Here are 7 business financial mistakes to avoid.

Staying on top of finances and making smart spending decisions is essential if you’re a business owner. Yet 36 percent of people who run small companies say cash flow management is a big challenge for them. If you’re having the same problem, you could be making one or more of these serious money management mistakes.

Jumping in without a budget.

Remember when you were a kid and blew through your allowance almost as soon as you got it? You can’t do that with your business funds. Working out a detailed budget gives you a way to visualize every expense and income source so that you spend smarter and don’t find yourself owing more than you can afford.

Get started by using a spreadsheet or bookkeeping software and listing out all of your expenses. They should fall into one of two categories:

- Fixed, such as rent, internet, phone, and insurance premiums

- Variable, such as utilities, inventory, and payroll

Fixed expenses don’t change from month to month and therefore don’t require any guesswork on your part. Predictions for variable expenses, on the other hand, should be based on past numbers or estimated using current market prices and pay rates.

You also need to list where business revenue comes from, or where it will come from if you’re budgeting for a startup. Look at recent sales numbers for each revenue stream, or research market trends for your industry to make educated projections.

When the numbers for the next few months are mapped out, start tracking actual income and expenses. Compare reality to your projections at the end of each month to determine where you need to make adjustments for greater accuracy. It shouldn’t take long to start seeing patterns and gain an understanding of how to tweak your spending habits to improve financial security.

Being a big startup spender.

In general, entrepreneurial spirit and vision are good things. However, getting overzealous in either area can cause you to overestimate what you need to get your business off the ground or take the next step toward growth. It’s tempting to go for the most impressive setup possible when all you need are the basics.

This is akin to purchasing an entire home gym before you know what types of exercises are most appropriate for you. Much like with a fitness program, you should start small with your business purchases and make new purchases only when the need arises. If you don’t, you could wind up sinking under the burden of credit card debt and loan payments. While some borrowing may be necessary to cover your larger startup or growth costs, you should never rely on lenders to fund unnecessary or extravagant purchases.

To avoid a situation where you need to borrow just to meet daily expenses, do a careful evaluation of your actual business requirements. You could discover you’re able to build a satisfactory operation or meet your goals for growth with less of an investment than you first thought and have more left over to save for future investments.

Forgetting about insurance.

Securing insurance is non-negotiable when you own a business, so you need to be sure you have all the right coverage. Policy requirements vary by industry and sometimes by location, so be sure to work with an agent familiar with your type of business and the federal, state, and city regulations you’re subject to.

Failing to have enough coverage or allowing gaps between periods of coverage can be disastrous for your business. You could get slammed with big penalties or find yourself with no way to recoup losses after an emergency. You might get stuck in the middle of a legal battle, racking up fees you can’t pay. No business owner wants to consider these situations, but thinking none of it could happen to you is irresponsible and puts both you and your employees at risk. Get the coverage you need now to avoid big headaches later on.

Obsessing over having the “best” price.

Price wars are pointless, so why get sucked into the trap of trying to beat your competitors just to bring a handful of bargain hunters in the door? The few customers who take you up on your “amazing” deals probably won’t become the lifelong patrons your business really needs for growth and success. Most of them are just looking to save a few dollars and have little interest in brand loyalty. In the end, trying to have the lowest prices all the time only leads to a constant struggle to keep up with the competition and can hurt the reputation of your company.

You’re much better off focusing on the customer experience, particularly in the areas of friendliness and efficiency. Forty-two percent of consumers are willing to pay more at stores where they feel welcomed and 52 percent are okay with higher prices if service is fast. Of course, competitive pricing doesn’t hurt, but you can’t take it to such an extreme that you end up lowballing yourself and losing money on the bulk of your transactions.

Put the majority of your focus on customer service and offer your products and services as something of value instead of commodities. You can still use some tried and true marketing techniques, such as loss leaders or deep discounts on hot seasonal items, but building relationships through positive interactions is what really sparks customer loyalty.

Failing to diversify your payment methods.

Given how easy it is to offer customers multiple ways to pay, there’s no excuse for not offering as many payment methods as possible. Every additional option you provide opens the door for more sales. Furthermore, new technology gives you a way to make sales in your store and online without the need to switch between payment gateways.

Using a mobile credit card reader, you’re free to take payments literally anywhere you go. Look for a provider with a point of sale app you can install on your phone or tablet and you’re be all set to take your products and services to local markets or trade shows. Or, upgrade to a smart terminal or smart POS system. You can even use the app to complete transactions behind the counter, on your sales floor, or on the go.

Make sure you choose a credit card processor with reasonable processing fees on as many payment types as possible. When you’re able to take cash, checks, credit cards, and NFC contactless payments through the same app, you can serve a wider range of customers and may experience a significant increase in sales.

Not saving for taxes or emergencies.

Paying taxes is the bane of every business owner’s existence, but it doesn’t have to be a hit in the wallet if you save in advance. A general recommendation for tax savings is to put aside 25 to 30 percent of business income. It’s best to set this money aside as soon as it comes in so that you’re not tempted to use it for something else. Then, when tax time rolls around, you’ll have the funds available to meet your obligations for payroll, sales, federal income, and other business taxes.

