How to accept payments at your auto body shop.

When you run your own auto repair business, you face numerous challenges. Training technicians, staying up-to-date with advances in vehicle technology and diagnostics, finding affordable and available parts, keeping customers happy, and hiring qualified staff for the long term are just some of the obstacles you face on a daily basis. And because you have no choice but to accept credit cards, you also need to sort through the complexities involved in accepting non-cash payments.

Quality of service vs. price: Which should you choose?

Accepting cash payments is cut and dry; you tell the customer how much their auto body work costs, and they hand you a fistful of bills and coins that cover the cost. It gets a lot more complex when you accept payments made with plastic, especially once you learn that you need to pay a per-transaction fee. Even these charges can vary according to what type of card the customer uses or whether you manually enter the numbers or the card is tapped or swiped.

In the end, those charges are only a part of the complete picture. More importantly, you need to look for a card processing company that is on your side at all times. This company should understand your auto body business’s special challenges, as well as the types and volume of transactions you process. Should snags arise with any of your transactions, this vendor needs to be equipped (and available), to assist you in resolving them quickly and efficiently. When you have a relationship of mutual trust with your processing partner, you will find that it is worth its weight in gold – even if a particular fee or charge is slightly higher.

Look out for red flags.

In years past, auto repair shops, as well as most other types of businesses had no choice: Signing contracts and paying expensive hardware leases were taken for granted. Fortunately, that is no longer the case. If a prospective vendor tells you that you need to pay for your credit card readers for auto body shops, fork over big bucks to pay for leases on a point of sale system, or shell out fees for early termination, politely decline, and take your business elsewhere.

Instead of leasing, it makes more sense for you to buy your card readers and other hardware. Equipment is very affordable and quickly pays for itself. Long-term contracts are outdated, running counter to today’s need for adaptability and flexibility in the auto body shop milieu.

Don’t go it alone.

Technology has downsides, but one of its greatest advantages is that it can connect you to a wealth of information and personal experiences. It’s no secret that payment processing can be overwhelming at times, but the good news is that you can gather rich nuggets from peers in your industry that will make your journey a great deal easier.

To that end, get in touch with other shop owners, particularly those of a similar size and customer base. Read any testimonials or social media posts they have written about their payment processor, and factor their advice into your final decision. Of course, keep in mind you’ll need to do your homework as every business is different. For instance, test out a prospective candidate by calling their customer service number. If you’re left on hold for longer than you deem acceptable, keep shopping around, and count your blessings that you avoided a bad match.

Find a processor that understands the autobody industry.

Auto body shops have their own particular quirks. Unlike other stores, Fridays are typically their busiest days and are the times when there are more credit card payments. Moreover, the customer only pays when the job has been completed. That means your shop must front the costs of expensive parts and labor, sometimes for several weeks before recovering the money.

If a processor does not understand these realities, your card behaviors might start to appear suspicious. The last thing you need is for your funds to be suspended or your account closed due to these misunderstandings. That’s why it is better to work with a company that is already well-acquainted with the auto body repair industry and can help keep your cash flowing.

Select a company equipped to evolve with changing payment technology.

Cash is going the way of the dinosaur when it comes to how customers pay for goods and services. But that’s not all that is shifting. Of course, today’s busy customers want the option of being able to quickly give you money for their car repairs through the use of a credit or debit card.

In addition, they are coming to expect convenience that goes beyond the mere acceptance of plastic. As the pandemic demonstrated, contactless options are preferred by more and more buyers. Furthermore, wireless technology allows associates to resolve a bill using a wireless card reader brought directly to the customer’s home or workplace. Even paying with text messaging is becoming popular with more and more car owners.

If you want to offer maximum payment flexibility, you can’t do it alone. You need a payment processing partner that demonstrates its willingness to adapt to the constant changes in technology and consumer preferences. Once you find one that satisfies this important requirement, you’ll be in the driver’s seat to be in line with your patrons’ preferences and grow your business for the foreseeable future.

