How to take credit card payments on your phone

With just a few easy actions, you have the potential to revolutionize the way you take customer payments, by turning the smartphone you use every day into a secure and efficient credit card reader.

Once you start to accept contactless payments on your phone, you will immediately begin to reap the many benefits that this simple trick will bring.

Why should you take smartphone payments at your business?

Nothing frustrates customers and staff more than long, slow lines at the register. If you use a credit card reader for your phone to accept payments, customers will be able to complete their transactions in a matter of seconds, from anywhere – all with top-of-the-line security intact.

Although your phone has now become its own payment processor, it is definitely not a stand-alone device.

In fact, it seamlessly integrates with your store’s point of sale system, allowing you to take advantage of all of the inventory, customer relationships, and employee management and reporting features that you already leverage to optimize the performance of your business.

As a result of these integration capabilities, you can use your phone to accept a wide variety of payments beyond just contactless payments. No longer do shoppers need to limit themselves to completing the sale using a credit card.

They can also use other types of mobile payment methods including PayPal, Apple Pay, Google Pay, and other digital wallet services. For instance, you can even offer recurring billing as well as payments in other currencies for your international customers.

Guide to setting up payments on your smartphone.

Considering the complex security safeguards and technology that’s used to accept payments, it is easy to think that integrating mobile payments into your existing systems would be extremely challenging.

In fact, it’s quite the opposite.

In order to set up your phone to accept payments, the first step is to choose a merchant provider. To ensure that you select the one that is best for your business, consider factors such as whether they offer recurring billing, multiple forms of payment, the ability to configure multiple currencies, and transparency when it comes to fees and pricing.

Because there is a wide variety of choices available to you, also pay attention to authentic reviews from real customers before you sign on any dotted lines.

Another vital consideration is privacy and security.

Before selecting a provider, be sure they offer features such as end-to-end encryption that keeps digital data confidential throughout the entire payment process, two-factor authentication to provide a second precautionary security layer, fraud protection, robust privacy settings, and regular security updates.

Requiring all of these elements helps to ensure that sensitive payment data remains safe even as the security landscape continues to evolve with the discovery of new threats.

You need to have a thorough understanding of the fees you will be required to pay. For instance, you may be charged extra for certain types of payments. Knowing what you will be expected to pay for can help you choose the merchant provider that is best for your business.

After setting up your merchant account, the next step is to download the necessary software or app required to accept payments.

