A contractor's payment guide.

Whether you do roofing, plumbing, window installation, or some other form of service business, one fact remains the same: You need to be able to get paid quickly and reliably. As a contractor, you are already well-versed in the techniques and skills that set you apart from your direct competitors. Now it’s time to learn how to be compensated for your hard work speedily and accurately with a minimum of complications.

Before the job starts.

There are several things you can do to enhance the payment experience your customers are destined to have once the work, building, or installation has been completed. These include the following.

- Be completely clear and transparent with your customer. That means drawing up a comprehensive contract that includes what will be owed, the schedule for making payments, any benchmarks that trigger the next payment, and how add-ons or subtractions in service will be handled. Furthermore, spell out what penalties will be charged for late payments, finance charges, any provisions that you want to specify for charging attorney’s fees, and your right to suspend the job until you receive the payment you are owed. If you are working with subcontractors, also consider adding a pay-when-paid clause specifying that these third-party entities are not paid until you receive money from your customer.

- Ensure that the payment process is easy. Many payment problems stem from unclear, incomplete, or inaccurate invoices. Proofread yours before sending them out, and clearly lay out the various payment choices available to the customer such as by mail, online, or in person via cash or credit card. Modern options for payment processing for contractors also give you the ability to offer alternative types of payments including wireless and recurring billing. Remember, the more choices you provide, the better your chances of receiving what you are owed.

- Harness the power of automated invoicing tools. No longer do you need to conduct billing by hand when your mobile credit card processing company can provide you with tools that work in conjunction with your point of sale solution. In just a few clicks, you can send out clear and accurate invoices, set up online payments and reminders, and even track your expenses in real time. Just remember to double-check your invoices before they go out to make sure that everything is correct.

- Set up a clear payment schedule in your invoices. For example, let the client know that they should submit the payment within 30 days of receipt of the invoice.

- Laying this foundation helps to ensure that all parties understand what is expected of them at every juncture in the flow of work. This transparency helps to solidify a good working relationship with your customer throughout the job.

When a payment is late.

No matter what you do, there will still be instances when a customer fails to pay on time. When, not if, this happens, take the following courses of action.

- Send a reminder. Whether by phone call, email, or mail, your first step should be to tickle the customer’s memory about the payment. Do so by sending a past-due notice, a copy of the contract, and a refresher about the penalties that can result from delinquent payments.

- Talk directly to your customer. This often uncovers the underlying reasons behind the payment stoppage. If they are holding back money because of dissatisfaction with the quality of the job, this is the time to investigate and resolve any outstanding issues. In some cases, customers deliberately default because they want to negotiate a lower price or change the job midstream. If this is the case, you will need to decide whether it is in your best interests to pursue legal action or simply to offer a discount and move along to other less stress-provoking jobs.

- Send a demand letter. More direct than your previous past-due notice, this correspondence states the exact amount due, the deadline when it must be submitted, and the consequences of failing to pay. The document should also identify next steps such as, “If the payment is not received by the above date, we will file a lien on the property for --- amount on --- date.” Arbitration is another option that you can offer in lieu of a lawsuit.

- File a construction lien. Also known as a mechanic’s or artisan’s lien, this legal document indicates that you have a financial claim on the property because of the uncompensated work you have put into it. Filing this legal document puts additional pressure on the customer since it negatively affects their credit score and makes selling or refinancing the property difficult. Because liens have time limits and filing rules specific to each city and state, it is important to do your research and submit everything correctly for the lien document to be approved. In most cases, customers will satisfy the lien by remitting payment. If they don’t, you can file a lawsuit.

Usually, you will receive what you are owed long before you get to the courtroom. Investing time and work in finding a high-quality payment processing partner and providing your clients with clear documentation before, during, and after the job is done will go a long way toward making every aspect of the job run more smoothly.

Related Reading

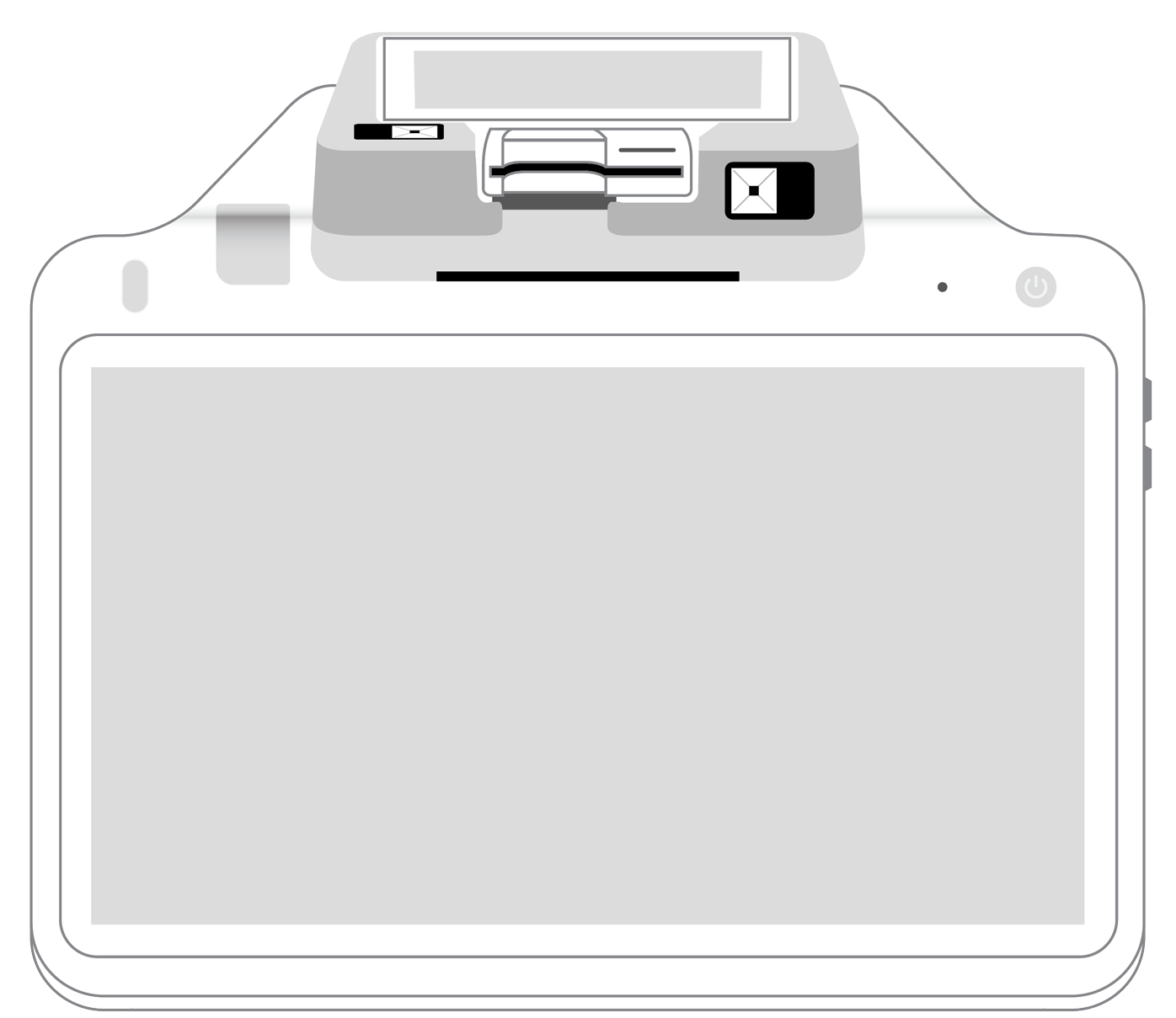

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||