Running a thriving auto body shop is not for the faint of heart. Rising above the many challenges involved can be a daunting task even at the best of times. However, cultivating and maintaining a relationship with a top-shelf payment processor who understands the industry is one of the most intelligent, forward-thinking moves you can make.

Related Reading

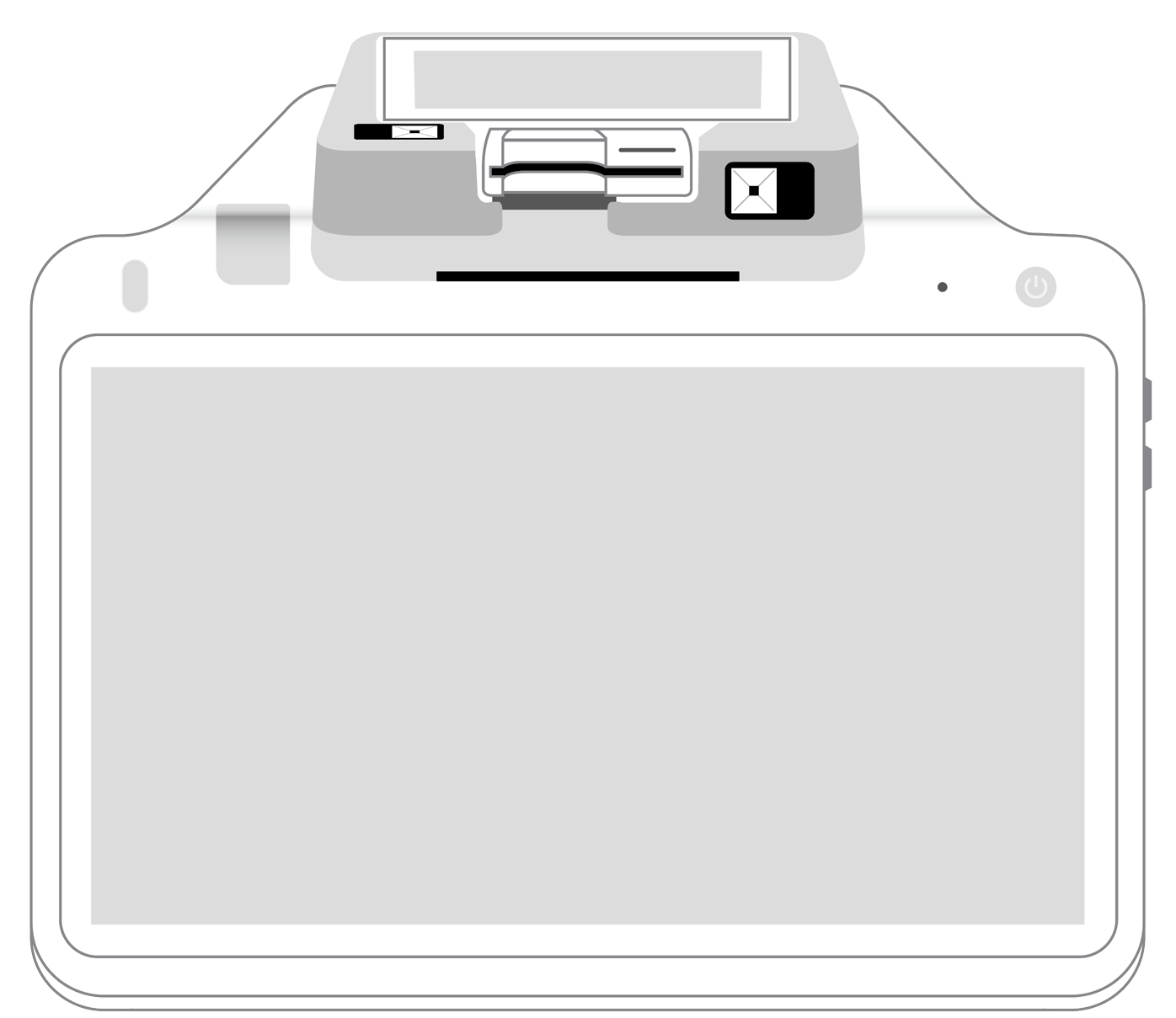

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||