Are NFC contactless payments a fad or the future?

If you accept credit cards at your small or large business, you have no doubt recognized the many benefits of doing so. Credit card transactions offer added convenience and enhanced security in a society where carrying large amounts of cash is becoming increasingly rare. From your standpoint as a merchant, these electronic transactions can lead to higher profits, more impulse purchases and, thanks to recent security innovations, lower instances of fraud.

That being said, the wheel of technology continues to turn. These days, taking credit and debit cards while using the usual methods of swiping and dipping is being gradually replaced with what are commonly known as NFC (near-field communication) contactless payments. As an entrepreneur who is constantly looking to keep your customers happy and to run your business in the most streamlined way possible, you probably want to understand just what this new transaction type is so that you can determine if it makes sense to adopt it in your store.

NFC contactless payments defined.

As the name suggests, NFC contactless payments require no actual physical connection between the point of sale (POS) terminal and the customer’s contactless payment solution (most likely their phone). You may already use contactless payments yourself as a consumer when you pay for gasoline with a SpeedPass, wave your transit card at a reader to get into the subway, or use your smartphone or watch to make a transaction at your local big box store.

A word about cashless payments.

Before we go any further, it is necessary to clear up a possible sticking point. Many people confuse the concept of NFC contactless payments with cashless ones. However, they are not the same. Cashless payments refer to any payment that does not require the use of cash. Under this umbrella term fall credit card payments, bank transfers, and purchases using digital wallets. In short, all contactless payments are cashless payments, but all cashless payments are not contactless.

How do NFC contactless payments work?

As previously mentioned, NFC stands for “near field communication.” Payment devices that are equipped with NFC technology allow the information on a customer’s card, wand, fob, or phone to be read contactlessly from a few inches away.

These consumer devices are powered by smart chip technology that accesses the unique consumer information stored in internal memory and transmits it to the reader by means of an embedded radio frequency antenna. Commonly used systems such as Apple Pay and Google Wallet take advantage of this NFC contactless technology.

When customers pay on their smartphones, the means of processing will be the same for you as a merchant regardless of the type of device they have. However, it is instructive to learn a bit about what happens in the nuts and bolts of each type of phone on the customer’s end:

• iPhone — Apple Pay uses Consumer Device Cardholder Verification Method (CDCVM) to approve the transaction. When a customer places their iPhone near an NFC contactless reader, they will be asked to biometrically authenticate their identity via fingerprint or facial recognition, providing the most secure payment platform.

• Android phones via Samsung Pay — no biometric verification or PIN is needed for transactions. Instead, the customer satisfies a security process when they open the mobile app in which the digital wallet is contained. Samsung Pay is the only platform that works with the old-fashioned magnetic stripe POS readers.

• Google Android Pay — this method does not require verification (or even that the app is opened in advance). The customer simply “taps” the mobile device near the reader. However, a PIN must be furnished for debit card purchases, and the buyer must give a signature for high-value items.

A brief history of NFC contactless payments.

Although the opposite may seem true, NFC contactless payments have been in the process of becoming available for decades. In fact, the residents of Seoul, South Korea have been using smart cards to access the transit system since 1995. As long ago as 1997, Americans who were thirsty for a Coke could buy one from certain Coca Cola vending machines via text message. In that same year, ExxonMobile first introduced the SpeedPass that enabled drivers to buy their gas by waving a smart chip-enabled wand at the pump. By 2011, mobile phones were becoming ubiquitous, and Google Wallet began to utilize the built-in digital wallet capabilities found in Android phones to facilitate “tap and pay” transactions. In 2014 with its release of the iPhone 6 and 6 Plus, Apple joined the NFC contactless revolution with its Apple Pay service. More recently still, wearables such as the Apple watch and Fitbit have also been equipped with these contactless capabilities.

The benefits of NFC contactless payments.

Perhaps the most compelling advantage of NFC contactless payments is convenience. Customers can use their smartphone (something they already carry with them) to buy virtually anything, with no need for fumbling through pockets or a wallet for bills, coins, or even a credit card.

Thanks to the fingerprint and facial recognition technology that is now included with their smartphones, consumers can authenticate their transactions quickly and in unique ways that foil the vast majority of fraudsters. In addition, the fact that the payment device never leaves the consumer’s hands, combined with the encryption that is included with every payment, greatly increases the security of the entire process.

Of course, there is another less tangible but equally compelling benefit: the “cool” factor. Nothing says you’re up on the latest trends like suavely taking out your phone and making an effortless contactless payment.

Buyers are not the only ones to experience the upsides of this new way to accept credit card payments. Retailers are discovering that the long queues at the cash register that have traditionally frustrated customers and harried staff can be markedly reduced by NFC contactless technology. The average cash transaction takes an estimated 33.7 seconds to complete, while a conventional credit card swipe or dip requires 26.7 seconds. By contrast, contactless transactions generally take only 12.5 seconds. Over the course of a long day, this difference can add up, and the result can be happier customers and employees!

