A brief guide to small business terminology.

The list of important tasks to master when considering starting your own small business is daunting, to say the least. In addition to figuring out what products you will be selling, where, and to whom, there is a world of terminology that you should master if you are going to be able to succeed and communicate with peers and customers alike. While you could invest in a targeted dictionary for entrepreneurs, why not start here with a few of the most important additions to your personal work-related glossary?

Payment services provider.

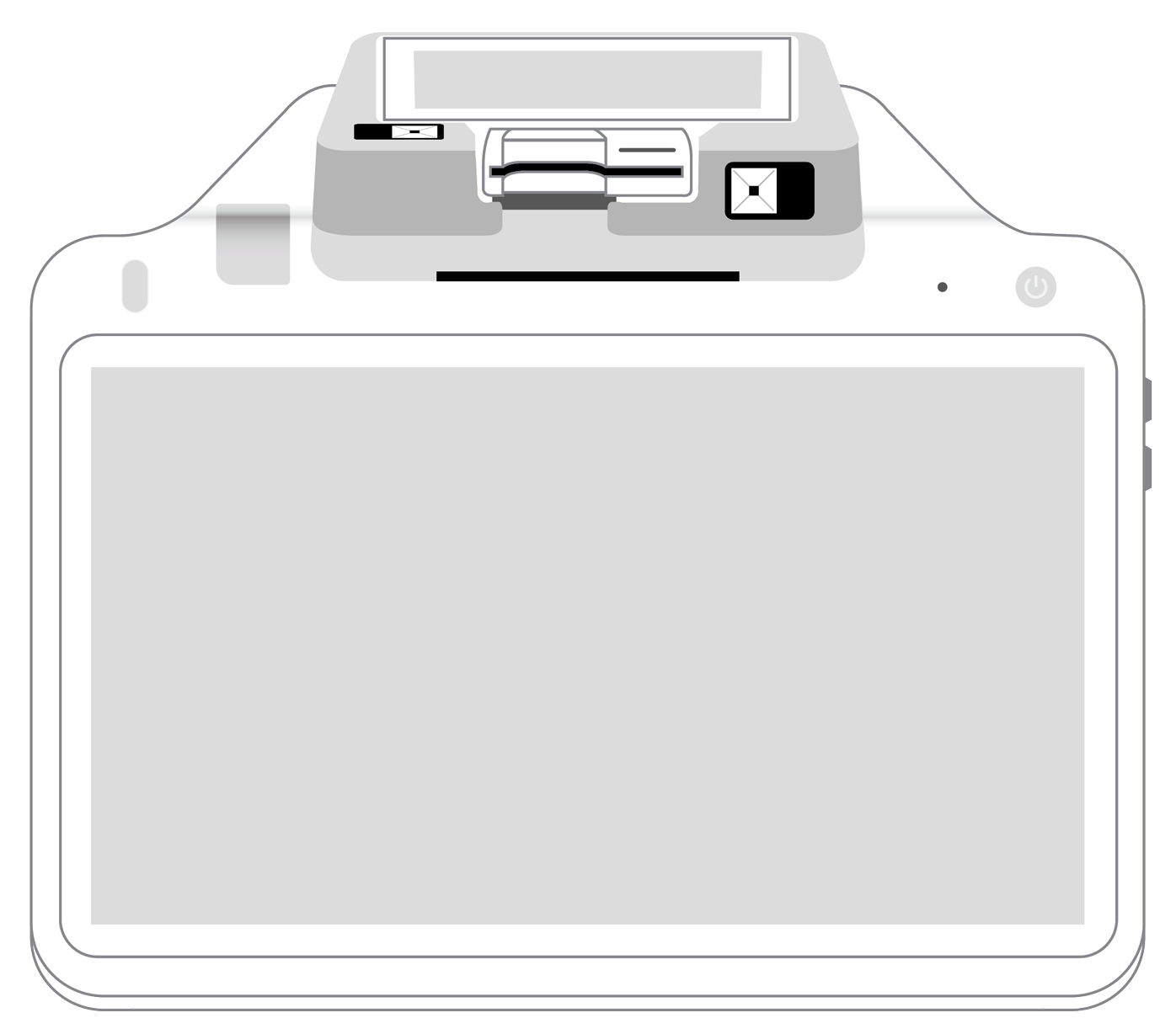

When getting set up in your online or in-person store, one of the first issues you will need to figure out is how your customers can securely pay for your products or services. This is where a merchant payments provider comes into the picture. Also known as a merchant account or merchant services provider, this is a payment technology company that provides you with a particular type of business banking account. Once enrolled, you can use it to accept a wide variety of non-cash payments, including those with credit and debit cards, gift cards, recurring billing, and cash. Furthermore, this entity can often give you all of the hardware (standard and contactless card readers, barcode scanners, receipt printers, etc.) and software you will need to ensure a smooth and seamless payment experience.

