How to choose the best POS system for your business.

Running a business involves coordinating a seemingly endless assortment of moving parts. Inventory and employee management, customer service, accounting tasks, and payment transactions are just a few of the numerous balls you will no doubt find yourself juggling. The good news is that having the right point of sale (POS) solution at your side can streamline all of these processes. Finding the best POS system may require a little additional time and energy at the outset, but that is an investment which should pay for itself many times over in the years to come.

Step one: determine what features you need.

It goes without saying that your POS should securely accept customer payments. However, today’s solutions contain a myriad of additional bells and whistles designed to further streamline your entire business operations. Your list of “must-haves” will most likely include the following:

- Inventory management capabilities that monitor stock quantities and notify you when you’re running low.

- Invoicing software for billing customers and sending out late payment reminders.

- Reporting tools that enable you to generate information about past sales, top selling items, employee performance, etc.

- Staff time tracking and scheduling.

Step two: expand your payment options.

First and foremost, your POS serves one vital function: processing payments. These days, customers are demanding a wider range of choices when it comes to giving you their hard-earned money. While you do not need to accept every type of payment under the sun, “the more the better” is a good rule to follow. In addition to accepting cash and debit and credit cards, you should consider whether your customers will request the following payment options:

- Automated Clearing House (ACH), also known as echecks. These are particularly useful for recurring subscriptions.

- NFC contactless payments powered by smartphones and tablets (Apple Pay, Samsung Pay, Google Pay, etc).

The best POS system for your business will be one that gels with your unique product line and works well with your customers’ payment preferences.

Step three: contract terms and options.

When you lease or purchase POS equipment and software from a provider, you may find that you are required to sign an agreement. It is crucial that you understand all of the fine print in your contract before signing on the dotted line. Here are the most important key aspects to be on the lookout for:

- Will you be giving permission to the POS provider to raise processing rates during the life of the agreement?

- Can the provider raise the fees that you pay for software?

- Will you be penalized if you terminate the contract early and if so what is the early termination fee?

Remember that you have the most leveraging power before you sign anything. With that in mind, be sure to ask questions and don’t be afraid to attempt to negotiate on costs.

Step four: be proactive to avoid hidden fees.

The main reason for being vigilant about the contract you sign is to keep you from regretting it later. One of the greatest sources of buyer’s remorse comes when business owners discover that they have inadvertently said “yes” to excessive or unplanned charges. In addition to the non-negotiable interchange, assessment, and processing costs you will pay to the issuing bank, card brand, and processor respectively, be on the watch for the following processor dependent fees and average fee amounts:

- Terminal or equipment fees ($5 to $60 per month).

- Monthly or annual fees ($0 to $100 per month or $0 to $300 yearly).

- Chargeback fees ($10 to $30 per instance).

- PCI non-compliance fees (from $20 to $120 annually).

- Monthly minimum fees (from $0 to $25 monthly).

- Early cancelation fees ($300 to $1000 per instance).

- Address Verification System fees ($0.05 to $0.25 per occurrence).

- Setup fees ($50 to $100 per instance).

- Batch fees ($0.05 to $0.30 per occurrence).

- PIN debit transaction fees: ($50 to $60 annually).

- Payment gateway fees ($5 to $25 monthly).

- Online reporting fees ($0 to $10 monthly).

- Account closure fees ($20 to $75 per occurrence).

- Merchant location fees ($5 to $25 annually).

- Statement fees ($5 to $10 monthly).

- IRS reporting fees ($25 annually).

- Non-sufficient funds fees ($20 to $25 per occurrence).

- Voice authorization fees ($.25 to $4 per instance).

Remember, before you get locked into a payment structure you are uncomfortable with or do not understand, pepper your account customer service representative with any and all questions. There are plenty of hungry competitors out there if the terms you are being offered do not meet your needs or seem suspicious or excessive.

Step five: proprietary vs. open source hardware.