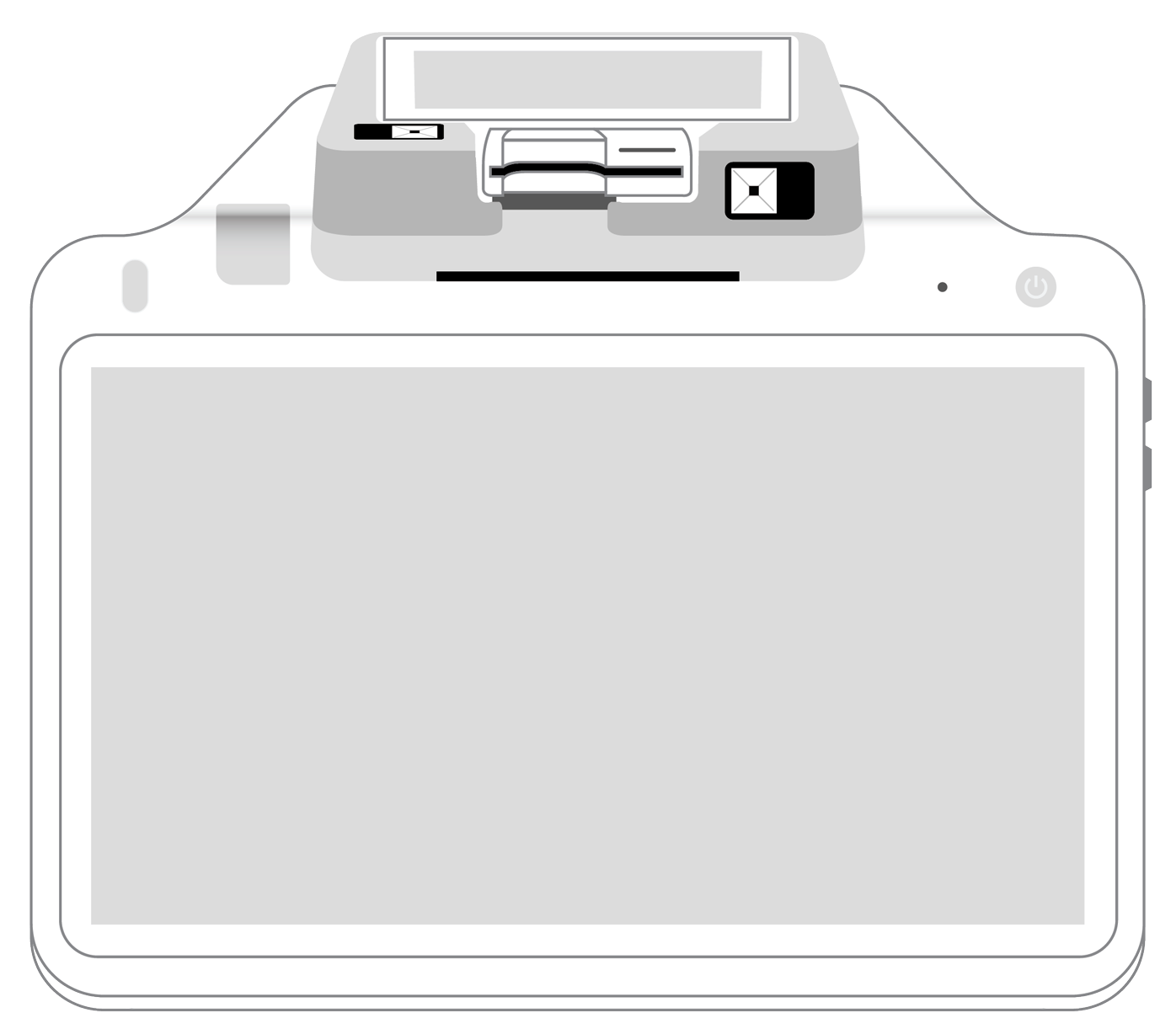

You will also need to get a credit card reader that quickly and easily integrates with your smartphone in order to swipe credit cards. Once you have completed these steps, you are ready to start accepting payments on your phone.

How payments using your mobile phone work.

In your life as a consumer, you have probably purchased an item using a mobile payment method. If this is the case, you already know how easy the process is for the customer.

They simply place their smart credit card, smartphone, or wearable device near your mobile device. Thanks to the digital precautions and convenience found in near field communications (N.F.C.) technology, stored payment details are securely transmitted within seconds from buyer to seller.

Depending on the app or service you use, you can also offer clients the chance to scan a QR code to initiate the payment process.

Enhancing your business with mobile payments.

As you can see, integrating mobile payments into your operations is safe and uncomplicated. Better still, doing so can bring a host of advantages to your company.

When customers discover the safety and convenience you now offer, satisfaction and sales numbers are likely to rise.

What’s more, the expanded number of payment options that you can take will appeal to a broader base of customers, making it possible for you to spread the word about your brand to a deeper pool of potential buyers.

Combine these advantages with the data analytics, reports generation and customer loyalty features that are built into your larger point of sale system, and you will have developed a powerhouse of capabilities that will please your customers, increase profits, and set you apart from your competitors.

With every day that passes, you are missing out on the lucrative benefits of accepting payments on your mobile phone. Take the time to explore your options now, and you could be impressing buyers and bringing in more dollars in a matter of just a few days.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||