Finding the best merchant provider to partner with is a subject that could take up an entire blog in itself. However, taking the following suggestions to heart can help to ensure that the partner you pick is a good choice for both you and your customers.

- Find a provider that makes payment security a top priority. To that end, be sure they are in compliance with the Payment Card Industry Data Security Standard (PCI DSS).

- Also, only go with a provider that uses advanced fraud protection tools such as certified, point-to-point encryption, military-grade tokenization, and the latest Hosted Payment Forms.

- Settling on a first-class merchant account provider will help you lay a foundation of credibility, stability, and payment security that will inspire trust and customer longevity.

POS systems.

We briefly touched on the idea of this combination of hardware and software that your merchant account provider can set you up with to take customer payments. However, this solution, known in the business as a point of sale system (or POS system for short) is leagues above a simple cash register. As it turns out, the right POS solution can revolutionize virtually every facet of your operations.

In addition to interpreting the data on your customer’s credit or debit card and sending it to the other players in the payments process, the right POS system can help you achieve the following.

- Help you manage your inventory. With the assistance of your barcode scanner and the system’s built-in database, you can record and track every piece of merchandise that enters your store from the time it arrives until it leaves in the hands of your customer. Once you configure the system, it can even let you know when stock is running low well in advance, allowing you to keep shortages to a minimum.

- Help you manage your employees. Smart POS systems allow you to track each person’s productivity, enabling you to provide rewards or helpful training when warranted. Manual emails announcing next week’s shifts can now be sent automatically, and you can make changes from anywhere at any time.

- Help you to run a customer loyalty program. Pulling ahead of your competitors is a full time job in itself but it can be made easier with a system that incentivizes existing patrons to make repeat purchases or visits. Your POS solution’s database can be used to capture customer contact details, shopping histories, and preferences. Not only can you then start a compelling rewards program, you can also send emails that target each person’s unique interests and buying patterns. What your point of sale system offers you is effortless customization without the need to invest endless hours that you could be spending on other important tasks.

- Help you to create actionable reports. Whether it’s getting a sense of your financial outlook or making more accurate sales forecasts, you need to be able to look through your data and make sense of it so that you can put it to work for you. Your POS system should take much of the guesswork out of this often exhausting process. Instead of sorting through receipts for hours on end, a few simple clicks should bring you instantaneous, accurate snapshots configured to exactly the parameters you are requesting.

By working right alongside you in virtually every operation of your small business, your point of sale system can enhance your efficiency, boost customer satisfaction and even inspire your employees to perform better. If you still have questions about how a particular solution can meet your needs, ask your merchant service provider to furnish you with an ultimate POS guide customized to fit your specific specifications.

Business loans.

Unless you have a bottomless trust fund, there will come a time when you need additional capital for your business. There are numerous different sources into which you can tap to get the money you need. Here are three of the most popular.

- Term loan. In this very conventional type of loan, you get a lump sum of cash up front and then pay it back over time with interest. With this arrangement, you can usually get cash quickly either from a traditional or online lender, and can often borrow a higher amount than with other types of loans. On the downside, you may need to provide collateral or a personal guarantee, and interest may be higher.

- SBA loans. Guaranteed by the Small Business Administration, these are offered by banks and other lenders. With some of the lowest rates you will find, these loans allow you to borrow up to $5 million with long repayment terms. However, the application and qualification processes are difficult and protracted, making them best for borrowers who have good credit and time to wait for the loan to be approved.

- Business line of credit. Similar to a credit card, you are given a limit and can withdraw funds up until that point, only paying for what you use. With this flexible borrowing method, collateral or personal guarantees are usually not required. However, you will need to show a strong positive credit history and consistent business revenue and may pay higher fees.

With the help of these arrangements, you can avoid going to friends and family with cap in hand in hopes of a financial bail-out.

The terms we described above are just the beginning of what you will need to know as a new business owner. However, being well-acquainted even with just these concepts will help to ensure that you can accept payments, run numerous other aspects of your business, and get the financial support you will need to succeed.

Related Reading

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||