Furthermore, a merchant is less vulnerable to theft or human error since the customer’s credit card number is not transmitted to or stored by their POS system. Instead, it is encrypted into a one-time code that ultimately proves useless to hackers. Because NFC contactless payments are compliant with Payment Card Industry Data Security Standards (PCI DSS), consumers and business owners alike can rest assured that the data is being safeguarded. Finally, those who incorporate NFC contactless payments into their business model may gain a competitive advantage over their rivals who do not. After all, customers enjoy having maximum flexibility and convenience when it comes to how they pay for goods and services. If one store provides this additional option and its neighbor does not, most savvy buyers would choose the former.

Are NFC contactless payments here to stay?

While no one has a crystal ball, trends certainly seem to be pointing toward the longevity of this new and convenient way to make and process customer payments. Nations including the U.K, Australia, and South Korea have already widely adopted the practice. As the number of smartphones continues to skyrocket in the U.S., it seems quite likely that America will follow suit.

If you want to get in on the bottom floor of this exciting trend but are not sure if it is right for your business, ask yourself the following questions:

• Do you work in an industry that is conducive to NFC contactless payments?

• Do you have a customer base who would utilize this option?

• Does your current financial situation and sales traffic allow you to invest in NFC contactless readers?

• Are you willing to purchase new hardware and software?

• Are you willing and able to train your employees in this new technology or find someone else who will?

• If you are not quite ready to fully embrace NFC contactless payments, are there other cashless options that you can integrate into your business model?

If you are like most modern entrepreneurs, you face competition from all sides: local, national, online and even global. As a result, finding ways to rise above your rivals is more important than ever. Accepting contactless payments gives you a way to be innovative and cutting-edge while providing enhanced security and added convenience to your valued customers. After reviewing your unique business situation and needs, now just might be the time to adopt this revolutionary way to accept credit card payments.

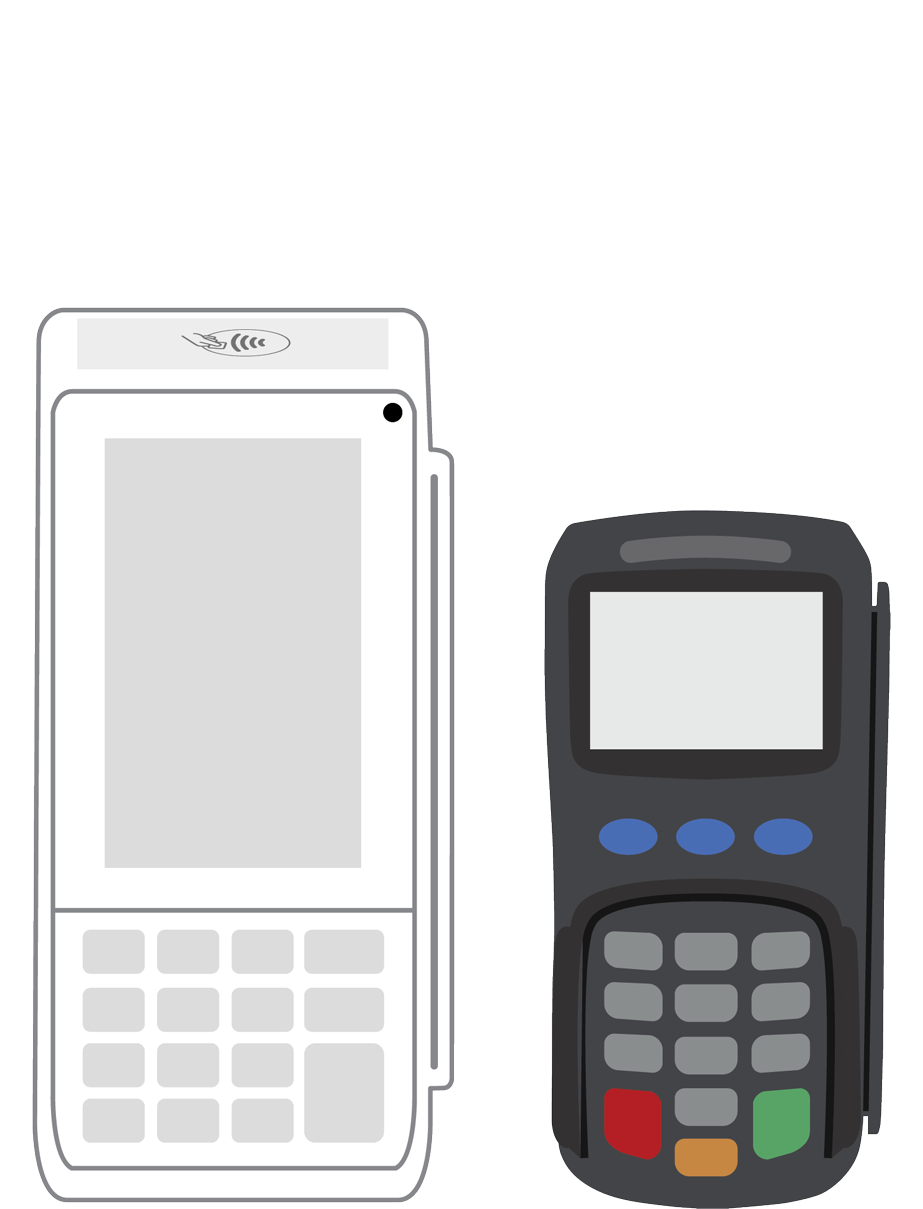

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||