Credit, contactless, debit, and EBT payments: Your business can easily accept them all.

Today’s consumers have a seemingly endless array of options to choose from when it comes to products and the retailers who sell them. Now that the world is their oyster and they possess the power of the internet at their fingertips, it is more challenging than ever to stand out as a seller. The good news is that modern point of sale (POS) systems provide you with an affordable, effective way to meet and exceed your customers’ expectations, thus enabling you to succeed in this daunting marketplace.

The point of sale system explained.

While it is still necessary for many businesses to accept cash, no brick-and-mortar, online, or hybrid operation can get by without accepting payments of other types. In order to do so, you need what is known as a POS system. This combination of hardware and software gives you everything you need to securely transmit vital data to your merchant service provider and, by extension, to the other players in the transaction process.

Your complete point of sale system consists of several components.

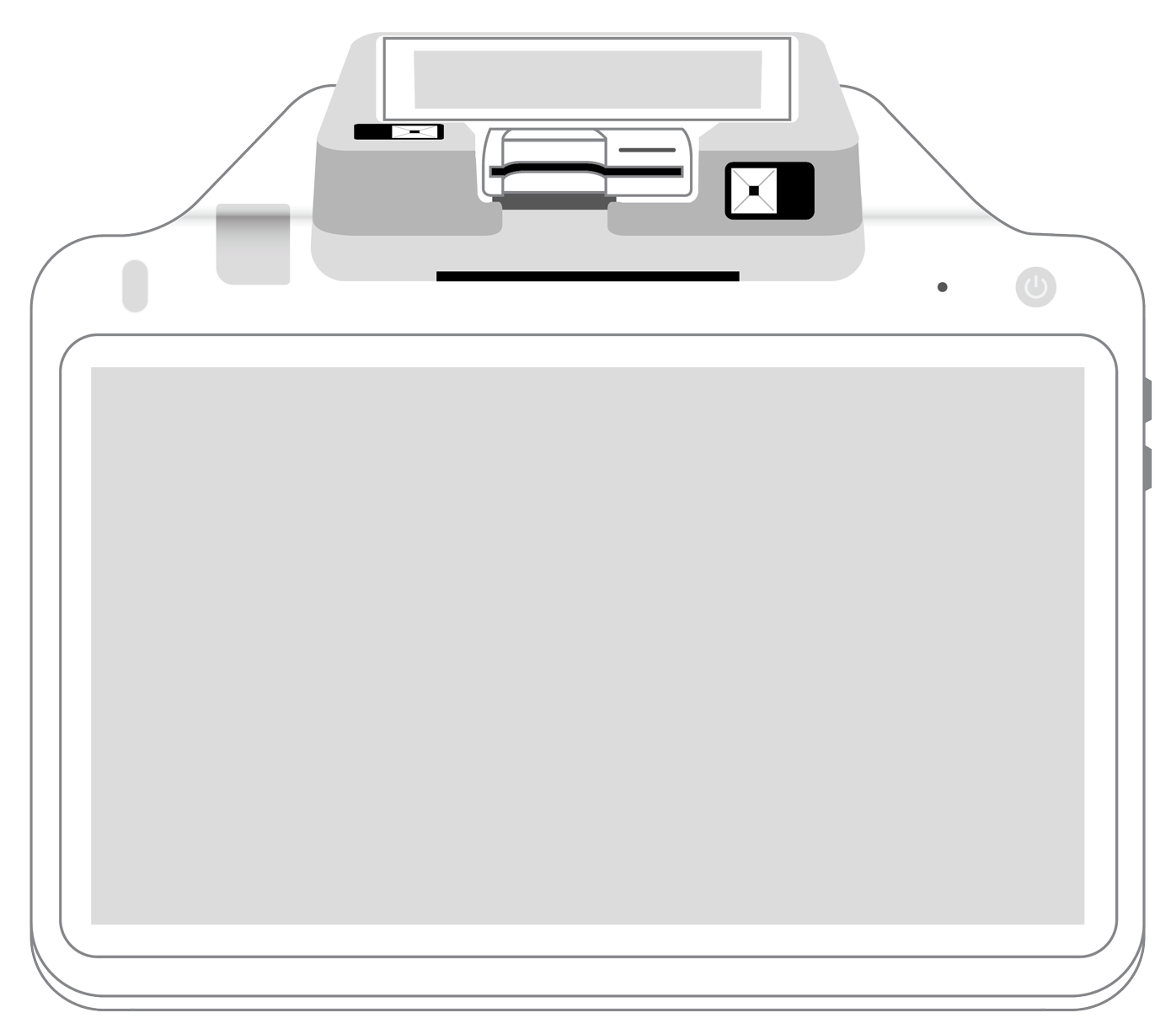

- Tablet or computer. Often called the back-office server, this piece of hardware is the central hub that runs your entire system. It contains a large display that allows you to streamline numerous operations throughout your business in addition to accepting payments.

- Keyboard. This works directly with the back-office server, allowing you to enter any data that is used to run the business.

- POS software. These applications allow you to accept payments, create reports, keep track of your payroll and employees, and run successful customer relations and marketing campaigns.

- Cash drawer. As the name implies, this is where your bills and coins will be stored. When it is connected to your electronic POS system, it can also maintain a count of how many times the drawer has been opened, making it easier to prevent fraud and employee tampering.

- Receipt printer. This provides your customers with a hard paper copy verifying when and what they purchased and how much they spent. Your POS solution should also be equipped to email a copy to your buyers, cutting down on paper use and giving your customers an easier way to keep electronic records.

