How to find the right credit card terminal for contactless payments in 2025

Today’s customers have been embracing the efficiency, security, and health advantages that come with touchless payment solutions. If you have not joined the contactless payment revolution, it’s time to jump on the bandwagon, both to enhance your retail operations and to meet current buyer preferences.

But just how do you go about finding the right contactless terminal?

Contactless payment terminals defined.

Unlike a standard credit card terminal, the touch-free version does not require that there be any physical contact between it and the customer’s card. Instead, contactless terminals utilize near-field communication (N.F.C.) technology that allows contactless cards or wearables to interact with each other at close proximity, usually less than three inches apart.

When prompted, a customer pays for their purchase by holding their card or device near the terminal.

Thanks to N.F.C., payment details are transmitted and tokenized, preventing the information from being intercepted by digital thieves. The entire process is secure, and is typically faster than a traditional credit card payment transaction.

Decide on your terminal type.

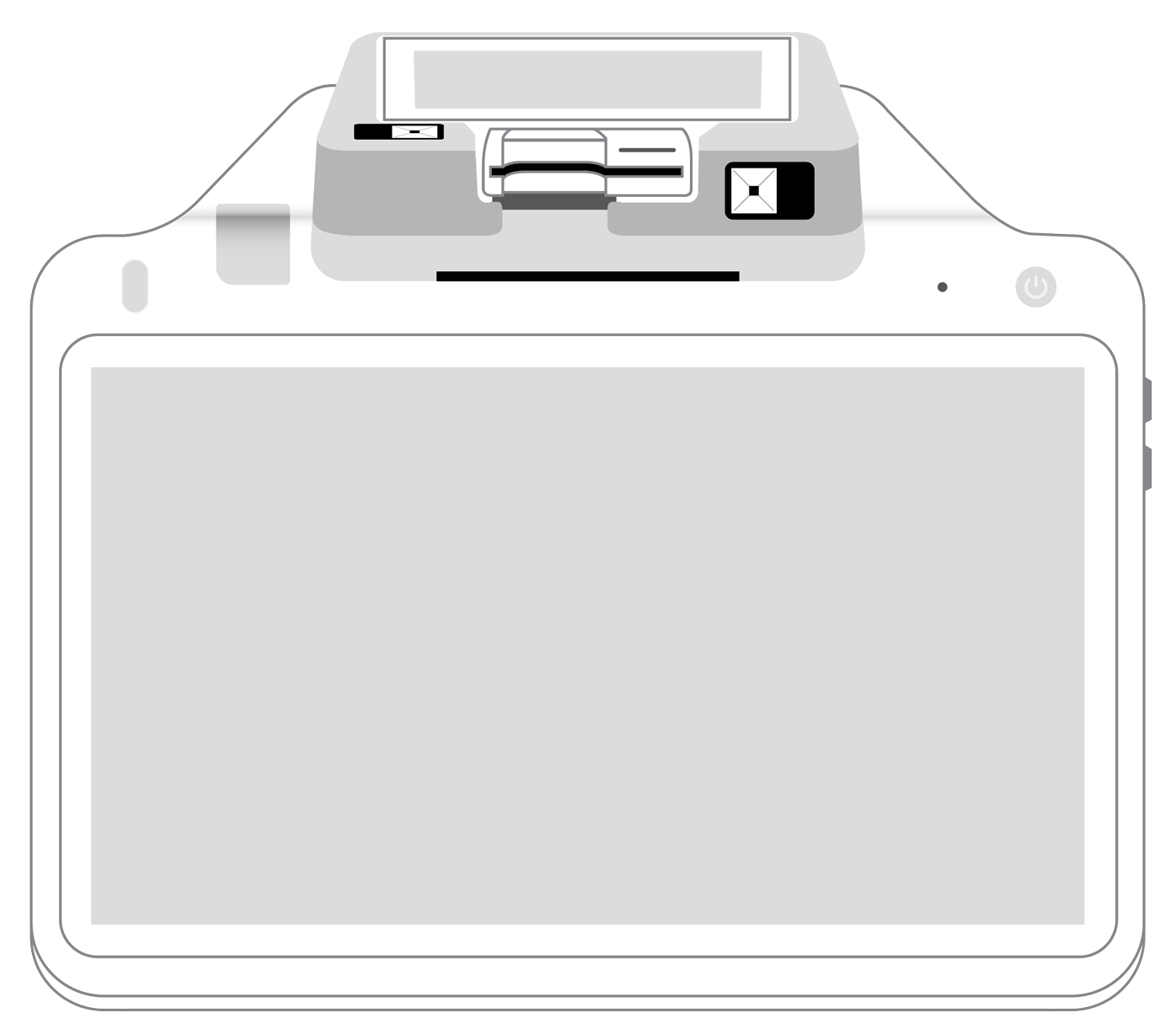

There are three different kinds of contactless card readers. First, fixed terminals are stationary, remaining tethered to the checkout counter. When making a payment with these, customers tap their card, smartphone, or wearable device near the payment symbol.

Usually integrated into the business’s point of sale system, fixed terminals can process other forms of credit card payments including traditional magnetic stripe and chip.

Second, mobile point of sale terminals (m.P.O.S.) are portable, enabling them to travel anywhere you want to take them. They can accept contactless and mobile payments and are easy to set up and integrate.

Interfaces are intuitive, and the device is generally battery-operated.

Third, integrated terminals are built into devices like smartphones. They generally communicate seamlessly with retail point of sale systems, allowing for sales tracking, data analytics, and report generation that can help businesses to develop marketing campaigns and track previous data metrics.

Features that should be included in a contactless terminal.

Don’t accept anything less than the best when choosing your new contactless card readers and terminal. Demand that it supports N.F.C. technology to facilitate fast and secure touchless transactions.

Since not all customers will have a so-called “smart card,” you also need a system that possesses an E.M.V. chip reader.

Additionally, demand that the terminal you choose is able to process transactions quickly and can work seamlessly with any payment processor. The terminal should come with a compact, integrated receipt printer and a customer display screen that shows buyers every step of the payment transaction.

This promotes transparency while simultaneously giving you a forum for the display of advertisements and other sales promotions that will be visible to everyone during the brief time spent at the register.

Now that you know what a contactless terminal is as well as its most important features, you are in a much better position to choose the one that will work best for your business.

Talk about your options with your merchant account provider today, and you will be taking touchless payments via your new terminal in no time.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||