While you’re busy saving for taxes, set aside a little extra in an emergency fund. How much depends on your typical operating costs and the amount of income you need to cover your own living expenses. Save enough to cover both of these for about three months just in case your business hits an unexpected slow season or an emergency creates a situation in which you’re unable to make sales for an extended period of time.

Missing the majority of tax deductions.

Your tax burden could be a lot less than you think. There are plenty of business expenses you can itemize and claim as deductions on your return. In fact, you could be among the 21 percent of business owners claiming less than half of that to which they’re entitled! An astonishing 10 percent claim very few deductions or none at all!

How can you maximize your deductions? Get familiar with the expenses you can claim and be diligent about recording every relevant detail. This includes employee spending, company vehicle mileage, equipment purchases, supplies, rent, insurance, and more. A knowledgeable accountant can help you properly categorize your expenses and uncover even more possible deductions.

Do any of these mistakes sound familiar? Now is your chance to clean up your act and get your business on track for a brighter financial future. If you’re planning to launch a startup, you have an opportunity to establish good money management practices from the start and avoid a lot of the mistakes that plague other business owners.

Whether you feel confident making changes on your own or need help from a professional, it’s time to stop ignoring what’s wrong with your company’s spending and saving habits and get started with a new plan for financial success.

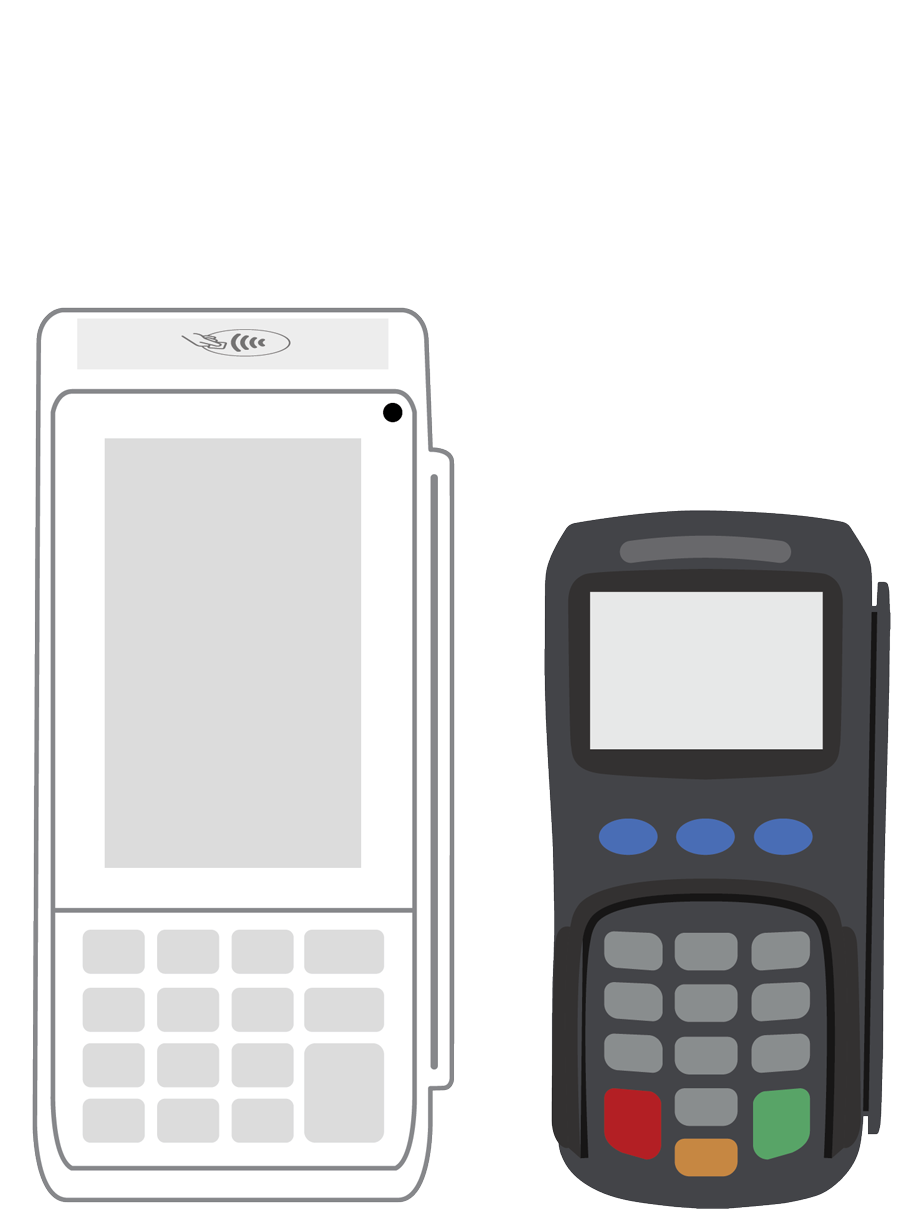

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||