Fast, seamless, and secure: Contactless payments have become the new normal.

It’s no secret that hygiene and physical well-being catapulted to the top of most people’s priority lists during the pandemic. Along with face masks and hand sanitizer, contactless payments have risen to the occasion, meeting the needs of an ever more health- and security-conscious consumer base. Take just a few minutes to learn everything you need to know about the ubiquitous contactless card reader and you just might find that investing in this hardware is one of the best business decisions you could ever make.

How do contactless payments work?

All modern smartphones come equipped with built-in digital wallets. This is a repository for sensitive electronic data, including credit card payment details that can be retrieved when paying for a purchase. All that is required is some advanced preparation during which the user inputs the necessary payment details and saves them securely.

Shopper’s phones and wearable device, as well as savvy merchants’ contactless card readers, are powered by something called near-field communication (NFC) technology. This innovation enables the two devices to exchange information provided that they are within approximately two inches of each other. At the register, the customer simply opens their digital wallet, authenticates their identity with a facial or fingerprint ID, and places their device close to the touchless reader. In a matter of seconds, all necessary data is relayed to the various players in the payment process, sufficiency of funds is checked, and a response of payment acceptance or declination is sent back to the merchant’s point of sale system. All the while, security remains high through the use of point-to-point encryption and tokenization that render the customer’s payment details virtually unhackable.

The advantages of contactless payments.

With the economy in a tailspin and supply chain woes continuing to plague businesses of all sizes, frugal business owners are reluctant to make any expenditures that go above and beyond the absolutely necessary. Devoting hard-won funds to upgrading credit card readers falls into that category for many entrepreneurs. If you find yourself agreeing with this mindset, stop for just a minute to consider what this safer and more efficient way of accepting payments can do for your retail store.

Let’s start with the obvious. Contactless payments meet consumers’ desires for a touchless way to pay. Unlike germy cash or potentially virus-ridden credit cards, NFC-equipped readers and smart devices can do their work without ever touching each other.

Furthermore, this new style of conducting transactions is speedy and efficient. Within a matter of mere seconds, funds can be transferred from customer to merchant, all without sacrificing data security.

It is this security that cements the integrity of contactless payments. Today’s digital wallets use sophisticated technology to encrypt each detail of customer information. Before the data is passed onto your point of sale system, it is converted into a single-use token, a string of digits that is useless to hackers even if they somehow manage to get their hands on it.

Although contactless card readers are small and many are actually wireless, don’t let their tiny profile fool you. Because they integrate seamlessly with the rest of your point of sale system, you don’t lose out on the numerous other features your payments software offers. In other words, your inventory and employee management, customer relationships, accounting, and report generation capabilities remain just as robust as ever.

The bottom line is that contactless payment technology represents a win-win for you and your customers. This powerful and versatile hardware elevates the shopping experience by increasing the choices available to your buyers while simultaneously ensuring that data security remains a top priority. From the merchant standpoint, it fits effortlessly in with the rest of your checkout, providing you with even more tools to effectively manage your business.

Today’s contactless payment systems meet a demonstrated consumer need while maintaining data integrity. Best of all, they can do this in an affordable way. It is even possible that your current card reader hardware can be used to accept touchless payments. The first step toward boosting your efficiency and enhancing the buyer experience is to talk to your payment services provider. A contactless card reader may be much more affordable and easier to integrate than you think.

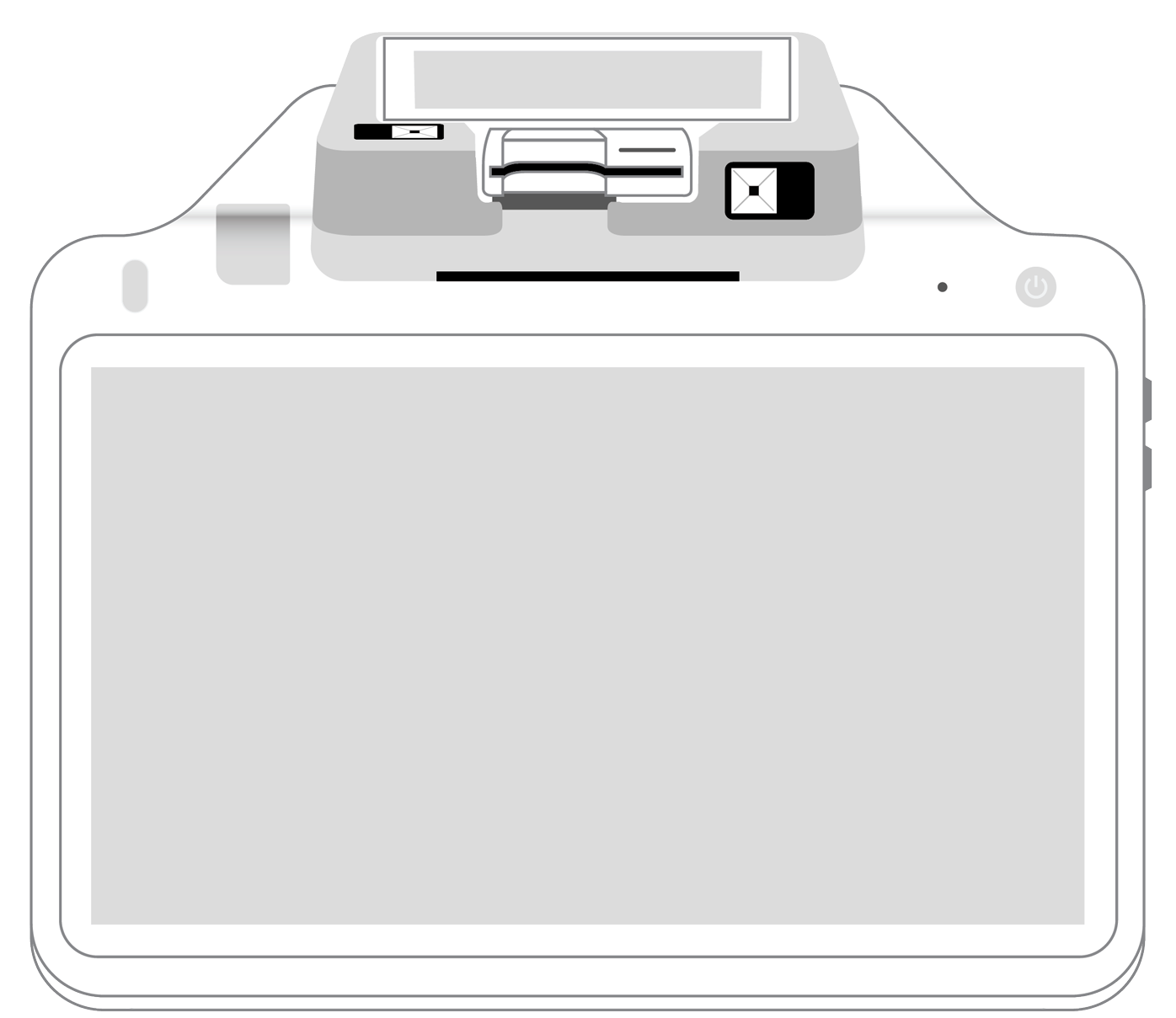

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||