Contactless payment options for every business type.

Even before the spring of 2020 when the coronavirus burst on the scene, contactless payments were gaining traction with merchants and consumers. However, the increased concerns about hygiene and convenience brought on by the pandemic provided a springboard that jump-started the popularity of this innovative way to complete payment transactions. Although COVID-19 is no longer forcing most people to stay at home, contactless payments are more important than ever for all varieties of businesses and the customers they serve.

What are contactless payments?

The name says it all: Unlike what happens with traditional types of payments such as cash, checks, and magstripe credit cards, the contactless variety does not require any physical contact between the buyer and the merchant or their equipment. There are four main types of contactless payments.

- Contactless credit cards. These use near-field communication (NFC) technology to communicate securely with the merchant’s contactless card reader. The customer simply waves or taps their card near or onto the reader at the point of sale to safely transmit the payment details that are embedded in their chip-enabled credit card.

- Mobile wallets. These digital repositories exist on all modern Apple and Android phones and dialogue with the seller’s point of sale (POS) system thanks to the wonders of NFC. Customers pre-load the Apple Pay, Google Pay, or Samsung Pay wallets that are built into their smartphones with credit and debit card details that are then securely stored and encrypted. At the time of purchase, the customer simply opens their wallet, authenticates their identity, and places their wearable device or smartphone near the merchant’s contactless reader to complete the transaction.

- In-app purchases. Some businesses such as restaurants and delivery companies let customers pay by adding card information to a digital wallet that is stored inside the application itself. This has proven to be a safer payment alternative for many customers concerned about hygiene and convenience.

Regardless of the particular type of contactless payment a consumer uses, they can rest assured that their sensitive card information will remain protected from hackers. This is due to the robust encryption and authentication protocols that all of the major digital wallets employ.

How to add contactless payments to your business.

One of the most compelling features of touchless payments is that they are universally popular. Whether you sell food, clothing, or gifts, or provide direct services, consumers will appreciate the speed, convenience, and security that touchless transactions provide.

Another upside when it comes to contactless payments is that setting them up is fast, easy, and affordable. If you’re ready to get started with this innovative solution, you will need two things.

- An NFC-enabled payment terminal.

- A payment processing platform that is compatible with contactless payments.

Most likely, the point of sale (POS) system that you are using already has these capabilities. If it doesn’t, talk to your payment processing company. They will be happy to help you upgrade so that you can reap the rewards of offering this popular payment solution.

Once you begin to embrace contactless payments, you will quickly come to realize their numerous benefits.

- Customers will respect your commitment to hygiene, safety, and their overall well-being. (Just be sure that you prominently post information about your touchless payment capabilities to ensure that everyone knows you have taken this extra step in customer care.)

- The security of payment data will be just as robust as ever and may even be increased with this cashless, touchless option.

- You should enjoy more customers and added sales when buyers can make cashless purchases simply by placing their smartphone or wearable device near your contactless reader.

Over the past few years, touchless payments have become widely accepted across the business landscape. Restaurants have started to incorporate them into their tableside ordering systems, and retailers have begun to outfit their sales associates with tablets that can not only provide access to product information from anywhere in the store, but can also accept contactless payments from the floor, the register, or even curbside.

No matter what you are selling or how large or small your store or restaurant might be, you and your customers will love the speed, convenience, and safety that touchless payments provide. Talk to your payment processing company today about incorporating them into your checkout!

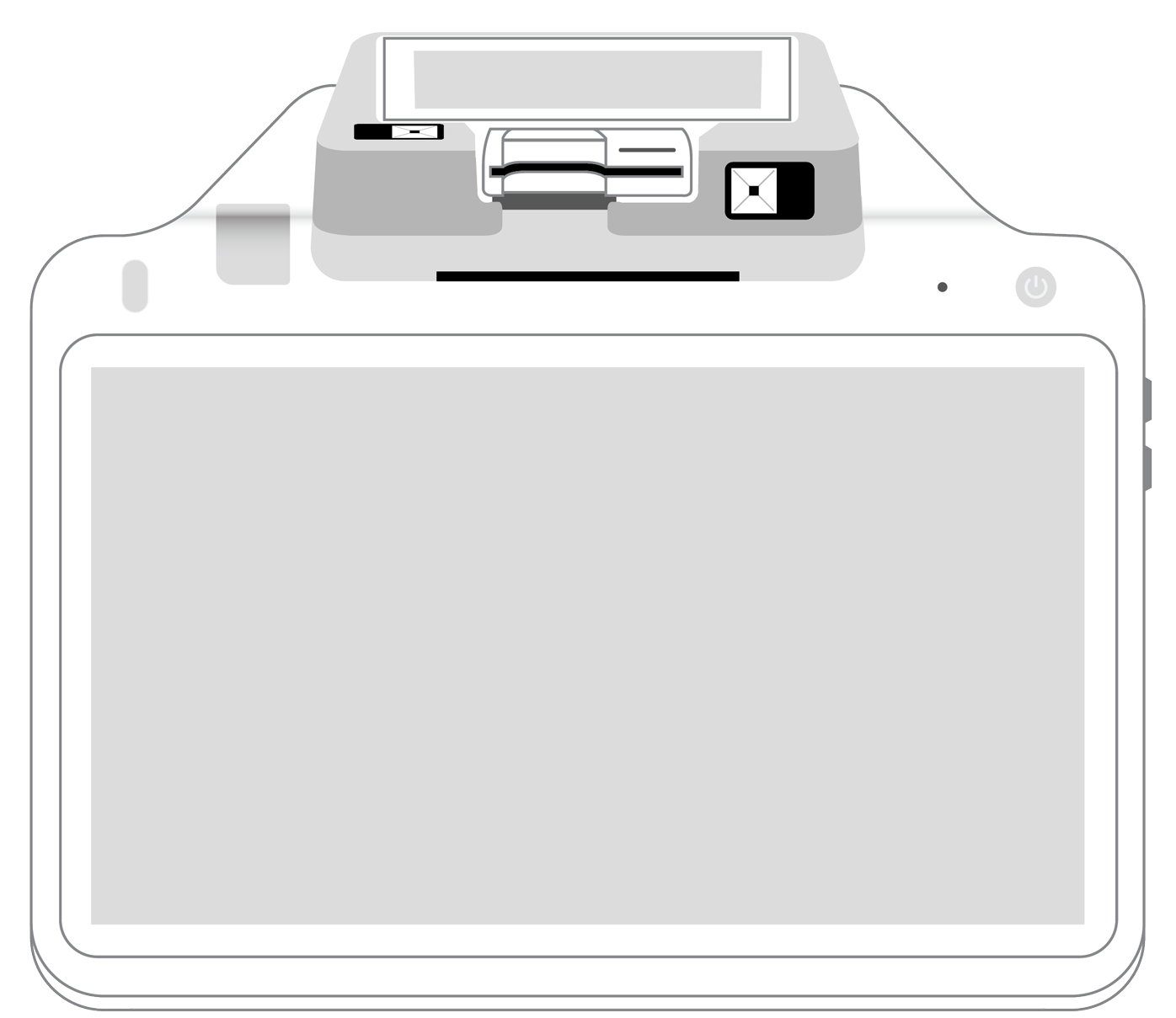

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||