How to use a tablet to accept credit card payments.

Running your business can occupy virtually every second of your time. No matter how busy you are though, you have no doubt noticed that wireless devices that allow for mobile transactions are the order of the day. Learn what this revolution is all about so that you can begin to accept customers’ credit card payments on your tablet or smartphone.

Why accept payments on your tablet or smartphone?

There are several reasons why you should enable mobile transactions at your business. For one thing, customers increasingly expect to be offered the safety, convenience, and efficiency that they gain when they complete their purchases in this way. From your point of view, using your iPad or other tablet enables you to repurpose a device you already have in your possession, with no need to invest in additional hardware.

The benefits don’t stop there. With tablet-based readers, you don’t need hardware connected by cumbersome wires. Moreover, you can easily carry your tablet anywhere, whether in your store, in another town, or even across the country. As a result, you can accept payments — and provide product information — seamlessly from virtually any location.

You can also use your tablet or smartphone for other tasks. These include processing returns and pre-authorized transactions and signing and sending email receipts. You can even harness your point of sale system’s online dashboard to track transaction and inventory details, generate reports, and manage your customer loyalty program.

What you need to accept payments on your tablet.

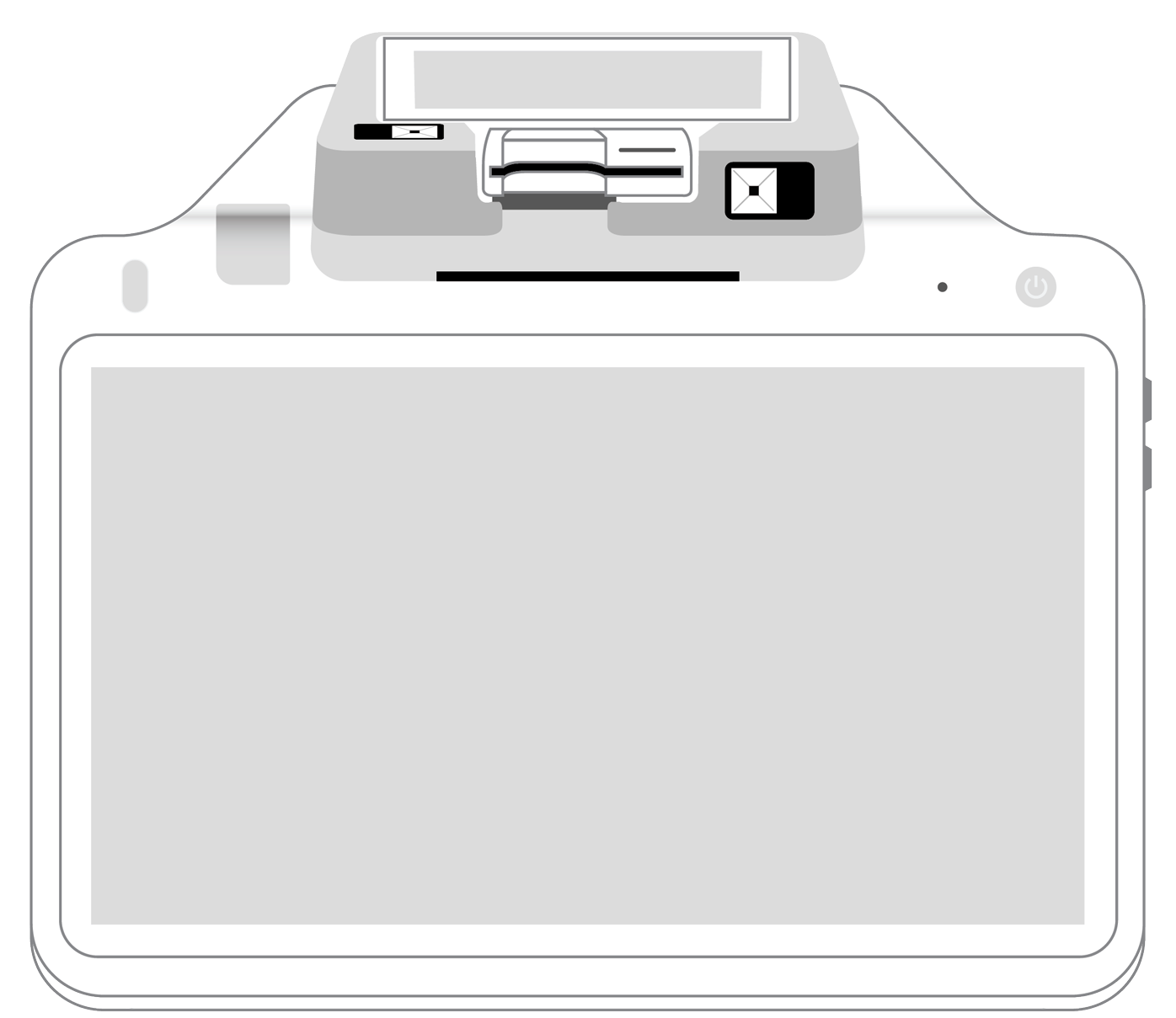

For your tablet to become a payment processing device, it must be connected to a credit card reader. These come in three basic types.

- Credit card swipers. This old-school reader takes magnetic stripe cards only. Although still in use, merchants generally pair it with one or both of the other reader types.

- EMV or chip readers. These work by accessing the payment information embedded in customers’ chip cards and represent greater security than swipe readers and magstripe cards.

- Contactless readers. This reader is equipped with near-field communication (NFC) technology that communicates with customers’ compatible cards, smartphones, and wearable devices at close range to exchange payment information securely and contactlessly. Most card readers that accept digital wallet payments can also process EMV and swipe cards.

You can get a mobile reader for your tablet in two different ways through your existing merchant account provider. All you may need to do is to ask your current provider to add mobile app capabilities to your existing configuration. Note, however, that you may be hit with fees for any services, subscriptions, or software you are required to purchase to get up and running.

How to accept mobile payments on your tablet: A step-by-step guide.

You’ll be amazed to learn just how easy it is to join the mobile payments revolution. Just do the following:

- Get an account that is compatible with mobile payments. This could be from a third-party provider or your existing payment technology partner.

- Download a mobile point of sale (POS) app on your Apple or Android tablet.

- Connect your device to your mobile card reader using a dongle or via a payment link or QR code. It is usually also a good idea to be connected to the internet, although many apps can also process in “offline” mode.

- When a customer is at the point of sale to make a purchase, ask them to swipe, dip, tap, or wave their credit card or smartphone near your reader.

The customer now has the option to leave a tip and can decide whether they want a printed or digital receipt.

Not so long ago, customer payments could only be accepted behind a stationary checkout counter via a system tethered to the internet by wires. Not only did this lead to bored cashiers and customers frustrated by long lines, it also stifled the entire flow of the business. Now that today’s merchants have been freed to move around their stores — and the country — thanks to wireless technology and mobile credit card processing for tablets, the entire payments landscape has been revolutionized. If you have not already catapulted your store into the 21st century with mobile payments, you shouldn’t wait another day to get started. Once you do, there’s no telling where your business may go.

Related Reading

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||