Mistakes that can happen with contactless payments and how to help your customers avoid them.

The coronavirus has changed virtually every aspect of our lives. That includes the way entrepreneurs and customers handle the process of purchasing goods and services. In an era when close proximity and touch could prove deadly, many retailers who may once have been reluctant to do so are now embracing contactless payment processing equipment to ensure maximum comfort and safety. While this strategy makes a great deal of sense for you as a small to mid-sized business owner, it is important to recognize some of the pitfalls and to do all you can to correct them or prevent them from happening.

What are contactless payments?

Before we delve into the problems that can arise with them, it is important to understand just what contactless payments are and how they work. As the name suggests, contactless payments can be completed without you or your cashiers ever needing to touch the customer or their credit card.

Contactless payments come in two basic forms. The first involves the buyer purchasing items using a wallet app built into their smartphone that securely stores their credit card data and interacts with the contactless reader contained in your payment processing equipment. This reader verifies, encrypts, and transacts the payment. Authentication of identity is performed when the person uses biometric data such as their fingerprint or facial ID.

The second form of touchless payment occurs via the customer’s credit card. For it to work, it must contain contactless technology and be held near a card reader equipped with near-field communication (NFC) capabilities. When a customer makes a tap-and-go payment, the system creates a one-time token that contains an encrypted form of the purchaser’s credit card information, resulting in a process that is speedy, secure, and seamless.

Taking excessive control of the payment process.

One of the many advantages that both customers and merchants realize with contactless payments is that the two parties do not need to touch each other – of heightened importance due to current coronavirus fears. Even so, you and your staff may find it difficult to resist the urge to reflexively reach out and take a customer’s card to speed up the process. Although this seems harmless on the surface, you could be putting your business in danger.

On the most basic level, you may be unnecessarily exposing yourself to the risk of contracting a virus. Avoiding items or surfaces that may be infected simply makes sense in an era when you can’t be too careful.

What’s more, gaining possession of a customer’s card, however briefly, gives you access to information such as the card number, security code, and expiration date. Should the customer become a victim of fraud, you just might find yourself accused of committing a crime. In short, why open yourself up to the possibility of being left holding the bag? Especially when your patrons have the technology at their fingertips to complete the entire process on their own?

Making contactless payment charging errors.

Touchless transactions are so fast and efficient that it is frighteningly easy to start multitasking. Once your attention is divided, the likelihood of entering the wrong payment amount into your system increases exponentially. Trust us when we tell you that there isn’t a customer in this world who would be happy to pay ten times the price for a cup of coffee or an item of clothing.

An error such as this can take place in a microsecond, but the consequences may be long-term. As a retailer attempting to stay solvent in these trying times, your reputation for honesty and integrity is just as important – if not more so – than the products you sell. Even if it slows you down a smidge here and there, don’t do your credibility potentially lasting damage by being careless.

Failing to trust your gut.

No doubt, you have done a great deal of thinking about credit card security in order to protect both yourself and your customers. If you hire staff to work at your checkout counter, you most likely instruct them to come to you with concerns if something about a customer or their method of payment appears suspicious. Unfortunately, some business owners do not treat contactless payments with the same level of scrutiny, perhaps mistakenly believing that fraud is not possible with these types of transactions.

In reality, it is quite possible for a criminal to steal a credit card equipped with touchless technology. All that remains is for the fraudster to wave the card near your reader and walk away with their ill-gotten gains. To protect yourself from this type of scam, emphasize with all counter staff the importance of listening to their intuition. If something about the payment seems off, they are well within their rights to politely request that the customer use a different form of payment.

Believing that contactless payments have limits.

There may come a time when you are faced with a customer who wishes to buy a big-ticket item, perhaps something that costs $100. The individual may approach your register with the piece of merchandise and then realize that the only card they have in their possession is of the tap-and-go variety. Regretfully, the person might tell you that they will need to come back another day when they have a different payment method close at hand.

The error here lies in the misconception that contactless payments can only be made for small charges. This misconception stems from the fact that some other countries do place a ceiling on the amount that can be paid using this method. However, this is not the case for transactions conducted in the United States.

Assuming that customers know about contactless payments.

Health and safety concerns have made consumers cautious, reluctant to put themselves at risk. As a business owner, anything you can do to allay fear and make potential buyers feel good about the steps you have taken to protect their well-being will be beneficial to everyone involved. Believe it or not, this rule even applies to contactless payments.

Make it a point to prominently post the fact that your store accepts touchless payments. Moreover, demonstrate your commitment to excellent customer service by offering to answer any questions people might have about card security or even how to go about tapping their card or using their phone in conjunction with your near-field communications payment processing equipment. You might even consider offering extra loyalty points to buyers who make payments in this way, particularly when you are introducing this new payment feature to long-time patrons.

