A map of the digital payment journey for your small business

With cash becoming the least favored option for more consumers every year, businesses of all sizes need to evolve with these changing consumer behaviors.

Since it is becoming a necessity to take digital payments of all types, there is no time like the present to learn how to incorporate them into your retail operations.

Understand how the digital payments ecosystem works.

Of course, your first step is to learn exactly what digital payments are. They can be defined as non-cash or electronic methods by which one party (your customer) transfers funds to another (you). Digital payments come in many forms: the traditional credit and debit cards, mobile wallets such as Apple Pay and Google Pay, and online transfers from the customer’s bank.

This latter type of transaction is often used when you set up recurring billing, an arrangement in which you and your customer come to an agreement about the date, frequency, duration, and amount of cash to be regularly withdrawn from a bank or credit card account.

As soon as you expand your horizons to begin accepting digital payments, you will start to see the benefits. It immediately becomes easier for both you and your customer to keep track of payments, enabling concerns or disputes to be resolved accurately and quickly.

Additionally, payments happen within seconds. Contrast that with the snail’s pace of a mailed check. Your bookkeeping becomes easier and more precise since details are stored securely in the cloud without the errors that can occur with human data entry.

Finally, your business can appeal to more customers, particularly those who prefer not to use cash for whatever reason.

Select a merchant account provider.

Taking digital transactions cannot happen until you have established a relationship with a payment processing company.

To narrow down your choices, start by taking your business and industry type into consideration. Some, including online pharmacies, firearms merchants, travel agents, adult entertainment, and gaming sites, among others, represent a higher risk to payment processors.

If your store falls into any of these categories or otherwise is more likely than normal to experience security problems or chargebacks or operates under numerous regulations, you probably need to seek a high-risk merchant account provider.

Although you will pay higher per-transaction fees and may be required to adhere to other conditions, having a relationship with this niche provider will give you specialized support and access to security protocols geared specifically toward the special needs of your industry.

As we have already stated, it is important to examine the features of several payment processing companies before you make a choice because they are not alike.

Look carefully at each candidate’s transaction fees, steering clear of any with confusing, opaque, or excessively high prices. Only select a company with prompt, reliable and knowledgeable customer service.

After all, difficulties with your payment processing software or hardware can lead to costly business interruptions that excellent client support can help you solve with speed and efficiency.

Finally, scrutinize the company’s security tools to make sure that their protocols are multi-pronged, cutting-edge and regularly updated.

Put your new payment system into action.

Launching your new system may well be when you first take advantage of your provider’s customer service department. Look to them to help you set up your systems, and bring any questions or concerns to them for fast and accurate resolution.

Be sure that the hardware and software they give you is updated to accept contactless payments.

This touch-free technology that has become ubiquitous since the pandemic lets customers pay quickly and efficiently without ever needing to be separated from their card, smartphone or wearable device.

Use payment services to improve business efficiency.

Software integration is key to stepping up the productivity of any business. To that end, the tools in the point of sale system provided to you by your payment processor should “play nicely” with the other third-party programs that you already use in your day-to-day operations.

One of the most important is your inventory management software since this plays an essential role in how you order, track and re-stock your products.

Don’t forget to also take your demand forecasting and supplier programs into consideration as well in order to be able to make insightful forecasts and communicate with suppliers in an accurate and timely manner.

Complete your integrations by also ensuring that your accounting program is fully connected with everything else. Without taking this crucial step, your budgeting will go off the rails.

Advertise that you take digital payments.

Now that you have laid your new digital payments infrastructure, it’s time to go public. After all, customers need to be made aware that you have upgraded and expanded your systems before they will use them.

Creating in-store displays that are prominently placed near the checkout is one of the best ways. If you have a website, it should feature these notifications in your payment portal.

Just as important, you need to provide answers to buyers’ most common questions. For your physical store, train staff to address any inquiries or concerns that arise.

By the same token, your website should specify the details about which payment types you now take along with the links necessary for shoppers to set up accounts.

Allow customers to pay with one tap in person or online.

One of the greatest causes of frustration for in-person shoppers is long, slow checkout lines. With digital one-tap payments, queues move much more quickly without sacrificing the payment security that is so vital in maintaining customer trust.

Faster and more streamlined secure purchasing leads to higher levels of customer satisfaction that will ultimately lead to boosted sales, positive social media testimonials and added referrals.

