Do you do business on the go? Then it's time to find the right mobile credit card reader.

Modern customers are ready to break out of lockdown and once again experience all that the world has to offer. Whether you want to sell your wares in a pop-up store, exercise your culinary skills in a food truck, or serve your customers wherever they may be, it’s time to augment your physical store or even leave it behind altogether. To best embrace these exciting goals, one of the most effective strategies you can adopt is to integrate a mobile credit card reader into your business model.

What is mobile card reading technology?

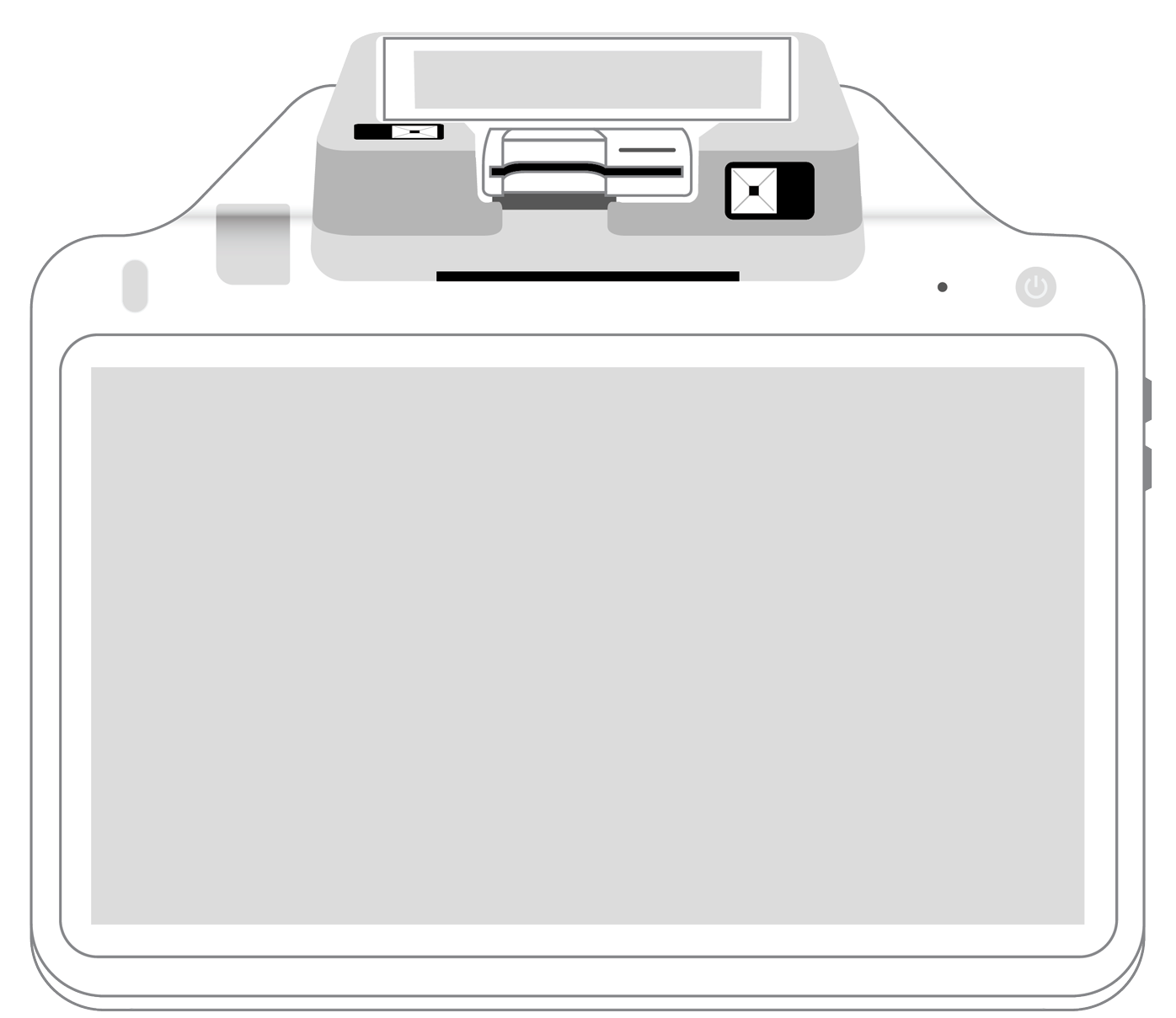

As the name suggests, mobile card readers are wireless. In other words, they are not connected to a stationary point of sale system, leaving you free to use them anywhere that has a wifi or cellular connection. Despite their small size and easy portability, however, mobile card readers can pack a wallop when it comes to functionality.

A mobile reader connects directly to your tablet or smartphone. In addition to this hardware, you’ll also need to install a smartphone app that connects to your payment processing company. Although you can use your mobile card reader anywhere, you shouldn’t have to sacrifice features. With the right reader and payments software, you’ll stay connected to a full suite of employee and customer management, financial, inventory, and report generation features.

Why a mobile card reader makes sense for your dynamic business.

If your retail operation is on the move, you cannot afford to be tethered to your brick-and-mortar location. Why wait to go through the laborious process of calling your office to accept remote card-not-present payments when you can take your reader directly to your customers? That way you won’t deprive yourself of business when a customer expresses the desire to pay at a remote location and you have no way to accommodate their preference? Mobile card readers give you everything you need to take your business anywhere you want to go, whether that is to a customer’s home across town, or a product fair on the road.

Being able to take customers’ payments wirelessly is also to your company’s advantage from an accounting standpoint. You and your staff will no longer need to keep tiny receipts organized, and your system will automatically update your financial records as soon as the transaction goes through. Should there ever be a question about dates or monetary amounts, you can bring up the proof in a matter of seconds.

Finally, now that your business is on the move, you can take your customers’ buying preferences into consideration. Even now that the pandemic has stretched on for more than two years, many people are reluctant to venture out of their homes. Having an easy-to-use and portable reader at your disposal gives these more fragile buyers ongoing access to the products and services they want without endangering their physical well-being.

If taking your business to the next level means expanding beyond your physical space, it’s time to look into how a mobile card reader can help you to achieve your goals. By embracing this widely accepted technology, you can provide an elevated shopping experience to your customers while simultaneously streamlining your entire business operations.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||