Does Your Business Need to be Able to Process Checks Electronically?

Do you have to hold back a sigh every time a customer writes a check for a purchase? It may seem like an outdated payment method in an era when instant payments are possible simply by waving your phone over a POS device, but consumers aren’t yet ready to give up checks. Fortunately for frustrated business owners, this payment method can be brought into the 21st century with electronic check processing.

Yes, You Should Still Accept Checks

You already know how important it is to accept credit cards at your business. Consumers seem almost conditioned to whip out the plastic when buying everything from packs of gum to flat-screen TVs. However, if you’re not taking checks, you could be missing out on sales from a large chunk of your target audience. In 2012, consumers used 18.3 billion paper checks to make payments, a whopping 15 percent of all non-cash payments. Given the prevalence of plastic and the growing use of mobile payment options, this is an impressive statistic. Businesses with customer bases consisting of older adults are likely to process more checks, although millennials are still making use of paper payments on occasion. Some businesses shy away from checks because they’re a high-risk payment method. Even if you never get smacked with a fraudulent or bounced check, you still have to wait for paper checks to be processed before you get your money. For consumers, checks can be cumbersome and nearly always take longer than other forms of payment. There are few things more embarrassing than watching a line form behind you and knowing the cashier is reaching the end of his or her patience while you labor to fill out a paper check. Despite all of this, there are a few reasons why consumers and businesses still bother with checks:

- Paper payments can be accepted if electronic systems go down.

- Checks are handy for covering purchases larger than expected.

- Businesses pay fewer fees for check processing than when processing plastic.

B2B customers may also prefer to pay by check for large purchases, so if you deal primarily with other companies instead of consumers, you can’t abandon check processing even if you’re sick and tired of dealing with paper.

How Does Electronic Check Processing Work?

Electronic checks, or e-checks, can be processed and accepted in one of two ways. Either a paper check is converted to an electronic format or a check is simulated electronically. Money is then transferred from the customer’s bank account to your business account using the Federal Reserve Bank’s Automated Clearing House (ACH) system, or the check is sent straight to your bank for clearing and deposit. The nationwide ACH system serves to move funds electronically between different entities and is used not only for e-checks but also for applications such as direct deposits and loan payments. ACH transfers are common and considered to be both reliable and efficient.

Of course, it’s impossible to magically turn paper into a digital payment without some kind of infrastructure to act as an intermediary. Accepting e-checks through your regular POS system requires a scanner to read the check, account and bank routing numbers, along with any other information necessary to complete the transaction. The customer receives the voided check back along with the receipt once the purchase is complete. What if you get a lot of payments online? E-checks cover this, too. If you have a payment gateway with an ACH or bank account option, your customers don’t need credit cards to pay you, and you don’t have to mess around with credit card fees for people who spontaneously decide they need $5 or $10 worth of merchandise. To use e-checks online, make the choice available at checkout. Customers wishing to pay by check can enter their bank routing and account numbers to simulate a paper check payment and authorize your company to take money for their orders. This is an especially useful method for recurring payments or subscription services because people tend to stick with the same bank accounts even when they switch their preferred credit cards.

Going Electronic Has Its Pros and Cons

Jumping on the e-check bandwagon might be a great idea, but it could also be a disaster if you don’t consider whether the advantages outweigh the drawbacks for your business. Will going electronic benefit you or just saddle you with a bunch of extra tasks and fees you don’t really want to handle? To know for sure, take a look at the pros and cons of e-check processing.

Pros

Allows you to use a check image instead of a paper check to receive funds

- Provides multiple ways to accept direct money transfers

- Can be used for both in-store and online purchases

- Can be used to process checks received by mail.

- No more trips to the bank to deposit checks.

- Eliminates the risk of losing paper checks before deposits are made.

- Less time waiting for payment approval and receipt.

- Verification is available to alert you to any prior record of back checks from a customer.

- Fewer processing and depositing fees.

- Faster transfer and depositing of funds.

- Encourages customers to pay with checks instead of cards for smaller purchases.

- Better security, including encryption during transfer.

- Lower processing fees for recurring payments when compared to credit cards.

Cons

- Checks are still a high-risk option.

- The possibility of fraud or bounced checks can’t be entirely avoided.

- You remain responsible for securing or covering payment for bad checks.

- Adding yet another payment type may be more than you can handle if you’re already processing cash, credit cards, and mobile payments.

- Increases the complexity of your POS and may slow the flow of sales.

- The need to invest in infrastructure for what’s essentially a dying form of payment.

- Customers must be notified of your use of e-checks because money is withdrawn from their accounts faster than with paper checks.

- Higher risk of NSF denials for customers who don’t understand how e-checks work.

Should You Consider Electronic Checks?

It’s obvious adding e-check processing to your payment options has a lot of perks, but only you can decide if it’s the best choice for your business right now. If you don’t take checks at all and your target audience is mostly millennials who prefer to zip through the checkout without ever actually touching your POS system, there’s probably no reason to bother. On the other hand, you may want to invest in e-check infrastructure if:

- Your patrons or business customers are already writing a lot of checks.

- You’re sick of dealing with high fees from people using credit cards to pay for small impulse purchases.

- You deliver some or all of your products or services using a subscription model.

- You process large payments on a regular basis.

- You’re looking for a smarter, safer way to handle check payments.

- Your business is growing, and your customers want more ways to pay.

- Customers send you a lot of checks through the mail, and you’d rather not risk payments getting lost.

