Is Android or Apple more business friendly for accepting mobile payments?

Now that cash has been relegated to the back burner, it is essential that your business also welcomes alternative payment options. Making the decision to accept mobile payments is rapidly becoming another virtual necessity in today’s commercial milieu.

In order to make this happen, however, you need to settle on the infrastructure you will use. This brings up one pivotal question: is Apple or Android preferable for taking mobile payments?

Advantages of accepting mobile payments.

Before we enter into a discussion about iPhone vs Android, however, it makes sense to back up a step. Let’s take a minute to explore why accepting mobile payments can be such a game-changer for your business in the first place.

Incorporating mobile payments can revolutionize many aspects of how you function. For one thing, it accelerates the payment process, reducing line length, and even enabling customers to check out from anywhere on the sales floor.

This individualized payment experience can transform checkout from a drudgery into a highly efficient and personalized event that will amplify satisfaction, and make people feel great about your brand.

The portability of mobile payment solutions means that you are no longer tethered to a wired payment terminal. Consequently, you can take your products anywhere, gaining additional exposure for your company, and having the potential to grow your customer base.

All the while, the data you gather is instantly incorporated into your existing point of sale system, streamlining vital operations such as customer relationships and inventory management, and maximizing your company’s reach and efficiency.

Which platform should you choose?

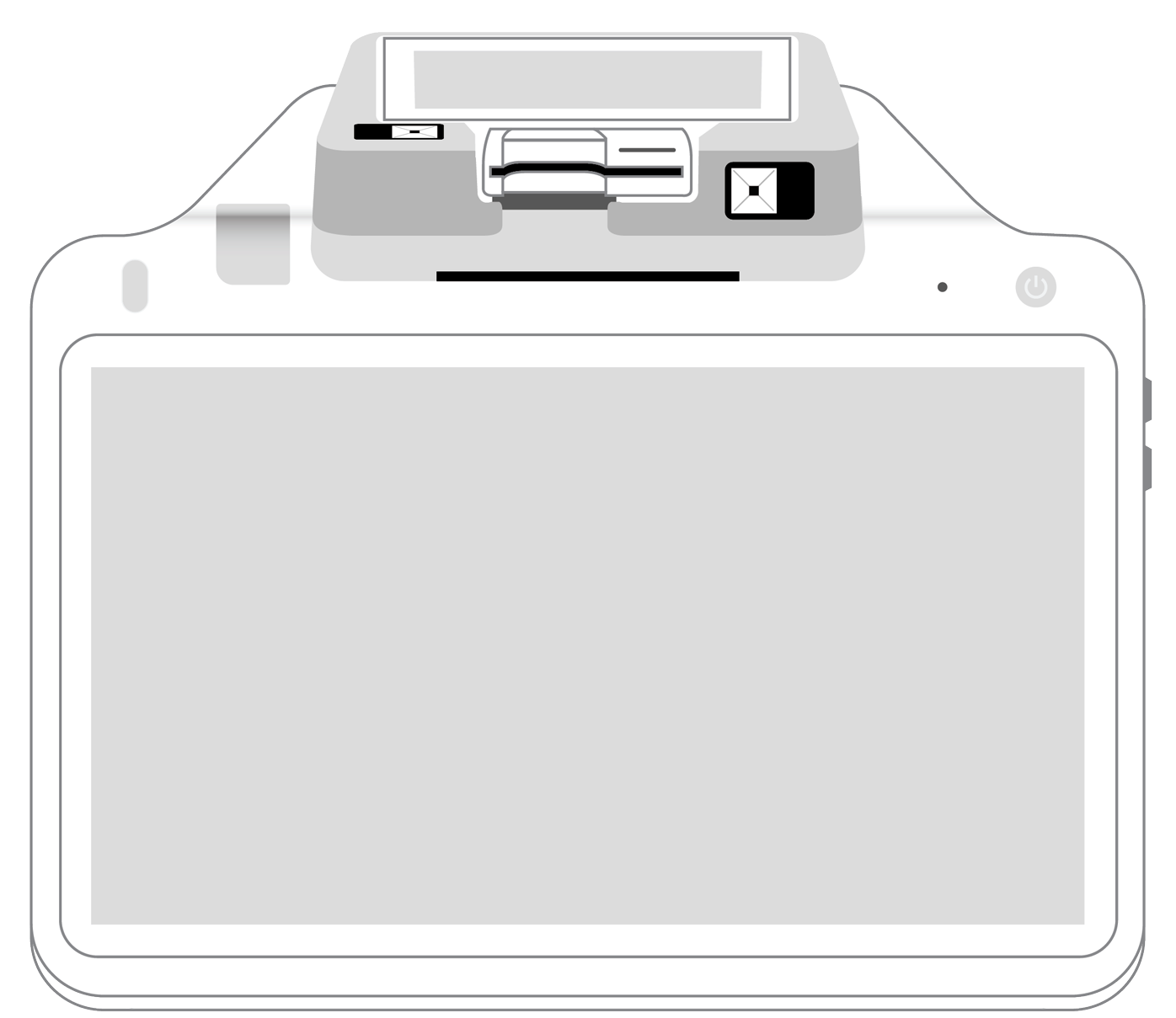

In order to take mobile payments, you can either connect an Apple or Android phone to a compatible reader, or download an app onto the device that allows you to use the phone itself as a wireless credit card terminal.

In either case, you will need to decide whether to do so by using either an Apple iPhone or an Android device.

Taking payments on the iPhone.

Although most readers are compatible with both Apple and Android, there are slight differences that you should take into consideration.

Famous for its ease of use, security and top-of-the-line customer support, the Apple brand is a top choice for many business owners. Their decision to adopt Tap to Pay on iPhone is bolstered by the fact that the Apple platform is tightly monitored for security, and frequently updated in order to keep up with the ever-changing threat landscape.

Apple devices are designed with ease of use and integration in mind. As a result, many entrepreneurs who are fans of the brand also find that it is a breeze to integrate their device with both the payment gateway they use, as well as common accounting software.

As a result, you will find that entering, storing, and communicating information among the various components of your company is intuitive and seamless.

Taking payments on Android.

Android is a worthy competitor to the Apple ecosystem, offering advantages of its own. The platform is less restrictive than Apple, making it possible for adherents to choose from a broader range of compatible devices.

Consequently, Android users have more control over their equipment and have greater leeway to customize it to fit with their needs. On the downside, this more open ecosystem can lead to increased vulnerability to security threats.

Since there are numerous Android apps and compatible devices, it can sometimes be difficult to ensure that everything is updated to its most recent security patch.

On the plus side, Android devices tend to be less expensive than their Apple counterparts. If your store is operating on a tight budget, this alone might be the deciding factor.

Android works seamlessly with the rich universe of Google apps, making it particularly business-friendly to many of its supporters.

When push comes to shove, your decision of whether to incorporate Apple vs Android into your retail ecosystem boils down to what you feel the most comfortable with as a business owner.

Your customers will receive a similar experience regardless of which type of device you use to process their payments, provided that you maintain a robust commitment to installing the latest operating system updates and security patches.

In the end, what they will take away, regardless of which device you settle on, is that you are committed to giving them both security and a diverse set of purchasing options, thanks to your decision to process mobile payments.

Are you ready to take your store to the next level with mobile payments on iPhone or Android? After doing your research and determining your priorities, talk to your payment processing provider to get started right away.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||