In the traditional model, companies created and manufactured their own brand-specific card readers, registers, and terminals that were designed only to work with their products. These custom-built systems proved to be relatively free of bugs and tech support specialists who were already well-informed about their specifications found it simple to address problems when they arose.

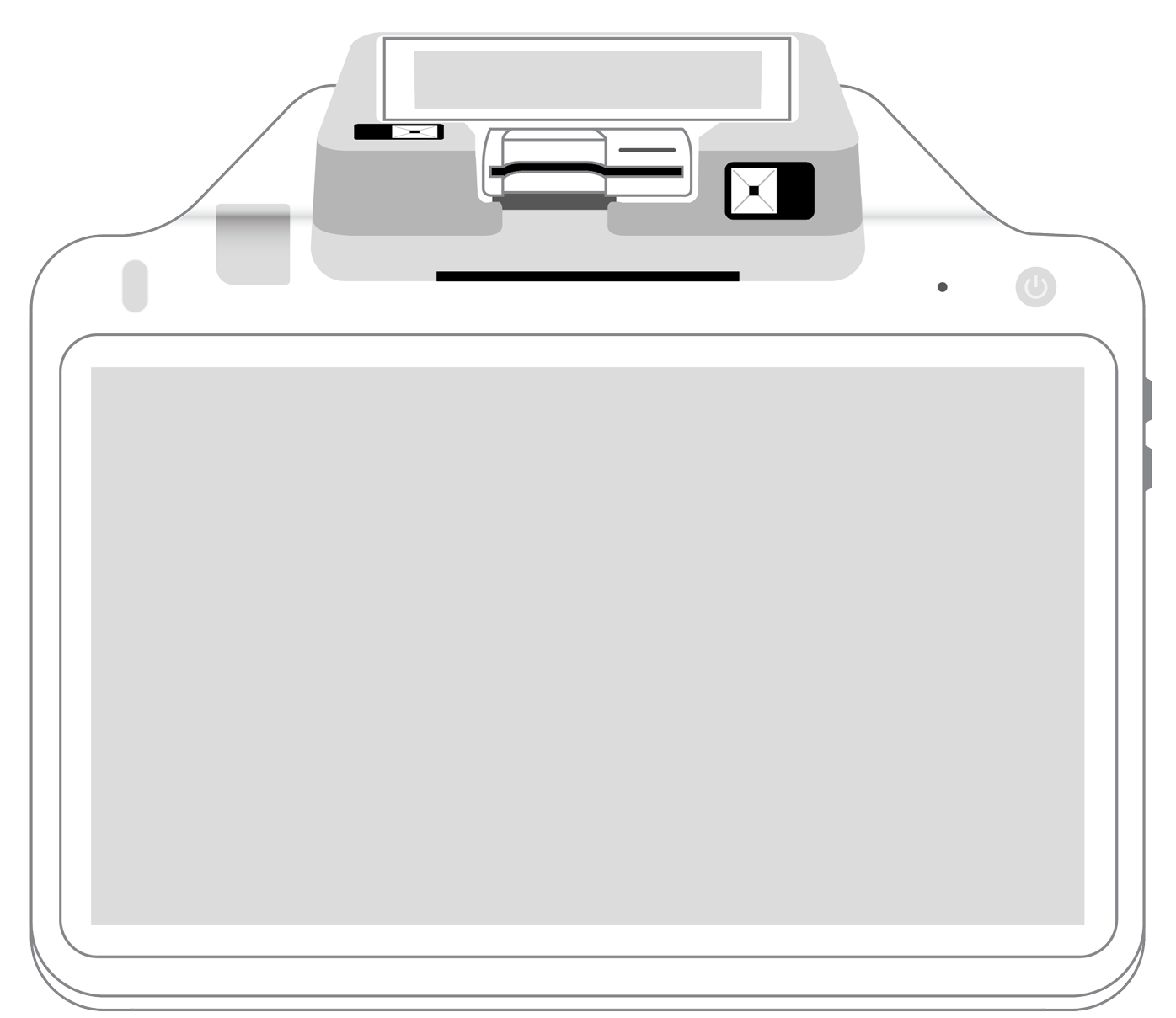

In recent times, companies have begun to create software that runs on multi-use hardware such as iPhones, iPads, and Android devices. Nonproprietary products have their own set of advantages. They are much more affordable as a rule and are often readily available without the need to make any additional purchases. Also, supplementing your system with add-on products is still possible and at a reduced price point.