If one, several or all of these situations sound familiar, here’s how you can get everything in place to start processing e-check payments and take the hassle out of accepting paper checks.

Get Your Business Ready to Process Checks Electronically

The first step in going all in with e-checks is to find out if your current payment gateway can handle the processing. If not, you’ll need to switch to one with the right tools or sign up for one dedicated to e-checks. Research the options available from merchant services providers such as North American Bancard.

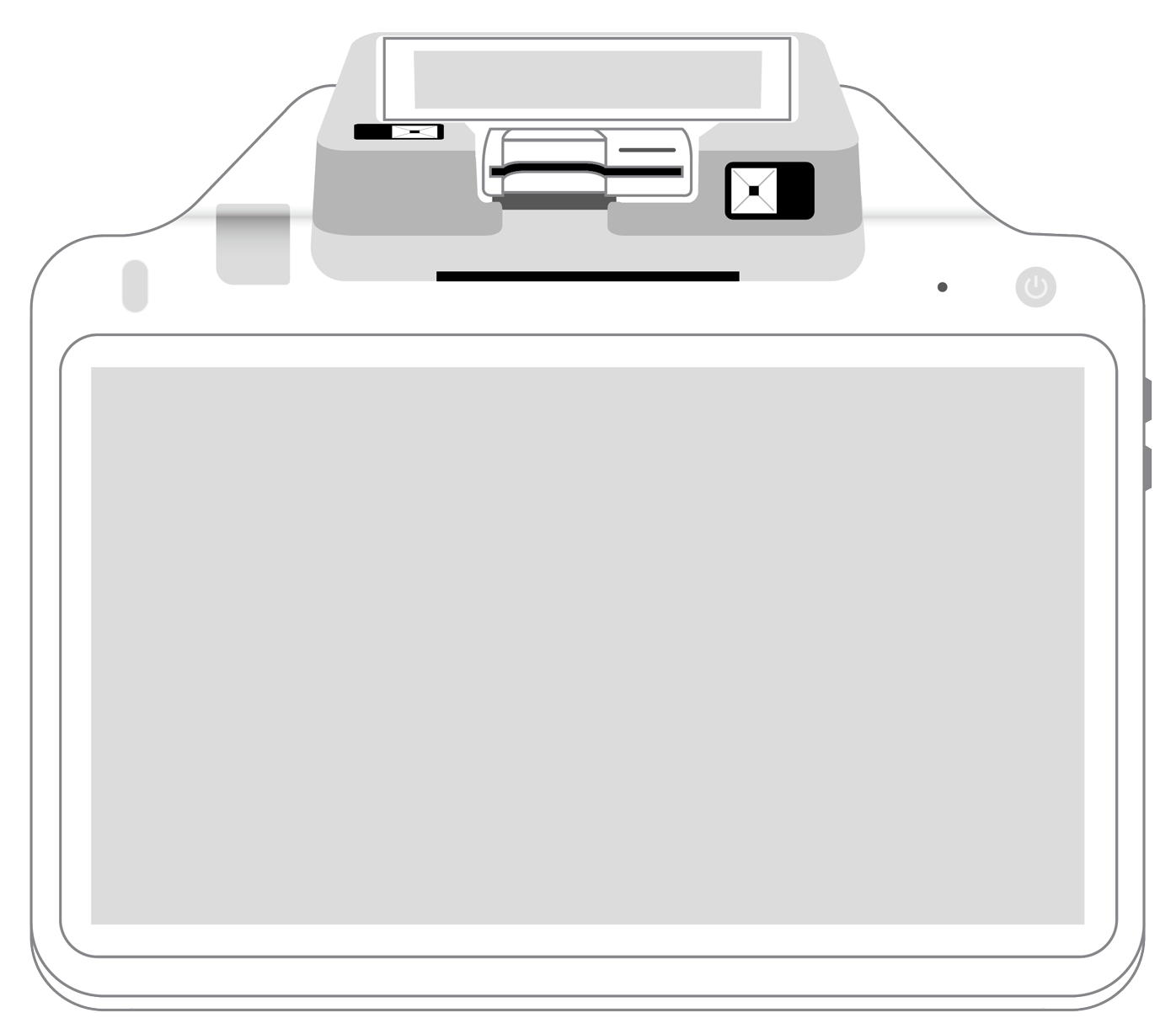

Whichever option you choose, you’ll also have to get a scanner for your POS system to convert paper checks to digital images for approval and processing. How do you decide which payment gateway is best? Look for these options:

- Acceptance of in-store and online payments

- Real-time authorization

- Guaranteed payment

- Guaranteed turnaround time

- Reporting and tracking

- Bank agnostic structure if you’re not sure how long you’ll stay with your current bank

Encryption is perhaps the most critical aspect of choosing an e-check payment processor. You can’t scan a bunch of highly sensitive information like routing and account numbers and send it all over the place without strong protection. Images, numbers, and customer data must always be encrypted during transfer to keep your business in compliance with privacy regulations and preserve the safety of your customer’s bank accounts. Consider an end-to-end processor, such as Electronic Payment Exchange, for a higher level of security.

Since checks are here to stay for now, the smart thing to do is to find the best way to merge old-school paper payments and electronic payment processing. Adopting e-checks as an acceptable payment method makes check processing cheaper for you and preserves freedom of choice for your customers. Instead of fighting not to roll your eyes every time you see a checkbook, find a good payment gateway to streamline the process and get paid sooner.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||