Digital payment trends, technology, and methods for your small business this summer.

It goes without saying that your business needs to be a model of excellent customer service, innovative products, and high efficiency. But for some reason, you may still be feeling like you want to do more to please your customers and elevate sales. This summer represents the perfect time to embrace some of the more innovative payment and business operations technology that is taking companies of all sizes by storm.

A word about digital payment services.

Before we get into the meat of this discussion, it’s vital to get our terms straight. When we talk about digital payment services, we’re referring to innovative methods of transferring money from customer to merchant that may be contactless, cashless, and even paperless. Thanks to modern internet technology and the point of sale systems, credit card readers, and credit card terminals that accompany them, you can provide shoppers with fast and highly secure ways to complete their purchases.

1. Payment devices featuring biometric authentication.

If you have a modern smartphone, you are probably already familiar with some of the ways this technology is impacting today’s consumers. Payment devices equipped with biometric scanners now primarily verify a consumer’s identity based on their fingerprint or facial recognition. However, other metrics such as heartbeat analysis, vein mapping, and iris scanning are becoming more popular. Before long, Visa will also be introducing a biometric payment card that allows consumers to validate their identity by touching a sensor that verifies their fingerprint.

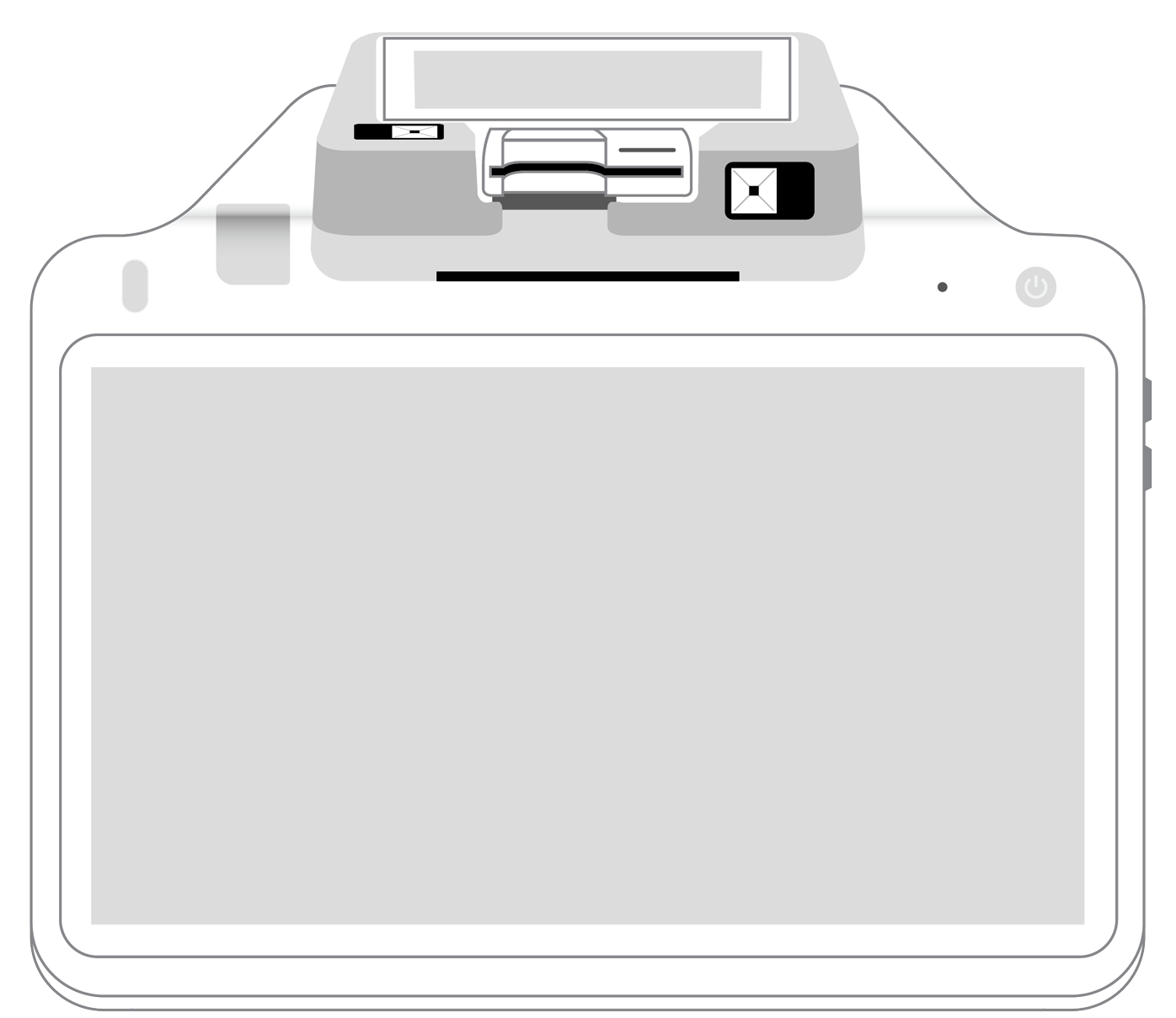

2. Mobile point of sale (mPOS).

Although many stores still use cash registers, they are no longer required in today’s payments landscape. This is because mPOS options are also now available. These use wireless devices such as tablets and smartphones that are connected to a card reader and an app to process the customer’s payments. Once these alternate forms of credit card readers are up and running, business owners can accept payments from anywhere in the store or even outside it, reducing or altogether eliminating the need for a centralized checkout area and the long lines and customer frustration that frequently accompany it.

3. Smart speakers.

Amazon Echo, Google Home, and Apple HomePod are becoming ubiquitous household accessories. They all pack a mighty punch when it comes to their features, including the ability to coordinate many home management and entertainment tasks.

One of their most useful functions involves making shopping easier. With a simple voice command, people can now browse major websites for items and even make payments as well as learning when their delivery is scheduled to arrive. Because this method of shopping is only going to grow more popular with each passing year, it makes sense to optimize your store so that it is voice command-friendly.

4. Contactless payments.

Before the coronavirus pandemic changed everything, many of us barely gave physical touch a thought. However, it has now become important to remain as hygienic as possible — even during a payment experience.

