Advantages of using payment links for your business

For a business of any size, the importance of sterling customer service cannot be overstated.

In addition to providing shoppers with terrific products at fair prices and a friendly staff, elevating the buyer experience also means offering a payment process that is smooth and seamless.

If you have not already incorporated payment links into your invoicing system, there is no better time than right now to find out what they are and learn how they can make your entire billing process more efficient and client-friendly.

What are payment links?

You may have heard of payment links and might possibly have used one yourself without thinking twice about it. A payment link or pay link is a unique URL that you send your customers when a bill needs to be resolved.

It can come in the form of an emailed invoice, a social media message, or show up as a “pay now” button on your company website. In all cases, these links send the customer to a secure checkout page where they can fill in their information and submit a secure payment.

That secure page does more than just show what the customer owes. It also displays all of the various payment methods you accept (credit or debit cards, digital wallets, or directly from a bank account).

In some cases, the payment link can be configured to store each buyer’s details or can link with the person’s banking app. As a result, the entire transaction can be completed with a single click.

Payment convenience.

The vast majority of delinquent payments are not premeditated. The fact is that most customers have every intention of resolving their bill. The problem is that they may put it off, forget, or even be daunted by an overly complex invoicing procedure.

Payment links can be set to come right into a person’s inbox or in text message form on their mobile device. Readily accessible without sacrificing security, these links allow the consumer to resolve their bill quickly, safely, and from anywhere 24 hours a day.

Additionally, your customer will immediately receive verification that the invoice has been paid, allowing for accurate record-keeping and easy retrieval should questions arise later.

Flexibility.

These days, credit and debit cards are just one of a variety of payment options that are available to merchants and buyers. When you use a link for payment, you can furnish your customers with a diverse set of ways to complete their invoice.

In addition to the conventional ways mentioned above, people can also pay using ACH or digital wallets. The array of choices they see depends on what you have set up with your processing company.

When you accept payments online via these links, everything is clearly laid out for customers, making completion fast and easy.

Lower payment processing costs.

One of the key advantages of online invoicing tools such as payment links is that they do not require a lot of expensive resources on your end. For instance, you don’t have to pay high prices for an extensive website if you only need to send customers to a secure checkout page.

A far wiser use of your capital is to spend it on maintaining a simple website that promotes your brand, highlights your products and services, and keeps customers updated about recent developments and promotions.

If you have already invested in an app for your business, you can also link it with your pay link service. This further cuts down on your costs while enhancing convenience for your customers.

Boost communication.

Cultivating a warm, dynamic relationship with each customer is the hallmark of today’s most successful businesses. Making payment links part of your operations gives you another way to stay in touch that is friendly and business-like without being obnoxious.

Since payment links can also be sent via text messaging and social media, you can approach buyers on a number of levels.

These days, they don’t even need to be near their laptop or desktop to view and pay their bill from you. In our multi-tasking world, this convenience makes it possible to take care of business and receive notification of the paid bill right from a tablet or smartphone.

Ease of creation and use.

Payment links take the complexity out of invoicing. When you use them, you no longer need to contend with complex checkout portals and gateways. Better still, it’s not necessary to have an advanced degree in IT to create them.

Setting up your payment links couldn’t be easier. In fact, your current payment processor or gateway might already allow you to access them as one of their standard features.

Just navigate to the platform’s payment page, and then select the option to create a payment link. Next, fill in all of the relevant fields, including the customer’s name and amount due.

After that, decide which, if any, advanced options you want. These might include authorizing automatic future payments and setting up where the customer will be redirected once the transaction is complete.

Great for one-off payments.

Depending on the type of business you run, you may need to process a large number of one-time payments.

It’s a breeze to set up a payment link that requests customers to input their bank account information, resulting in a fast, guaranteed transfer of funds into your account.

Great for new businesses or social media stores.

Social media sites like TikTok and Instagram have revolutionized not only people’s shopping behaviors but also how companies do business.

These days, you can market your goods and services solely from these sites if you choose to do so, an added flexibility that drastically lowers your overhead costs without sacrificing your accessibility to a large customer base.

Payment links let your customers view your merchandise on social media and purchase items immediately, quickly, and securely.