Data can be “skimmed.”

In general, the tokenization and contactless nature of these types of payments go a long way toward ensuring security. However, criminals can use easily obtainable RFID skimmers to collect data from a customer’s card from as far as a meter away. These fraudsters can then gain access to all of the personal data on the card, including number, expiration date, and customer PIN.

Ensuring that all of your transactions are encrypted is one of the best ways to shield your business and customers from this type of criminal fraud. In addition, actively take steps to ensure that your network and payment processing equipment meets all of the standards set forth by the Payment Card Industry.

Contactless payments provide a fast, reliable, and secure way for customers to pay for goods and services. Even so, mistakes can happen on your part or due to lapses by your patrons. However, if you maintain high standards for security and customer service, you can take advantage of the many benefits of contactless payments without jeopardizing your business or the security of your clients’ sensitive data.

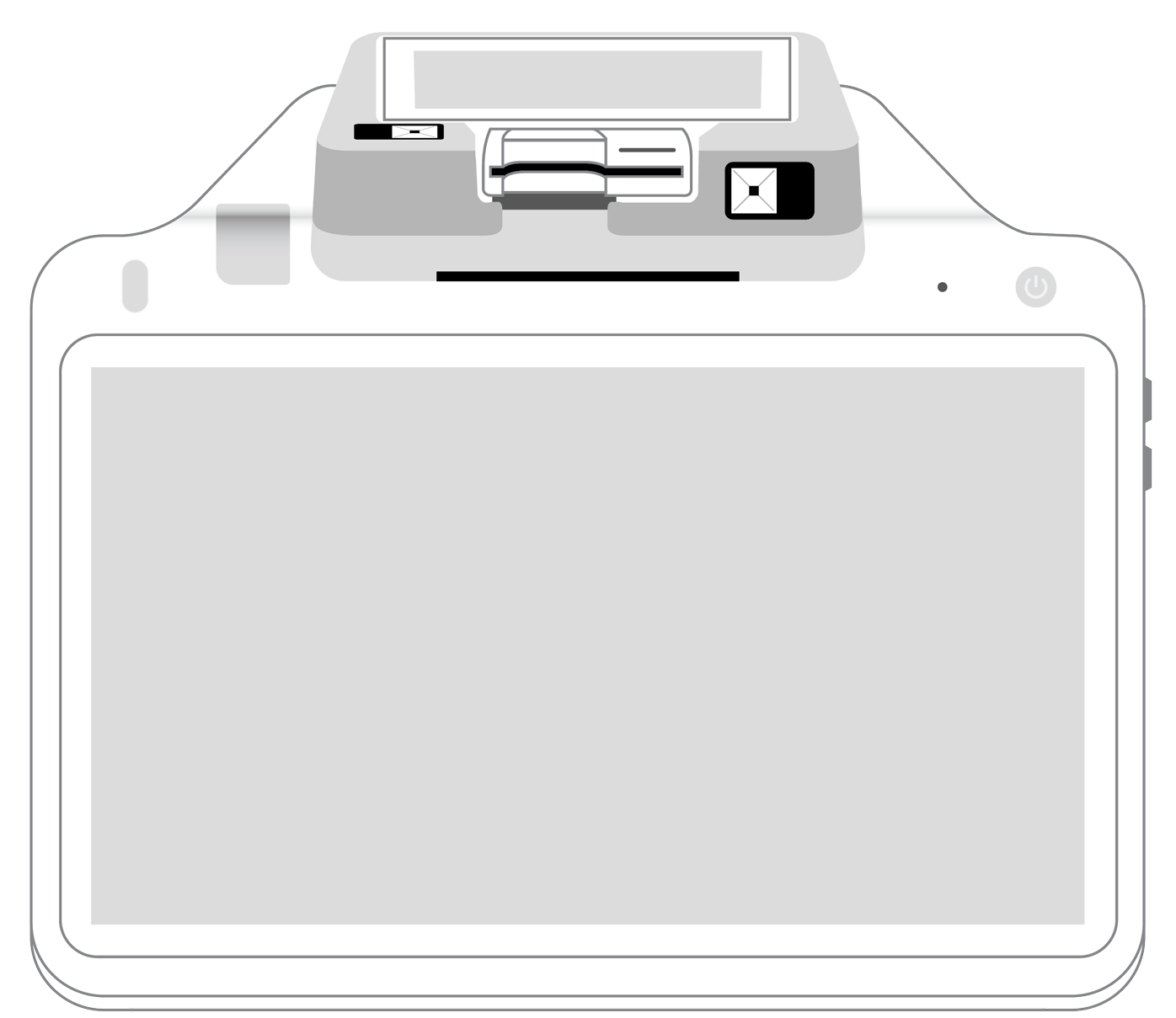

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||