How a smart terminal helps your business grow.

These days, consumers and business owners alike often seem to take credit cards and the payment processes underlying them for granted. However, most people would be hard put to imagine life without paying via plastic, whether credit or debit card. In order for that to happen, a complex and highly regulated infrastructure must be in place that is vital for the success of these transactions. As an entrepreneur, the more you know about so-called smart terminals, the better it can be for your enterprise and your customers.

What are smart terminals?

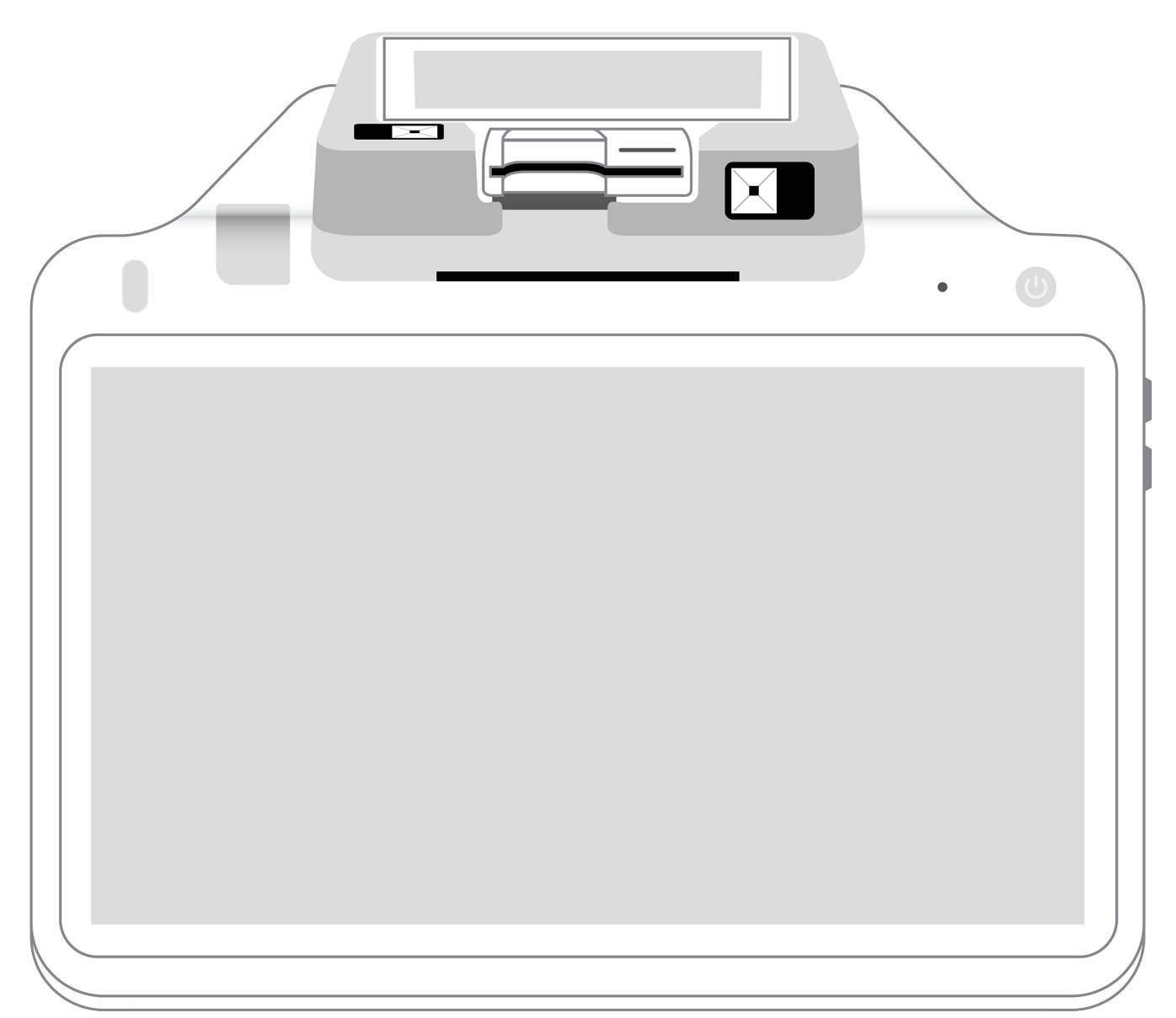

Strictly speaking, a credit card terminal is the piece of hardware machinery that allows you to accept a customer’s credit card in exchange for a good or service. Over the years, the look and complexity of these terminals have evolved. Today’s smart terminals, often referred to as point of sale (POS) solutions, are also packed with additional features that enable retailers to streamline many aspects of their businesses.

Although a credit or debit card transaction takes place in a matter of seconds, a great deal occurs during that brief timeframe. First, a customer dips (EMV chip cards) or swipes (traditional magstripe card), or taps (NFC contactless) their card or, in the case of NFC payments, their phone on, into, or near the smart POS terminal.

