How instituting payment links can be a game-changer for your business

In an era when convenience is key and every penny counts, companies of all sizes are finding innovative ways to get paid online by their customers.

Payment links are quickly becoming a go-to for buyers and sellers, providing a seamless and secure solution for all. But just what are payment links, how do they work, and can you incorporate them into your business?

Payment links defined.

Payment links offer a simple and straightforward alternative to traditional payment methods. These URLs are direct, safe, and easy to understand.

Sometimes also known as checkout links, payment links are services provided by your payment processing provider. They are unique URLs that are generated by a company seeking to resolve an invoice and can be used by customers to make a secure, hassle-free payment.

How do payment links work?

The payment link process involves several steps. They include the generation of the link, distribution to customers, payment, and confirmation.

Once you learn how payment links work, you will understand why so many businesses are bringing them into their operations. Although they appear seamless on the surface, the payment links process does involve several important steps.

First, the merchant generates a link through their payment gateway or payment service provider. The seller then enters details into the system including payment amount, description, and any optional fields.

Next, the seller distributes the link to one or more of their customers. This can occur via various vehicles: social media, messaging, SMS, email, or embedded on their own website. As a result, there is no longer a need for manual invoicing.

As soon as customers get the payment link and click on it, they are redirected to a secure payment site. At this point, they simply choose their preferred payment method and complete the transaction, filling in any blank fields.

After successful processing, the buyer and seller receive instant confirmation.

Benefits of payment links.

The benefits of payment links are many. They include accessibility, convenience, security, flexibility, affordability, and real-time tracking.

This innovative method is gaining widespread acceptance because the advantages of payment links are compelling. For one thing, they make resolving invoices accessible to everyone, requiring no need for technical expertise or a merchant account.

The streamlined checkout process can be accomplished with just a few clicks, increasing customer satisfaction and reducing shopping cart abandonment and delinquent payment rates.

Thanks to the encryption and other security measures built into the merchant’s payment gateway, data safety remains paramount. Meanwhile, the process can be tailored to reflect various currency choices and payment methods.

Customization options allow for the inclusion of product details and promotional offers. All of this takes place with no setup fees or monthly commitments.

Finally, payment links give merchants a way to analyze sales data, monitor transactions, and reconcile accounts in real-time. With this information in hand, they can make more intelligent financial decisions and create intelligent sales and marketing forecasts.

Uses for payment links.

Payment links are ideal for numerous situations. These include ecommerce, paying for services, events, hospitality, peer-to-peer payments, social media, emails, websites, and invoices.

But just what is the best time to use a payment link? There are many scenarios that are ideal for the use of this method.

Merchants selling products online can embed payment links directly into their social media profiles or ecommerce platforms to streamline purchases. Freelancers, contractors, and consultants can send personalized payment links to collect deposits or receive full or partial payments for services rendered.

Event organizers can leverage payment links to sell tickets or take donations. Moreover, payment links make retail purchases and reservation payments fast, secure, and convenient.

The applications of payment links don’t stop there. In the peer-to-peer payments realm, people can use these links to collect money from friends, split bills, or share costs. Additionally, links can be placed on social media pages, within emails, on websites, and embedded into billing documentation to create digital invoices.

Payment links furnish a wide range of advantages for merchants and customers. Affordable, easy to integrate, and intuitive to use, they are quickly becoming the go-to invoice resolution method for businesses of all types and sizes.

If you are now convinced that these links can revolutionize the way you do business, talk to your payment processing provider today to get started.

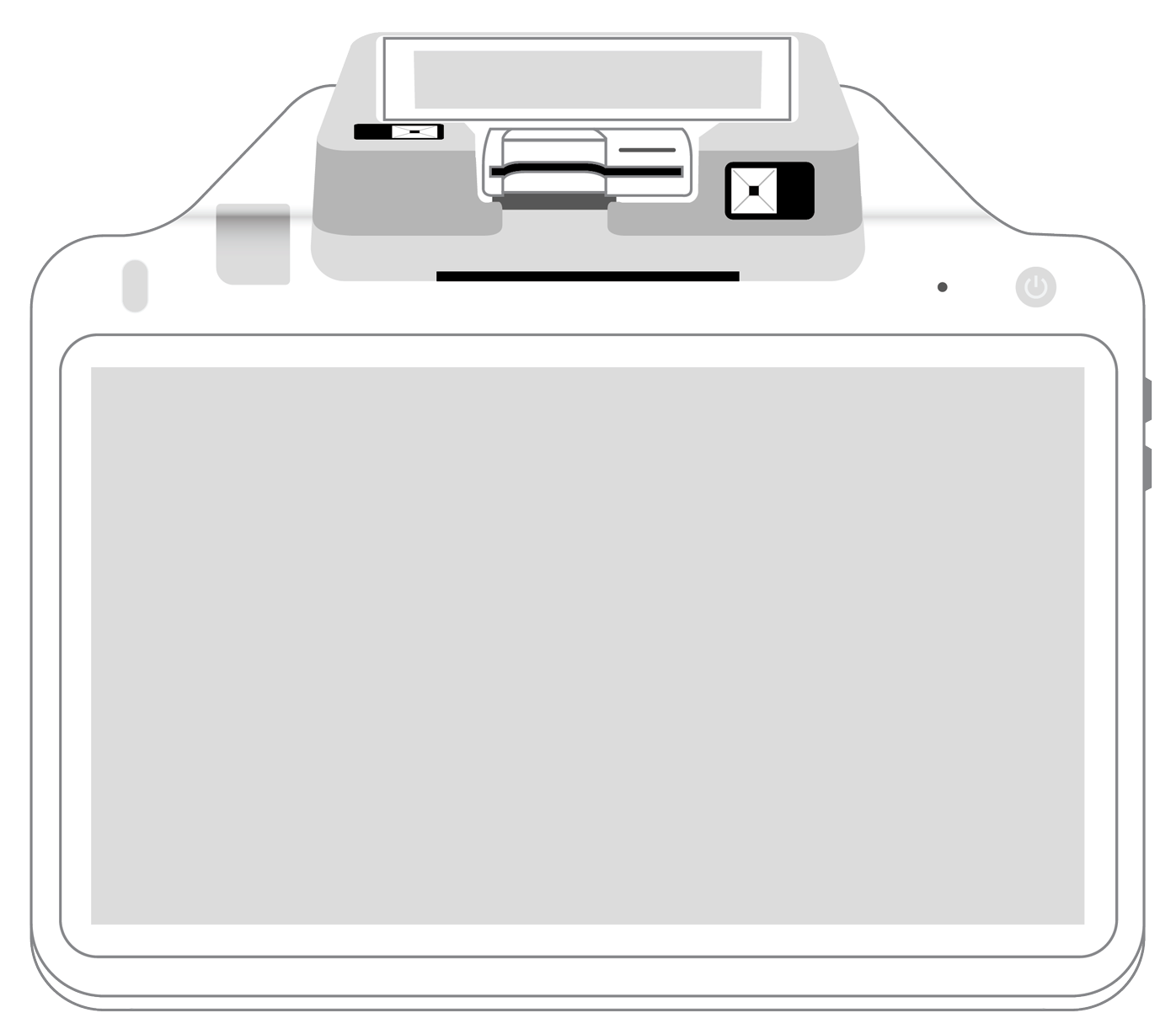

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||