your employees. It never hurts to have an objective third-party review it as well just to be certain that no infringements have occurred.

Natural disasters.

Wind or ice storms, hurricanes, earthquakes, fires, floods, and landslides: the list of the natural disasters that your company could potentially suffer from is long. Depending on where your store or servers are located, you should take steps to plan ahead for the particular disasters that are more likely in your region. That means protecting your assets with property and disaster insurance that can assist you in rebuilding and recovering if necessary. If your data is stored on an offsite server, you should also make sure that the provider is covered against loss.

Fraud reduction.

Human nature being what it is, you can never be totally immune from the effects of fraud. Almost always, the consequences of disingenuous or criminal behavior are totally unforeseen and can result in emotional and financial upheaval. In the case of internal fraud, employees or partners might help themselves to company funds. Alternatively, customers might deliberately attempt to cheat you by using stolen credit cards or claiming that they never got a product that they actually received. Making sure to have upgraded credit card processing equipment that contains address verification software can be quite helpful when it comes to thwarting cybercriminals. Constant vigilance is a must, both in terms of your employees’ behavior and that of your customers. To that end, conducting training procedures for management and checkout staff on the red flags of customer fraud can also be helpful. As a business owner, make it a point to always keep your eyes and your door open when it comes to fighting fraud.

Reputational damage.

Nothing can interrupt the flow and profitability of a business like a big scandal. Whether or not it actually happened, who did it or why, the consequences can be disastrous once the word gets out, especially given how quickly news can travel on social media. In some ways, the more popular your business is, the more devastating a big hit to your reputation could be.

If you are unfortunate enough to be at the business end of this type of situation, do your best to contact the wronged parties as quickly as possible. If they are making their complaints on social media, consider replying to their messages publicly so that other readers see that you are quickly acting on the initial concerns. If there are measures you can take to smooth over or correct the situation, act quickly and publicly. This is often the wisest course of action even if you do not believe your business to be at fault.

Personnel crises.

No matter how hard you try to hire and partner with trustworthy people, the fact is that they are human beings who will experience work-related or personal crises of their own. Like it or not, the consequences of their actions can trigger an undesirable backlash against your company, since your organization employed or supported that person and is therefore associated with them. In cases like this, your first job is to identify the full scope of the employee’s actions. Next, determine what, if any, disciplinary steps you plan to institute and make any public statements that you deem to be appropriate.

No matter how up-to-date your software may be, how many payment options you agree to take, and in spite of all measures you can implement to avoid unplanned disaster, you can never fully protect your company against the unknown. Your best strategy is to be as proactive as possible. Prepare for what you can predict, while leaving yourself an additional financial and insurance cushion to safeguard your business against what you cannot.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||