Although one-tap transactions are quite secure on their own, you can elevate their safety with secondary verification. This added security layer prompts customers to confirm their identity with a password, biometric identification or PIN that has been texted to their smartphone. It only takes a few extra seconds, but it provides you and your customers with added peace of mind and protection from identity theft and fraud.

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.

Related Reading

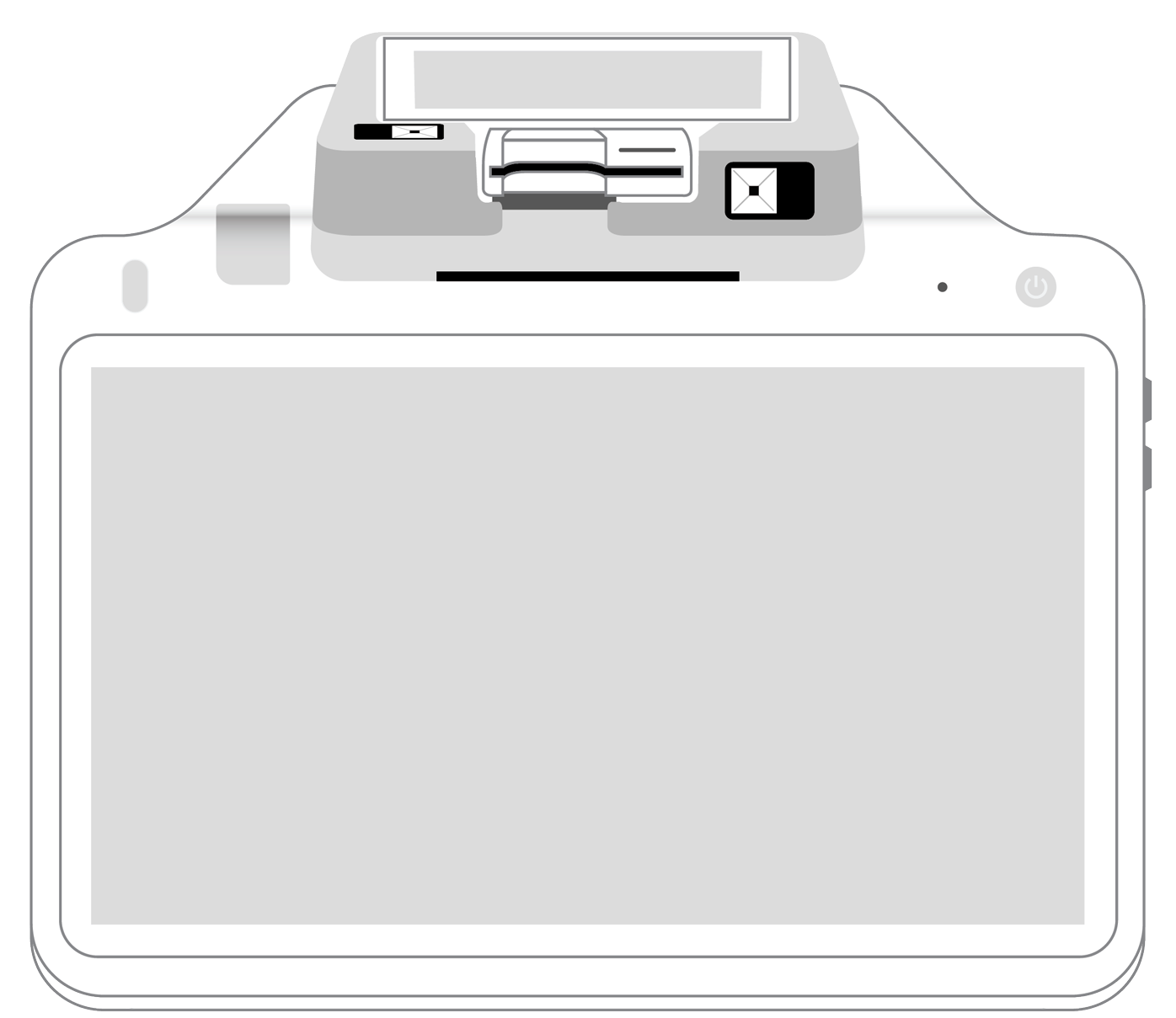

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||