- Barcode scanner. This small accessory enables you to keep track of each piece of merchandise from the time it is delivered until it ultimately leaves in the possession of your customer. By keeping a running count of your inventory, you can easily check prices and monitor counts to ensure that you never order too much or too little.

- Card reader. Whether you use a phone or a dedicated device, you need a way to securely input the number, expiration date, and CVV code from your customer’s card in order for the payment to go through. Additionally, shoppers can have a way to provide this information simply by placing their card or device within one to two inches of your POS system if you have a contactless card reader powered by near-field communication (NFC) technology. Especially at a time when hygiene and health concerns are at the top of everyone’s mind, many savvy merchants are upgrading their systems to include this feature.

- Customer display. This separate display allows the buyer to get a clear idea of what they are being charged as well as any discounts or other promotions. Providing easy access to these details fosters trust and transparency and helps to reduce confusion that may result in costly product returns and chargebacks.

All of these elements work smoothly together to help you run a successful operation that keeps your customers coming back again and again.

The benefits of an upgraded POS system for your business.

Although the conglomeration of parts that fit together into a POS system can seem overwhelming at first, most merchants quickly discover the numerous advantages that automating and streamlining everyday tasks can bring. Below are just a few of the gifts that a POS can instantly bring to your business.

- Easy inventory management. Thanks to your barcode scanner and your payments software, you’ll no longer need to rely on clunky manual techniques such as updating spreadsheets when you want to get a handle on your product stockpile. Instead (and with just a few clicks) you can easily see what goods are selling, what is failing to fly off the shelves, what needs to be ordered in greater quantities, what should be scaled back, and much more. Never again will you need to use a precarious combination of guesswork and hope when determining your next product order.

- Effective employee management. Keeping tabs on the schedules of an entire crew of workers is challenging at the best of times and nearly impossible when you are at your busiest and trying to accomplish everything through the use of hand-written schedules and word of mouth. Your POS system should provide you with a full spectrum of tools that let you create and distribute individualized schedules via email that can be updated by you or other staff members in real time. What’s more, you can zero in on each associate to gauge their performance and progress, making it easier to provide feedback and targeted training that really works.

- Personalized customer relationships. Today’s shoppers want to be treated like the unique human beings they are, and are not content with broad-brush marketing schemes. Instead they respond to promotions that recognize their specific needs and buying histories and reward them for their repeat business. Your modern POS should come equipped with tools that let you create and maintain your own customer loyalty program that gives your buyers what they are increasingly demanding.

- Precise report generation. By now you’re probably realizing that your POS system should serve as the hub of your entire business. It should therefore come as no surprise to learn that it holds a huge repository of valuable information about your business: profits and losses data sales histories and trends, payroll information, and other analytics-based intelligence. The system’s reporting capabilities let you choose what information you want it to highlight in creating reports you can use and act upon. For instance, you could ask your POS system to produce a document showing what times of the day yield the highest sales numbers so that you can be sure to have sufficient staff on the floor to meet your customers’ needs. Really, the possibilities are virtually endless, and the results can give you an unprecedented ability to take the pulse of your store at any time and from anywhere.

How the right POS solution can offer real choice to your customers.

We have spent some time focusing on the more far-flung, administrative capabilities that contemporary POS systems can bring to your operation. However, no discussion would be complete without also delving into how your system can assist you in its primary function: getting you paid. As it turns out, your POS gives you a lot more than just card acceptance.

- Credit cards. Your POS solution should be designed to accept all of the major credit cards, including Visa, Mastercard, Discover, and American Express. It should be updated to accept EMV chip cards, the more secure upgrade to the old-school magnetic stripe cards that were the standard in the United States before 2015. If you have a mobile card reader, you can accept payments anywhere since the device is wireless.

- Contactless payments. Modern POS technology allows your customers to pay for goods and services using their credit card or compatible mobile device without ever coming into physical contact with you or your equipment. Consult your merchant service provider to be sure your POS system contains near-frequency communication (NFC) technology. This enables your customers’ digital wallets to send encrypted payment information to your contactless card reader. Your reader then safely transmits the details to your processing company, which facilitates all aspects of the secure payment within a matter of two or three seconds.

- Debit cards. Allowing your customers to pay with debit cards gives them added choice and convenience while simultaneously costing you less in transaction charges than you pay with standard credit cards. In order to offer this option, however, you must check with your merchant service provider to be sure that your software is fully compatible.

- EBT cards. Electronic benefit transfer (EBT) is a payment system that gives consumers access to funds from various state and federal aid programs such as the Supplemental Nutritional Assistance Program (SNAP). This is done using a secure magstripe card similar to a debit card. Although most EBT purchases are food-oriented, certain other retail items may also be approved, making accepting this payment type a good idea for more generalized sellers. Since EBT programs are sponsored by state and federal governments and not the credit card companies, fees are much lower. In fact, there are no PIN debit or interchange fees at all. In order to accept EBT, you will first need to complete the necessary state or federal applications and provide any requested supporting documentation. Next, be sure that your POS equipment is compatible. It must possess an integrated or separate PIN pad on which customers can enter their code. Furthermore, it must be configured by your merchant provider with their unique encryption keys.

By providing your valued customers with as many payment choices as possible, you can boost your store’s reputation and set your business apart from your local and global rivals.

The ideal POS solution is a compact combination of software, hardware, and accessories that does not take up a great deal of physical space. Even so, it truly is a powerhouse when it comes to the running of your online and/or physical retail store. When you utilize its capabilities to the fullest, you can manage your inventory and employees while offering buyers the choices they are increasingly demanding.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||