Evolution of Consumer Opinion on Mobile Payments

Opinions are in a global state of evolution regarding the benefits of mobile payment systems. A recent study conducted by Prime Research in cooperation with MasterCard identified regional sentiments and disparities on the subject.

Tracking over 85,000 comments across Facebook, Twitter and various forums and blogs, the Mobile Payments Social Media Study found that while many people are optimistic regarding the new technology's potential, two main barriers remain common throughout much of the world: concerns over security and confusion about competing systems in the mobile market.

European populations have been most forthcoming with their views regarding mobile payments, followed by segments of Asia, Oceania and North America. In terms of positive feedback, countries in Asia and Oceania rank highest Ð especially Australia and China Ð followed by the United States. The countries most skeptical towards mobile payments include Canada, France and the United Kingdom.

A breakdown of the study yields the following findings:

Across Europe, skepticism centers on security concerns with mobile payment processors, along with doubts as to whether the model will ever gain universal acceptance.

U.K. users like the convenience promised by the mobile payment concept, but don't imagine it becoming widely available in the near, foreseeable future.

Non-adopters throughout the Caribbean and Latin American regions are generally unclear about the benefits associated with mobile payment solutions, while those who have adopted voice typical concerns over private data security.

Discussions regarding mobile payment solutions are most active within the countries of Asia and Oceania, especially Australia, China, Japan, Singapore and Thailand.

African and Middle-Eastern consumers are most likely to base their assumptions regarding mobile payment solutions on relayed news stories. The most concentrated areas of discussion are located in Nigeria, Saudi Arabia, South Africa and the UAE.

Users in the United States are most interested in how mobile payment solutions can work with other forms of digital transaction. Further discussions typically deal with security, quality and the long-term advantages of mobile POS. Canadians voice roughly the same concerns, though with less frequency.

Overall comments regarding mobile payment solutions are mixed amongst early adopters, yet enthusiastic amongst those yet to adapt. Comment tallies in the former category ranked as 58 percent positive, while those in the latter group came out 76 percent positive.

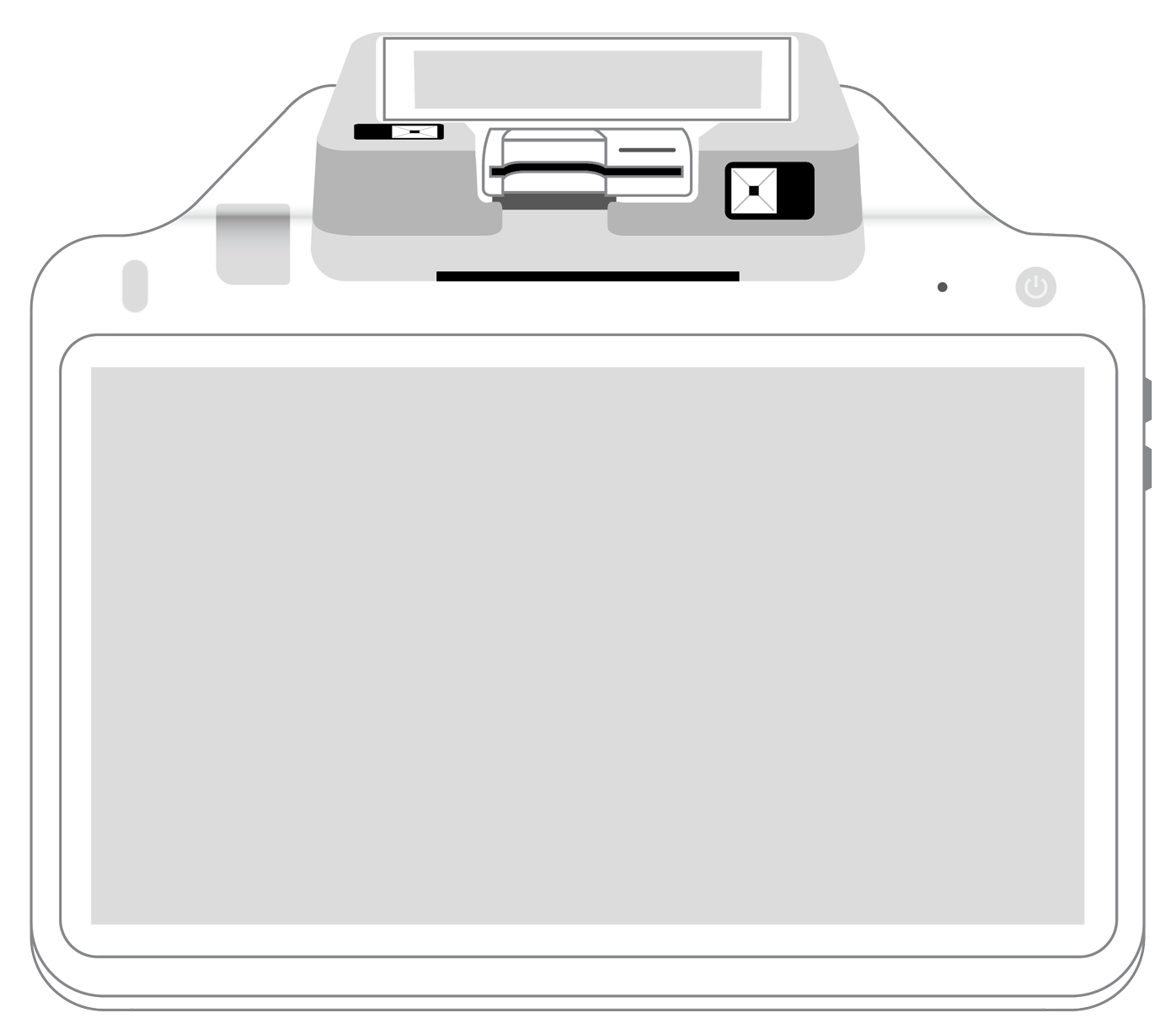

Nonetheless, opinions are sure to evolve in the coming years as increasing numbers of people experience the ease and convenience of making payments through solutions like PayAnywhere Ð a robust app and lightweight card reader that attaches to iOS devices, Android smartphones and tablets, and BlackBerry smartphones to accept card payments in practically any indoor or outdoor commercial setting.

More from News

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||