Accept multi-split payments online with payment links

When you accept payments for your online business, the arrangements can become complex. Fortunately, your payment processing company can now furnish you with a new and innovative way to let people complete their purchases and resolve their invoices.

If you aren’t already using payment links and taking advantage of their many features, learning about their benefits will likely inspire you to get in touch with your provider today.

Payment links defined.

Payment links are solutions that are generated by you, the seller, and are sent to your customer. They can take the form of a “pay now” button, a QR code, or a URL.

Regardless of what it may look like, clicking on the link takes the customer to a secure checkout page where they can supply the required details to complete the transaction.

In situations where you have already stored the person’s unique data, completing the payment may only require a few clicks.

Benefits of payment links.

First and foremost, payment links are convenient for you as the seller. They can be shared in numerous ways, including via email, text message, Whatsapp, and social media platforms as well as on your website.

Moreover, you never need to compromise on choice when using payment links. Customers can still resolve their bill in the usual ways, including via credit and debit cards, and digital wallets.

Links can also be customized to contain multiple line items and custom fields as well as brand-centered coloring and logos, thus inspiring trust and adding to your business’s credibility.

Another advantage of payment links is that they make accepting funds easier for companies, particularly small ones. If you have little or no technical experience and/or don’t yet have a full website, these links can provide you with a credible, secure, and easy way to let your customers buy your products and services.

Accepting multi-split payments.

A lesser-known upside to using payment links occurs when you want to take multi-split payments from two or more users.

No longer do you need to experience the stress of sending individual invoices to each customer by hand. Now you can use split payments technology to do the job for you.

There are several scenarios where this is invaluable. For example, a buyer can pay multiple sellers with a single split payment transaction. You can then disperse the money to the parties owed.

Another excellent way to make split payments work for your business comes when you want to separate charges for products and services from additional fees.

With just a few clicks, you can use this technology to distinguish between what the customer contributes for the merchandise or service itself and any additional charges you have agreed upon.

A very common use of split payments comes when your customer wishes to pay in installments instead of all at once. Although this arrangement once made for a complicated and often protracted billing process, split payments now let you effortlessly divide the charges over a set period of time and number of payments.

As a result, your business will reap the many rewards that come with offering recurring billing. This will be true even if the arrangement happens among two or more customers or companies.

With the recurring billing or subscription model, clients know exactly when and how much they will pay each month and can budget accordingly. You as the merchant will experience a great deal more predictability of cash flow, funds that you can rely on and even use to pay for inventory and advertising campaigns.

A mutual advantage is that your relationship will be richer and less transactional since you will spend less time chasing after late payments and more in curating products and services and communicating information about new items and promotions to your client.

Payment links provide businesses of all sizes with an easy, multi-faceted, and efficient way to augment their existing billing structure.

Taking full advantage of their features leads to more timely resolution of invoices, predictable cash flow, and the ability to distribute payments across two or more customers securely and with ease. If you have not already incorporated payment links into your invoicing and checkout systems, there is no time like the present.

Contact your payment processing provider today, and take your internal payment processes to the next level tomorrow.

Related Reading

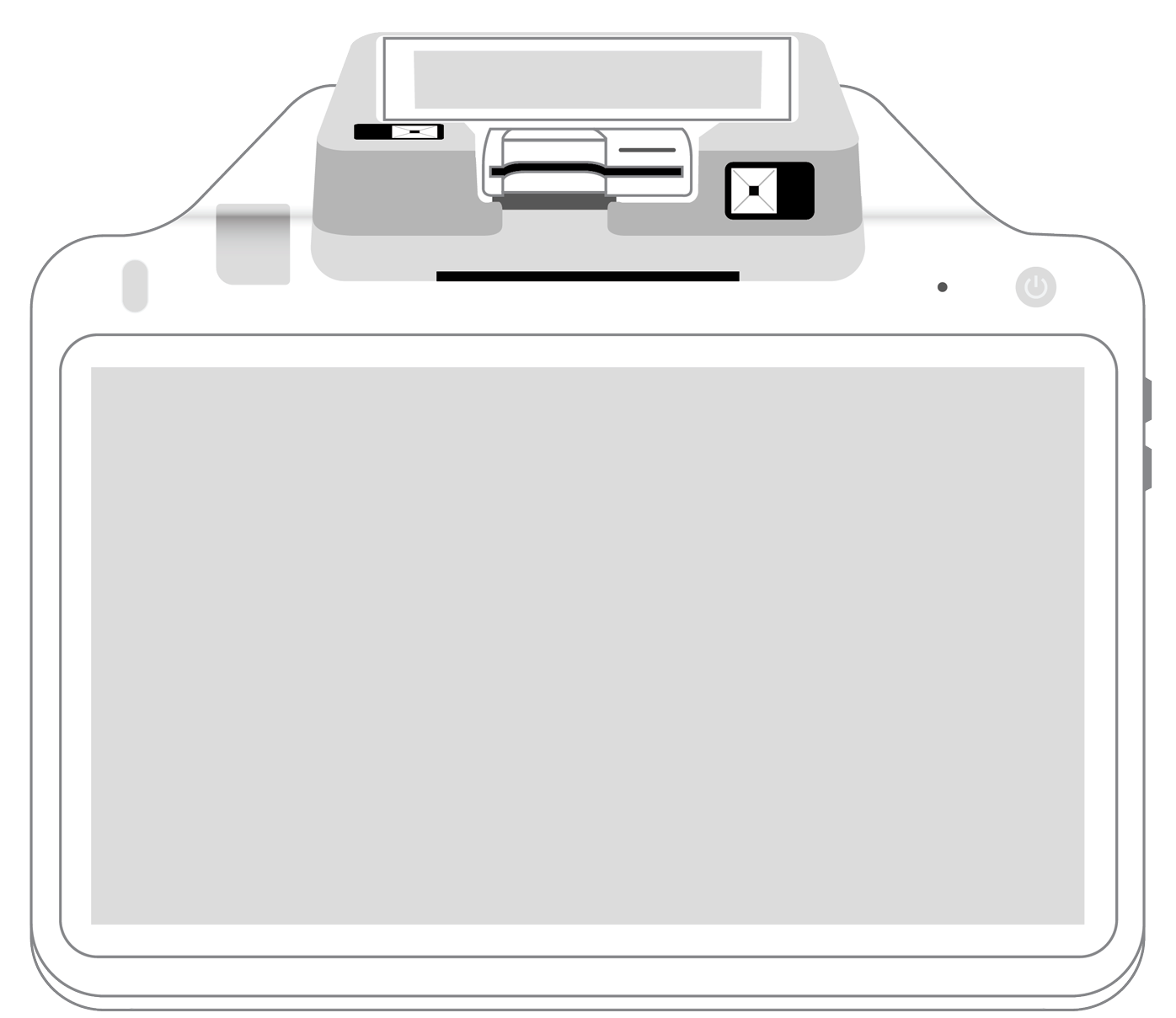

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||