How to accept credit card payments with no extra hardware needed.

As technology becomes more advanced, more companies will continue to adjust their processes to meet the increasing demand for easy and contactless payment solutions. Many businesses already accept "tap-to-pay" card transactions, which allow users to pay with a simple touch of their credit or debit card. Tap-to-pay on iPhone and similar technologies are compatible with most conventional point-of-sale systems. However, there are other ways for companies to accept card purchases without the need for extra equipment.

Mobile payment apps.

When it comes to accepting various types of contactless payments without the need for additional hardware, mobile payment applications are among the most convenient and accessible options. To facilitate contactless transactions, several platforms, such as Apple Pay, Google Pay, and Samsung Pay, make use of a technology known as near-field communication (NFC). Customers can attach their credit or debit cards to these applications and then provide payments by touching their cellphones or smartwatches on the payment terminal. The only thing that businesses need to do is make sure their point-of-sale system is compatible with mobile payment applications.

QR code payments.

Quick response (QR) code payments are an inexpensive and safe option for taking payments. This is because companies can create QR codes that connect directly to their payment gateways. Customers who have smartphones and banking applications on them scan the business's QR code to start the transaction. QR code payments are simple to use and provide flexibility to companies of all sizes. This makes them ideal for a wide range of environments, from restaurants to retail shops.

Text-based payments.

Another effective method for accepting card transactions without the need for additional hardware is to implement payment systems based on text transmission. For the purpose of facilitating transactions using text messaging, businesses use special phone numbers, or shortcodes. Customers can begin payments by sending a text message to a certain number or by clicking on a link included in the original text message. Because it enables companies to provide their clients with a smooth payment experience, it is especially advantageous for enterprises that participate in transactions that take place remotely or via mobile devices.

Email payment links.

Email links are another way to adopt contactless payments without the need for extra hardware. By including a link to a safe payment gateway inside the email, clients can click on the link, which will then take them to a payment portal where they can conveniently finish the purchase. This approach is particularly advantageous for service-oriented businesses, freelancers, or those engaging in remote transactions.

Online invoicing.

Companies can save money by opting for online invoicing instead of purchasing extra gear to accept payments. Digital invoices allow companies to provide consumers with an easy and safe option for paying their bills. Many invoicing systems let companies add payment links or QR codes straight to their invoices. After that, customers can use either the link or the QR code to pay. Freelancers and independent contractors routinely find this technique very useful.

Virtual terminals.

Instead of using physical card terminals, companies can use virtual terminals, which are web-based platforms, to process card payments using a computer or tablet. Although most of these systems work with standard credit card readers, several additionally allow for contactless payments. Alternatively, businesses can utilize a card reader linked to a computer or tablet to manually enter the card data. This method enables the contactless payment feature without the need for further hardware expenditures. Online retailers, remote service providers, and companies without physical storefronts all benefit from virtual terminals because of their adaptability and versatility.

Conclusion.

Companies should think about their operational demands, consumer tastes, and industry norms when choosing which types of contactless payments to accept. To find the best solutions, it's important to look at the target demography, the technology infrastructure, and how easy it is to integrate. One of the most in-demand payment options is Tap to Pay on iPhone. And fortunately, your company can accept it without having to buy extra equipment. All you have to do is choose from any of the six options discussed above.

Related Reading

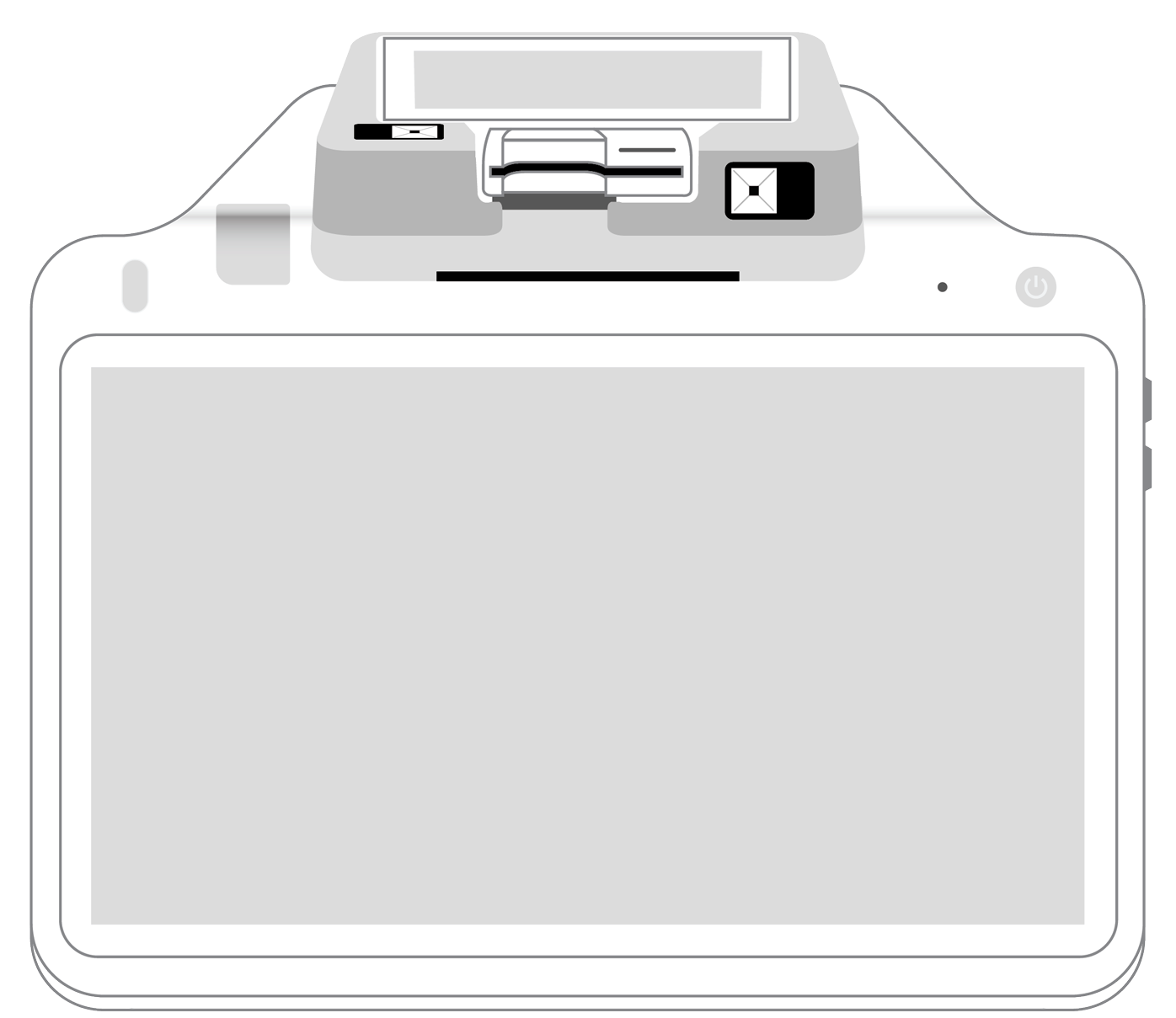

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||