A word about add-on products.

With portable solutions being the rule rather than the exception for consumers these days, it makes sense that the POS solution you choose comes equipped with the ability to accept add-on products that can further augment its potential. For instance, a tiny mobile reader can make it possible for customers to simply wave or tap their digital wallet-equipped phones in order to pay quickly, safely, and securely.

Furthermore, a mobile POS that is enhanced with extra mobile readers can furnish your sales associates with unprecedented flexibility (to accept payments anywhere in or around your store for instance) and access to information. Whether they are speaking to customers within the physical boundaries of your store or at a product fair, they can call up product information and process payments on-site without the buyer needing to stand in a long checkout line. This ease of payment leads to efficiency for your employees and satisfaction for your time-conscious customers.

Today’s business milieu is multifaceted, with a seemingly infinite stream of priorities demanding your attention day and night. Securing the best POS system for your company is one of the surest ways to streamline your operations. That way you can remain laser-focused on what is most important: growing your business. If you keep your eye on the ball now as you research the point of sale system that will be your most adept partner, you should realize the benefits in countless ways with each passing year.

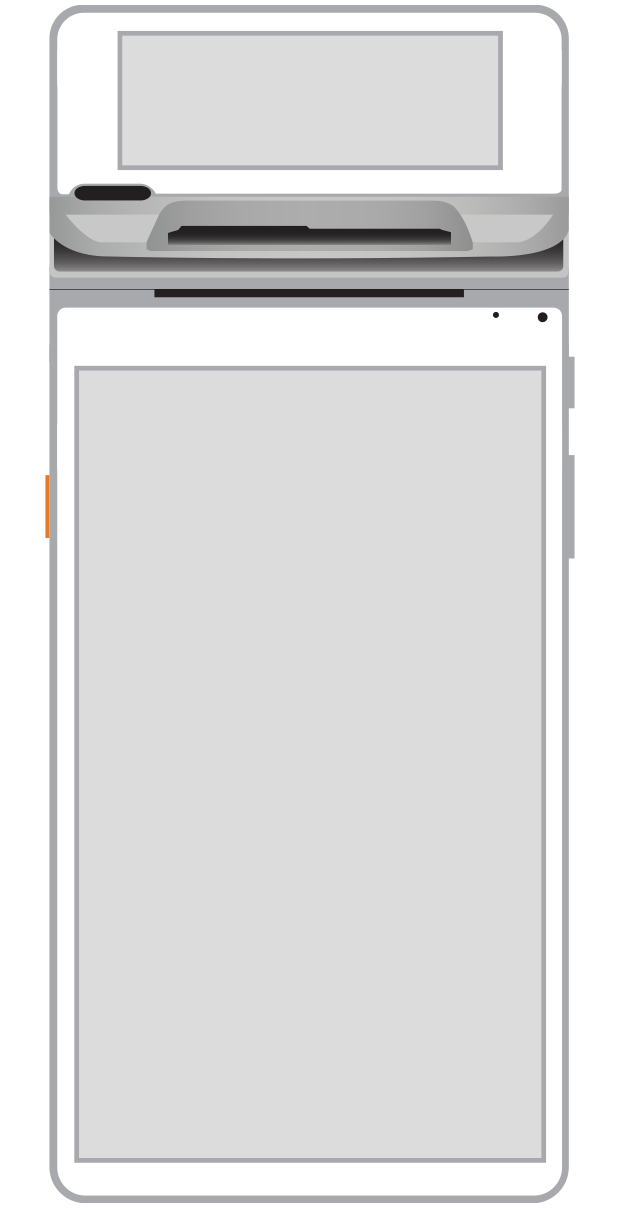

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||