How your POS can increase your cash flow.

If you want to expand your business, you’ll need to do more than simply offering additional products. By the same token, obtaining an influx of new customers is not the complete answer either. The overarching solution is encapsulated in your point of sale (POS) solution, a suite of hardware and software options that can vastly enhance your company’s range and efficiency. Once you learn all that a modern POS system can do to streamline and enhance your operations, you’ll be sure to make it your virtual right-hand helper in the upward trajectory of your enterprise.

Understanding cash flow.

While this term may seem self-explanatory, it does bear a little explanation to avoid confusion. Cash flow refers to the finite amount of money you have on hand at a particular time. This is not the same thing as profit, a figure that represents the amount of money your business gets to keep after all expenses have been paid. Think of cash flow as a figurative drawer where your petty cash is stored. Should an emergency arise that requires funds available for immediate liquidation, you can immediately tap into this store. Maintaining an ongoing record of the exact amount of your cash flow can help you make forecasts about future purchases while enabling you to look back on how well specific sales initiatives have performed. As many business owners are discovering, these tasks can be made much easier and more streamlined with the help of a modern POS solution.

What is a POS solution?

Think of a good POS solution as a hub, the center of your operations. Sales, customer relationships, inventory management, staff-related tasks, and report generation all flow from this vital main component. The right POS payment system allows you to accept credit cards, initiate and maintain a database and loyalty program, track and forecast sales, and determine which of your products need to be ordered (as well as which are not selling). Your POS system should also integrate well with other solutions you have in place, like your accounting software. Remember, your POS solution is supposed to be there to make your job easier, not more difficult.

Your POS system may consist of several important components:

- On-premise or cloud-based software that interfaces with your existing programs.

