Merchant accounts vs. payment service providers explained.

When you first set out to launch your business, you may not have guessed just how much confusing terminology you would need to navigate and grasp. Whether you accept payments online, accept payments in-store, or both, there are two concepts that you need to understand. Once they make sense, you will see just how merchant accounts and payment service providers function and work together to promote successful, secure purchase transactions.

Merchant accounts defined.

No doubt, you already have an account where you store your company’s funds that is hopefully kept completely separate from your personal one. This is quite different from a merchant account, however. Although it is also a business-related account, it is specifically designed to enable you to accept and process electronic credit and debit card transactions. This account functions as a “middleman” between you, the merchant, and your customers’ financial institutions and makes it possible for you to accept numerous types of payments.

The merchant account is the place that holds the customer’s funds after they make a digital or credit card purchase. At this point, you cannot access these funds. However, they will be released to you by the processing company within a few days.

Payment processors defined.

The payment processor is the company we referred to above in our description of how and when you will eventually receive your cash after a purchase is made. This company is responsible for facilitating the authorization, processing, and settlement of payment transactions between merchants and their customers.

Specifically, the processor’s duties include the following.

- Authorization. The processor verifies the customer’s payment information (card number and CVV), conducts security screenings, and determines whether there are sufficient funds in the customer’s account to support the purchase.

- Processing. Funds are transferred from the customer’s account to the merchant. This involves secure communication among all players in the payments landscape, including banks and card networks.

- Settlement. Funds are eventually transferred into the merchant’s business account, usually within a few days.

Payment processors frequently either partner with payment gateways or have their own built-in ones. These applications collect and transmit online payment information, allowing for a safe, and streamlined payment experience for your customers.

Merchant accounts vs. payment processors.

Both merchant accounts and payment processors are vital components in the payments universe. Merchant accounts are safe storage vaults where funds are temporarily stored after a purchase. Payment processors are the overarching entities that are responsible for facilitating the entire funds transfer from start to finish.

Both of these entities come with associated rates and fees. The banks that furnish you with your merchant account will most likely impose per-month, transaction, and chargeback fees. What you will pay may vary based on your provider as well as factors about your unique business or industry.

Payment processors will levy transaction and setup fees that can vary according to the company, your particular business and industry, and the volume of transactions you process. Additionally, you might opt to lease hardware such as point of sale equipment, which also comes at an extra charge.

How merchant accounts and payment processors combine to enhance your business.

Look at the following narrative flow to learn how these two entities collaborate to help your business.

- Your customer enters their payment details online or in-person by swiping or inserting their card or tapping their card or device.

- A payment gateway collects and encrypts data made from online or mobile payments and sends it to the processor.

- After receiving the information, the payment processor sends an authorization request to the customer’s financial institution or issuing bank. After screening and checking for sufficient funds, the bank sends a declination or authorization code to the processor.

- Your payment processor informs you of the status of the payment.

- The customer receives notification if the payment has been approved.

- Funds are temporarily stored in your merchant account.

- Your payment processor then transfers the funds from your merchant account into your standard business account.

- The payment processor furnishes you with the transaction records and reports that allow you to keep track of all transactions.

As you can see, this hand-in-hand relationship between merchant account and payment processor is beneficial for both you and your customers.

Finding the best merchant provider and account for your business is crucial. Once you have established a relationship with both an account provider and a payment processor, you will have the elements in place that will ensure varied, safe, and streamlined payments for both you and your valued customers.

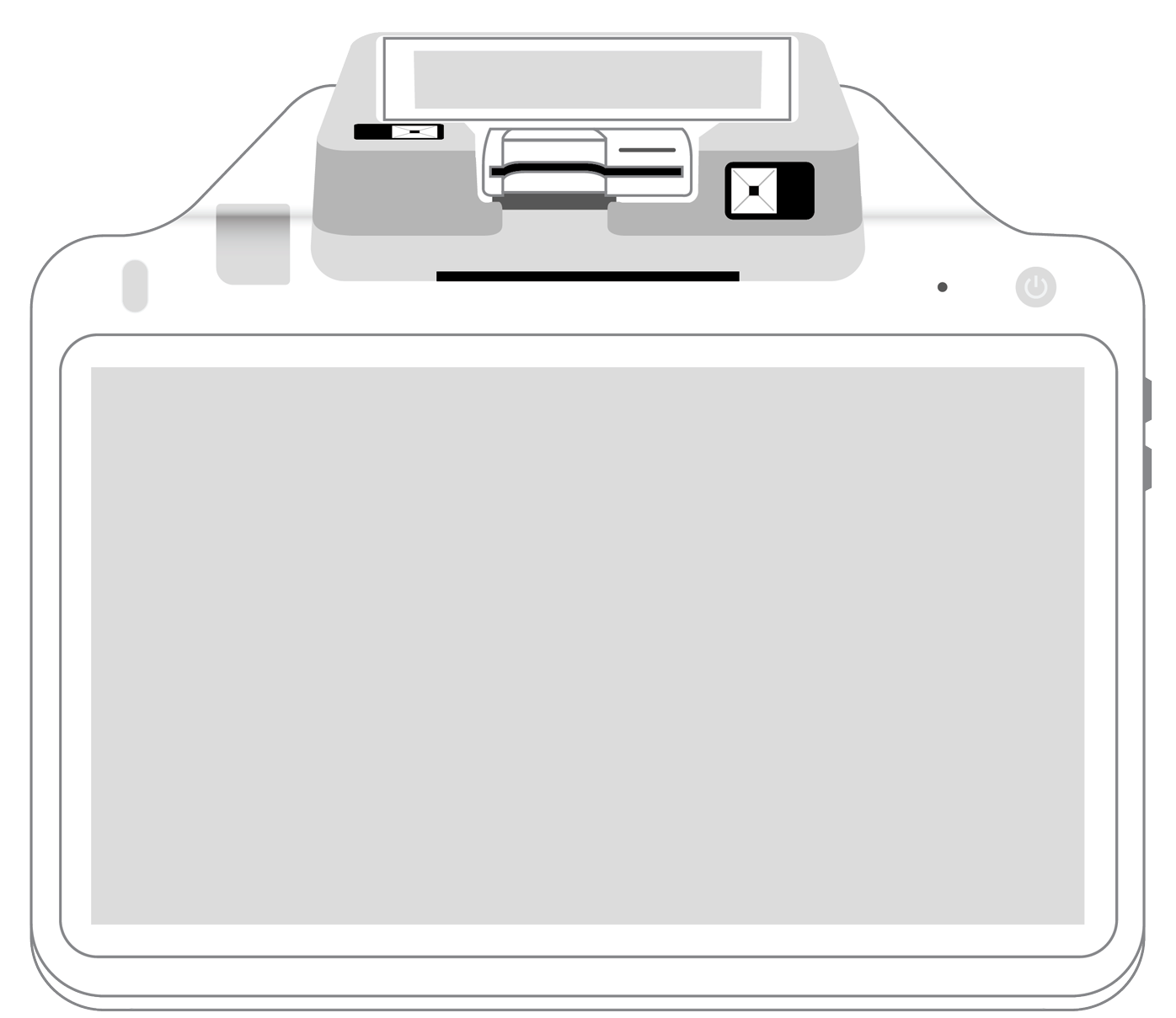

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||