Alternatively, you or a member of your staff might manually enter credit card information into a virtual terminal if a payment is being taken over the phone, for instance. Regardless of how the data entry takes place, the terminal submits a request to your merchant services provider, after which the request is transferred to the customer’s acquiring bank for approval. Once the payment is approved and verified, the funds are sent to your merchant account, thus completing the sale. In order for all of this communication to happen, the terminal must be connected to the internet, either via hardwiring or wirelessly using Bluetooth, WiFi, or cellular. Thanks to the portability and versatility of today’s smart terminals, credit cards can be accepted virtually anywhere without difficulty. In other words, businesses no longer need to be shackled to a stationary countertop machine in a brick-and-mortar location to securely accept customers’ credit card payments.

The benefits of a smart terminal.

Flexibility and portability make these smart POS terminals a plus for both retailers and their customers. From the buyer’s point of view, it is no longer necessary to carry around large amounts of cash in order to make major purchases. In addition, a customer can have peace of mind knowing that their payment has been electronically recorded and is much more secure. Environmentally conscious consumers can also rejoice in the ability of most POS systems to send receipts via email instead of using paper. These emailable receipts can even be linked to surveys to solicit customer feedback. From the merchant’s perspective, bookkeeping becomes much easier since records of all transactions are recorded by the terminal. Furthermore, modern systems enable savvy business owners to capture customer data that can be used in numerous ways for highly effective marketing and customer appreciation campaigns.

Smart terminals are packed with features you can use.

Regardless of how big or small your operation may be, or what products or services you sell, it just makes sense to examine the features commonly found on today’s smart terminals. Payanywhere, the premier choice for today’s savvy merchants, offers smart POS terminal solutions that can help you to take your business to the next level. They accomplish this task by offering several compelling features that are sure to help you and your customers in a variety of ways. These include:

- A hand-held unit for easy operation.

- A five-inch touch screen that is portable and easy to navigate.

- The ability to accept all types of payments, including magstripe, EMV chip cards, and NFC contactless payments like Apple Pay and Samsung Pay.

- PIN Debit card acceptance.

- Barcode scanning capabilities using both front and back cameras.

- Receipt printer.

- 4G and WiFi connectivity.

The Payanywhere Smart Solutions also allow you to conduct reporting tasks in real-time and to customize your capabilities to allow for features such as split payments, tips, discounts, and pre-authorizations. Receipts can either be emailed or printed depending on preferences and tasks such as inventory management and ordering quickly become a breeze. Sending and keeping track of invoices and late payments, once an arduous job that could suck hours from your schedule, can now be handled effortlessly with Payanywhere’s intuitive monitoring and emailing features. Amazing though it may be, all of these capabilities are expertly included in integrated hardware and software combinations that are as sleek and attractive as they are affordable and easy-to-use.

Why you should incorporate a smart POS terminal into your business systems.

As the above information makes clear, smart terminals do a great deal more than simply accept customer payments. In many respects, they function as virtual silent partners that can assist you in performing many of the business tasks that may currently take hours of your time every week. These include but are not limited to staff payrolls, customer invoicing, receipt recording and storage, and inventory tracking. Simply removing the burden of one or two of these duties from your shoulders may be enough to give you sufficient motivation to jump on the bandwagon of smart payment devices. However, if you still need some additional inspiration, consider the following advantages.

To begin with, smart terminals are constantly evolving and contain access to a dynamic array of applications that you can use to improve many aspects of your business. You can think of this capability as analogous to the apps that are available in the Apple or Android store for your smartphone. As technology improves and your needs morph, there is a seemingly never-ending new stream of apps, and the same is true when it comes to smart terminals.

Smart terminals are easy to use, and that quickly can become a huge plus for your business. When staff members can utilize a touchscreen to quickly input data, the likelihood of costly and time-consuming human error drops dramatically. Over time, that translates into a checkout process that is faster and more streamlined, fewer costly mistakes that can impact your bottom line and, perhaps most important of all, happier customers. When buyers experience a payment process that is fast and frictionless, they can get out the door and on with their day, left not with bad memories of frustration but with only positive feelings about your tech-forward company and its friendly and competent staff.

When you are ready to join the smart terminal revolution.

Are you convinced that smart terminals represent the next step forward for your business? Keep in mind that their surging popularity has led to a cutthroat marketplace for this brand of cutting-edge technology. Before you jump at the first option, be sure that the one you choose has the important attributes like:

- The ability to communicate with a merchant portal to securely log and keep track of all customer transactions.

- Acceptance for all types of payments, including NFC contactless, mobile payments, magstripe, EMV chip cards, and PIN Debit cards.

- Electronic signature capture.

- Features that allow you easily produce custom, online reports.

- The capability to generate emailable receipts.

- Sharing capabilities that make it possible to transmit information from one computer to another.

With the use of tablets and mobile phones skyrocketing and cash becoming rare, it seems more than likely that smart terminals are here to stay. The good news is that they can provide businesses of all sizes with numerous advantages while simultaneously benefiting customers. While it is not often that technology is mutually helpful to all parties, it seems that smart payment devices represent that sweet spot of bestowing benefits on virtually all of the players in the electronic transaction marketplace.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||