Defining Credit Card Processing

If you're brand new to the world of credit card processing, don't fret. We've got you covered and will make sure you know everything you need to know. Accepting credit cards with PayAnywhere is an easy and quick process to complete.

- Set up a PayAnywhere account in just minutes and get a free credit card reader for your smartphone. You can do this by applying online or calling 877.387.5640.

- Download the app from the App Store and start testing it out in demo mode, which we call "Test Drive."

- Once your account is approved, you can start accepting credit cards.

See how simple that was? Now, time to get into a couple of the terms we use most at Pay Anywhere.

Anyone who would like to accept credit card payments needs a merchant account to begin. A merchant account is a checking account that is established by a merchant (in this case, you) with a merchant processor (like Pay Anywhere/North American Bancard). Having a merchant account means you can receive payment for credit card transactions. You'll be able to stay in control over your money, since you are assigned a unique merchant identification number (MID) when you open a merchant account. Trust us, no matter who you are or what type of business you are, you want to have a merchant account. Those who claim "no merchant account required" put your money at risk - when you set up with them, you are pooled into a shared account that leaves your money open to potential fraud.

And as with any credit card processing service, there are fees associated with a merchant account and having a merchant services provider. However, if you've got PayAnywhere, the only fees you have to worry about are transaction rates. You only pay for PayAnywhere when you use it. No joke. There are no fees to set up an account, nothing you pay month to month, and if the day comes where you don't need PayAnywhere, well we won't charge you for that either. A transaction rate is a service cost that is charged on a per transaction basis, and is dependent on whether you swipe or key in a credit card transaction.

What's the difference between a swiped or keyed/manual transaction? Simple. We provide you with a free credit card reader accessory ($19.95 Shipping and Processing applies to cover our costs) so that you can swipe a credit card. Just like at any retail location, swiping a credit card through is a lot more secure. Because of this, there are lower transaction rates associated with swiped transactions. Keying in a transaction is just manually inputting the credit card information.

To recap: The credit card processing terms you need to know first and foremost are merchant account and transaction rates. You'll get a merchant account, and you'll pay transaction rates dependent on your credit card transaction type.

More from News

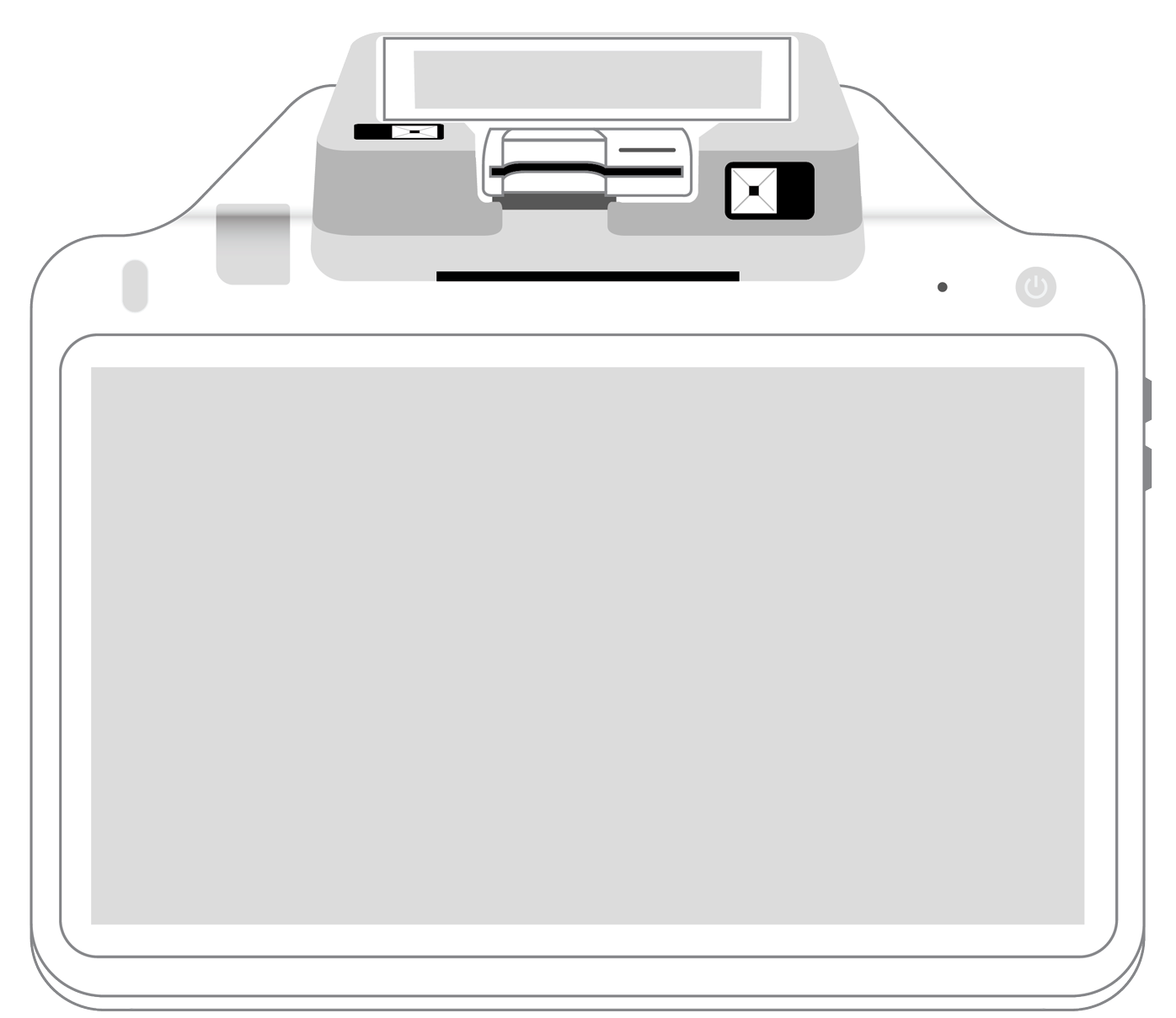

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||