CBD retail sales and consumer buying statistics

In 2018, the Farm Bill was signed into law. This legislation made it legal to sell hemp-derived products, including vapes, lotions, candies, tinctures, ointments, and much more.

Since then, people have been using these items to treat pain, relieve anxiety, and simply de-stress after a long day.

But what are the statistics behind the sales of CBD-infused merchandise, and what are the potential long-term consequences of these innovative products?

The CBD market: sales and buying statistics.

By 2021, CBD sales in the United States had risen to a whopping $5.3 billion. What’s more, there seem to be no indications that the success is waning. By 2026, projections estimate that sales will have reached over three times that figure.

It didn’t take long to get to this point, considering that the Farm Bill only became law six years ago. But back in 2021, the market only generated a relatively paltry $108 million in sales.

That being said, a lot has happened in recent years. By 2022, global CBD sales generated $14.7 billion, certainly a harbinger of the upcoming success that sub-markets such as the U.S. will experience.

California’s $730 million in 2022 signaled a trend that appears to be spreading across the nation. Only during March of 2022 until that same month in 2023, was there a dip in CBD product buying.

Consumer insights and usage statistics.

No doubt, CBD has come into its own in recent years. Whereas many potential buyers once feared that products containing this oil would have severe psychoactive properties, those concerns seem to now be allayed as CBD takes its place as just another acceptable form of treatment on pharmacy and specialty store shelves.

In fact, 60% of U.S. adults either use or have used one or more types of CBD-based products. The majority of users, 62%, have come to rely on CBD items as primary treatments for any number of conditions, from pain to anxiety. Therefore, it might not come as much of a surprise to learn that 90% of older study participants age 77 and over have come to incorporate CBD into their health care regimens.

By contrast, younger consumers want to spend their dollars on value-added items such as vapes and edibles and will often devote a sizable percentage of their budget, over $50 a month, to these purchases.

Consumer perceptions of CBD products.

CBD’s reputation has undergone a major transformation in recent years. No longer viewed as a dangerous outgrowth of the counterculture, these products are now actually seen as being safer than alcohol by 65% of the U.S adults surveyed.

A somewhat fewer 45% believe that using these various items has become acceptable in their social circles. A large number of these individuals also believe that the use of CBD should be legal for everyone.

Retail distribution channels.

Because of its burgeoning success, all types of retailers have jumped on the CBD bandwagon, eager to market these items to their newly converted customer bases.

The industry has become particularly popular among online sellers, who have established highly successful websites thanks to the upsurge in the availability of high-risk merchant account providers who are willing to partner with them in accepting shoppers’ dollars.

These providers are adept at assisting even novice entrepreneurs in navigating the industry’s complex security and regulatory landscape and have been instrumental in facilitating the success of many ecommerce retailers.

Not to be outdone, retail pharmacies have quickly jumped into the sales space as well.

Capitalizing on the extra level of convenience and personal customer service they can provide, large chains like CVS and Walgreens have begun to feature CBD products such as topicals in a growing number of their stores.

Popular CBD products and segments.

One of the fastest-growing areas for CBD product sales is in the realm of enriched vitamins. Already, consumers are spending over $20 million on these supplements which promise to augment the benefits that standard vitamin and mineral supplements are already furnishing.

Although these supplements are not officially approved by the Food and Drug Administration (FDA), their manufacture is increasingly being monitored by established laboratories, helping to ensure that consumers receive CBD in the quantities and quality advertised.

In the health and wellness category, nutraceuticals comprised over 60% of shoppers’ spending. These products are made by combining foods with CBD oil to bring about both health and nutritional benefits.

Common types include oils, topicals, capsules, edibles, and beverages. All are designed to promote health and wellness by featuring CBD oil as one of the primary ingredients.

Many consumers have come to view CBD-infused topicals, edibles, beverages, and other products as a safer alternative to strong prescription medications.

Those experiencing the debilitating effects of severe pain, stress, depression, and anxiety are often wary of the side effects that go hand in hand with many of these so-called traditional pharmaceuticals.

Furthermore, for better or worse, they can often become their own doctor, coming up with a self-styled treatment regimen that involves little to no supervision by a medical authority.

In just six short years, CBD products have taken the country and the world by storm. People are using them to treat everything from mild stress to the most severe types of pain and, for the most part, are taking their health and wellness into their own hands.