With the help of wireless technology and advanced authentication safeguards, customers can now pay for purchases and even transfer funds from one account into another merely with the tap of a card or the wave of a specially-equipped smartphone or wearable device within close range of a merchant’s credit card readers. Common applications that are being used for peer-to-peer and business payments include Venmo, PayPal, Google Pay, and Apple Pay. Although there is no additional fee attached to accepting a payment using one of these vehicles, you as the merchant will still be charged for a card-present transaction as usual.

5. Social media payment options.

If you haven’t already become an active participant in the social media revolution, your immediate job is to get your pages up and running on the sites your customers visit frequently. Not sure which ones they like? One of the best ways to find out is to ask them using a survey that incentivizes them for giving their opinion with free gifts or product discounts.

Then it’s time to create engaging textual and visual content. This should include information about your business, compelling stories and demonstrations of highlighted products, and fun and attractive vehicles for interacting with buyers.

In addition to hooking people in with fun polls, captivating conversations, social forums, and insiders’ views of your business, you also need to make it possible for visitors to connect directly to your website from your social media pages. It should be seamless for a customer to learn about your brand, be inspired to find out more, and ultimately purchase it on your secure payment gateway. The major sites — Facebook, Instagram, and Pinterest — all have business accounts that allow merchants to sell directly to consumers for a small fee. This channel can be a highly effective tool for courting new customers and establishing long-term relationships with them.

6. Online payment methods.

If you have any experience in the ecommerce ecosystem, you already know a lot about setting up your site to accept standard online payments. These happen when someone enters their credit card details into your secure payment gateway. The information is then transmitted to the other players involved in the payment process, and the transaction is screened both for fraud and to make sure the customer has sufficient funds. If all goes well, the payment goes through.

While this conventional way of purchasing is still common, there are also newer choices and methods that are gaining popularity.

- Bank transfers.

- eChecks.

- Buy now pay later (BNPL).

- Cryptocurrency such as Bitcoin.

- Recurring billing/subscription options.

In an age when competition is fiercer than ever, furnishing customers with additional payment methods and styles conveys the message that you are willing to go the extra mile to bring about choice and satisfaction.

Now is the time to catapult your store above all the rest. Consumers with money are eager to spend it, and you have worked hard to offer products and services that mesh with your target audience’s needs and wants. Implement some or all of these cutting-edge payment methods, and your store can rise above its competitors once and for all.

Related Reading

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||