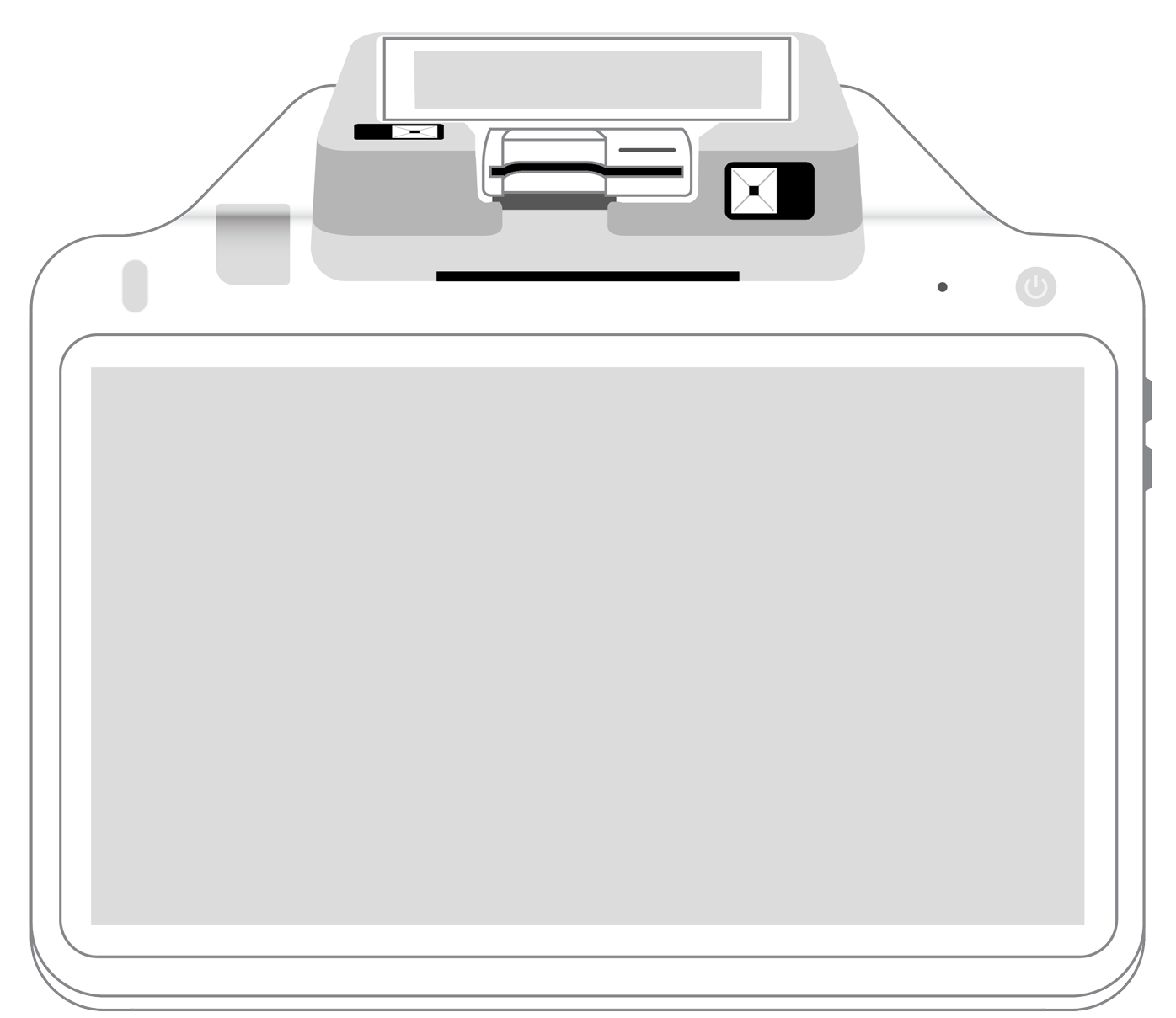

- Physical hardware that enables you to view databases and reports on a screen.

- Barcode scanners that automate checkout by adding product information to the total when a customer is buying products and enable inventory counts to be updated in real time.

- EMV-compliant credit card reader(s) that allow(s) you to accept credit card payments securely.

- A cash drawer to allow for transactions with bills and coins.

- A receipt printer to generate a hard-copy verifying purchase.

While the use of these final two components is diminishing with the increased reliance on non-cash payments and emailable receipts, they remain important for a full-service business to provide.

These various POS elements combine to form a powerful tool that can assist you with numerous business-related tasks, including:

- The generation of sales reports. Ideally, your POS solution should allow you to track sales by product, employee, time, total cost of items sold, total retail amount, gross margin, and net profit. You can also use it to generate quick snapshots of how your sales are going during a particular time period in order to make forecasting more accurate.

- Inventory management. A good POS system should have features that let you scan and count products, use unique serial numbers to track individual products, manage inventory in multiple locations, allow for product variations such as size or color, and combine several purchases into a single order.

- Effectively managing customer data and relationships. You’ll also want a solution that allows you to monitor customers’ purchase histories, capture and store valuable customer information such as birthdays, email and physical addresses, and phone numbers. That way you can send email promotions and newsletters and set up a dynamic customer loyalty program to keep regular buyers coming back.

- Employee management. Your POS can simplify all aspects of staff management by enabling you to add new employees, create and modify work schedules based on sales forecasting, email schedules to staff, track employee hours over time, and determine your top performers.

In light of all the possibilities your POS can provide, it is important to put careful thought into choosing the one that is best for your specific business. If you are in the market for a new solution, be wary of jumping at the first option just because it may appear to be cheaper. Instead, take the time to determine which features are must-haves have you and which are optional. Concentrate on choosing a suite of products that is easy to use, priced affordably, and data-driven. You’ll also want to make sure your solution is upgradeable with robust hardware and will keep your data as secure as possible with PCI-compliance and the latest in encryption and tokenization.

Your POS solution and cash flow.

Now that we’ve taken a peek into the various benefits that a POS solution can offer your business, you may be getting a glimpse into its potential positive effect on your cash flow. For one thing, any business expansion or product upgrade necessarily involves spending extra money. Funds can come from profits that you have squirreled away or be generated through receiving any of a number of types of small business loans. In order for either of these possibilities to occur, it is vital that you have a clear idea of the resources you have on hand. No prospective lender would entrust you with their dollars without this information. Furthermore, any investors and partners you may have would certainly frown on undertaking any major expenditures without it. Your POS solution, with its automated features, can greatly simplify these forecasting and reporting tasks.

Within seconds, you can determine the products sold, when the sales occurred, your bestsellers, and what payment methods are being used. If you set up your system correctly, you can even refine the information to include who your key customers are so that invoices can be sent in a timely fashion. Once you invest a little time into getting your POS solution set up, these tasks can be totally automated, boosting your efficiency and allowing you to devote your time to other important tasks, including expanding your operations.

Your POS solution also enables you to reduce the amount of funds that are trickling out of your account every day. With it, you can easily determine where your greatest expenses lie. It also allows you to streamline your operations, thus increasing efficiency. After all, time is money. If, for instance, you are wasting hours on tweaking your stock or sending back products that turned out to be poor sellers, start to rely on your POS to track product sales and provide accurate forecasts based on what is purchased, as well as customer input.

By now, it should be clear that your POS system can do infinitely more than simply accept credit cards and other payments. If you’re looking to take your business to the next level via physical expansion or simply through upgrading your product line, your POS solution can streamline each and every task involved. Not the least of these is enabling you to track the cash you have on hand at any given time. Armed with this information, you’ll be in a much better position to determine if you are ready to take the next step now or if you need help from lenders, partners, or other outside sources.

In this era of constantly changing technology, you cannot afford to rely on creaky old credit card terminals or, worse yet, paper ledgers and receipts that can be prone to error or loss. Modern POS solutions are affordable, easy to use, and virtually indispensable for all growing businesses. Isn’t it time to welcome one of these invaluable partners into your company?

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||