To tap into the rapidly growing CBD industry, your business needs a CBD-friendly payment processor to ensure smooth transactions. By partnering with us, you'll unlock the potential to reach a broader customer base and increase your revenue. Get in touch with us today to get started on your path to success.

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.

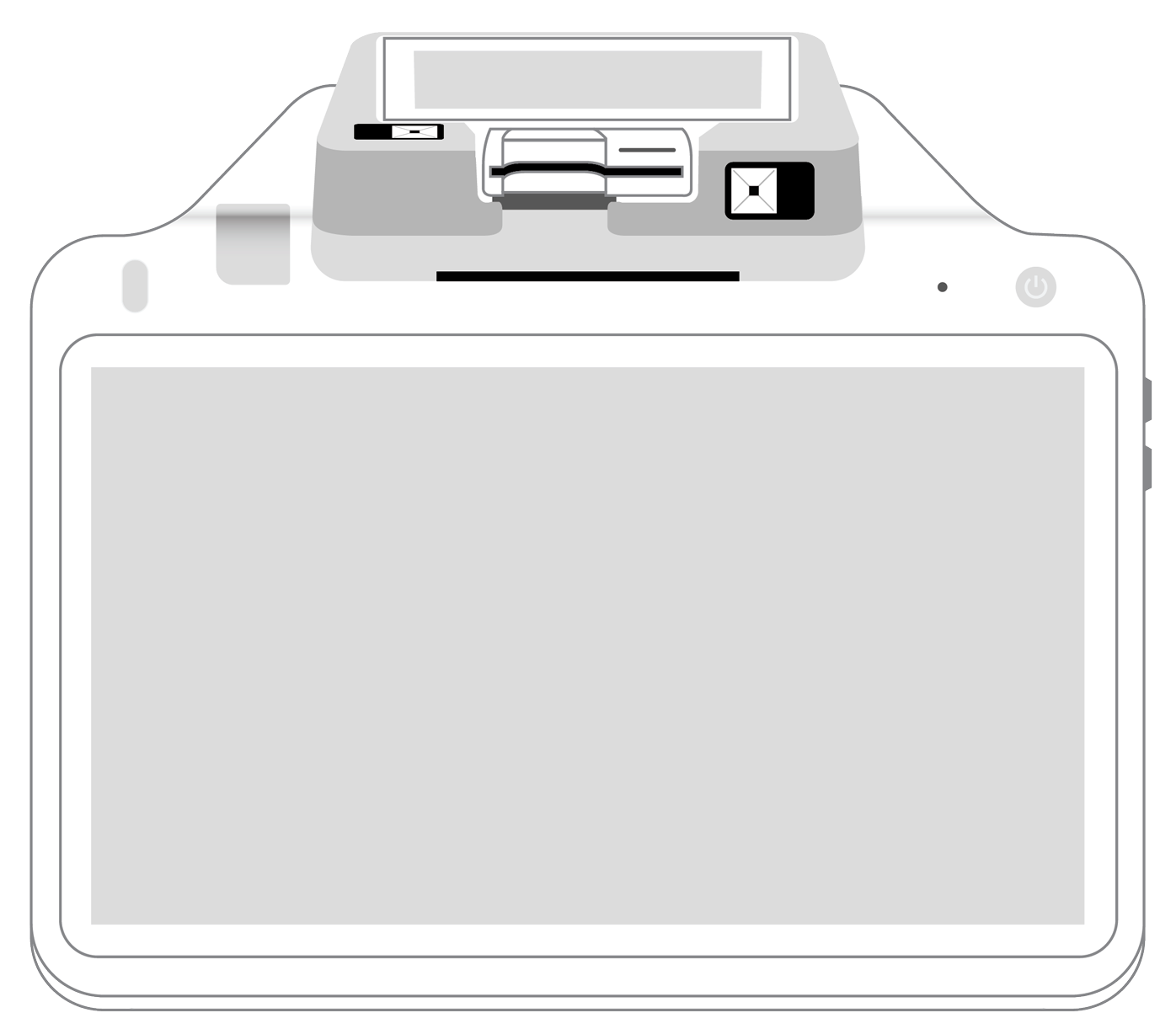

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||