Financial Skills for Small Businesses

As we recover from the recession, small business owners would be wise to remember a few key things to stay on the road to success. While vision is a necessity and owners need to be able to deal with a wide variety of people, financial management is definitely a crucial element that owners need to focus on the most. So much so that small business owners also need to be the CEO and CFO of their companies. Here are the skills small business owners need in order to effectively manage their businesses.

As we recover from the recession, small business owners would be wise to remember a few key things to stay on the road to success. While vision is a necessity and owners need to be able to deal with a wide variety of people, financial management is definitely a crucial element that owners need to focus on the most. So much so that small business owners also need to be the CEO and CFO of their companies. Here are the skills small business owners need in order to effectively manage their businesses.

1. Ability to conduct bookkeeping and financial support. While doing so, business owners should pay particular attention to important documents and be able to recognize the pertinent information they provide. Financial statements and ratios are excellent tools for predicting possible issues and developing solutions and ways to avoid problems. Small business owners must learn to use them in this way.

2. Knowledge of planning methods. Every small business needs a business plan. Putting it on paper forces the business owner to think about threats and opportunities, forecast cash flows, and determine realistic profit. It also causes business owners to think about the industry and market, as well as the value the business would deliver to its customers.

3. Credit evaluation ability. Business owners must be honest about their needs, negotiate manageable terms, and be realistic about repayment. It is important to research SBA and lenders to make the best possible credit decisions as they have significant impact on business.

4. Integrity in fund management practices. The person who approves invoices should not be the person writing checks. Likewise, the individual in charge of handling payroll should not be in charge of hiring. Take steps to ensure that there is transparency in operations. For example, there should always be at least two signatures on everything, especially checks.

5. Knowledge of succession planning. Succession plans are important. Don’t wait until it is too late or until there are nearly no options left. Taxes and trusts are necessary; take the time to set them up accordingly.

Remember that you do not have to do everything on your own. Build a team and a support system to help you through this process. Maximize your relationship with your CPA and your bank account manager. Learn as much as you can from there, and ask them for help when needed.

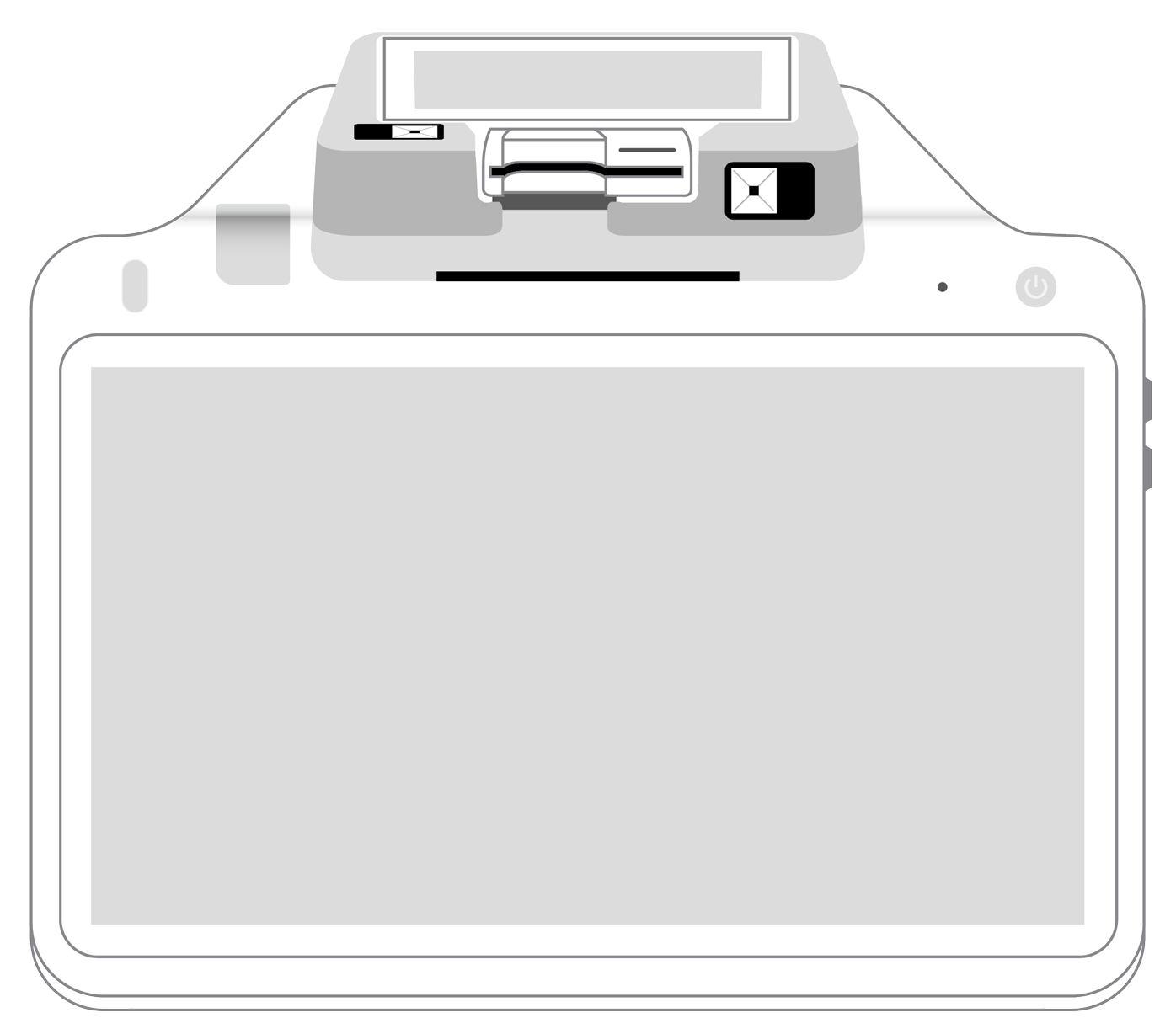

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||