When you receive what you are owed efficiently and reliably, you can run your business with one eye on your present priorities and the other on your future.

With their affordability, convenience and effortless set-up, payment links can be a powerful tool that helps you to succeed both today and tomorrow. Talk to your payment processor right away about integrating them into your operations.

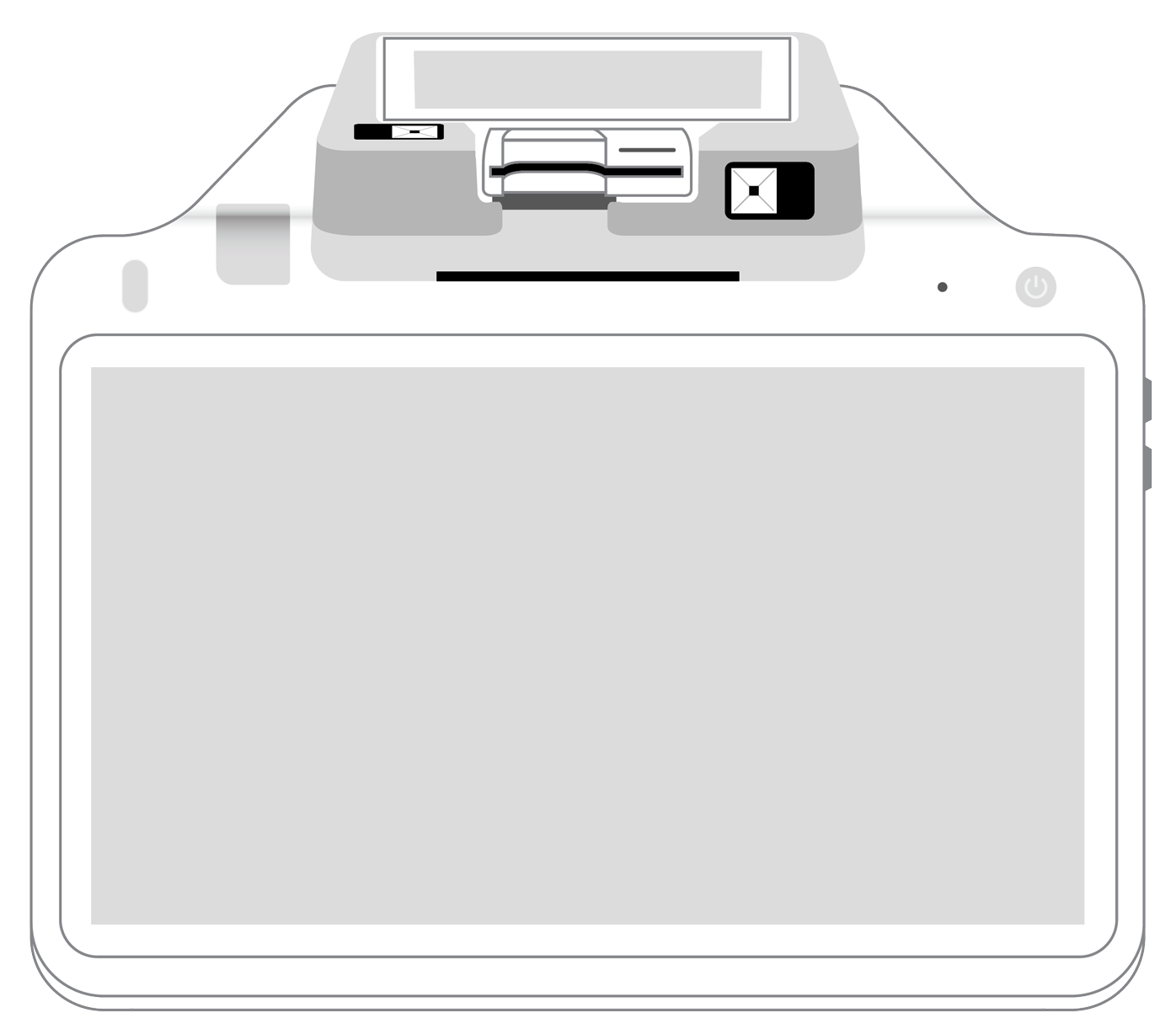

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||