Mobile credit card processing in the digital era explained.

As soon as innovators and consumers began to realize the potential of the smartphone, the idea of using it to pay for goods and services became a no-brainer. Even so, it took several decades for this payment method to truly come into its own. As you consider whether (and to what extent) you should incorporate mobile payments into your business model, it is an important first step to understand what they are and how they work.

Mobile payments defined.

The term “mobile payments” refers to several types of transactions between a buyer and a seller.

- Ecommerce mobile payments. These involve using a cellphone to make online purchases on a retailer’s website or app and can also refer to paying bills via mobile phone.

- In-store mobile payments. A “contactless” or “touchless” solution that allows consumers with a smartphone or wearable device, such as a watch, to pay simply by tapping. In these instances, the merchant has a point of sale system that is equipped with near-field communication or RFID technology. This reads the consumer credit card data that has been pre-loaded into their device’s digital wallet.

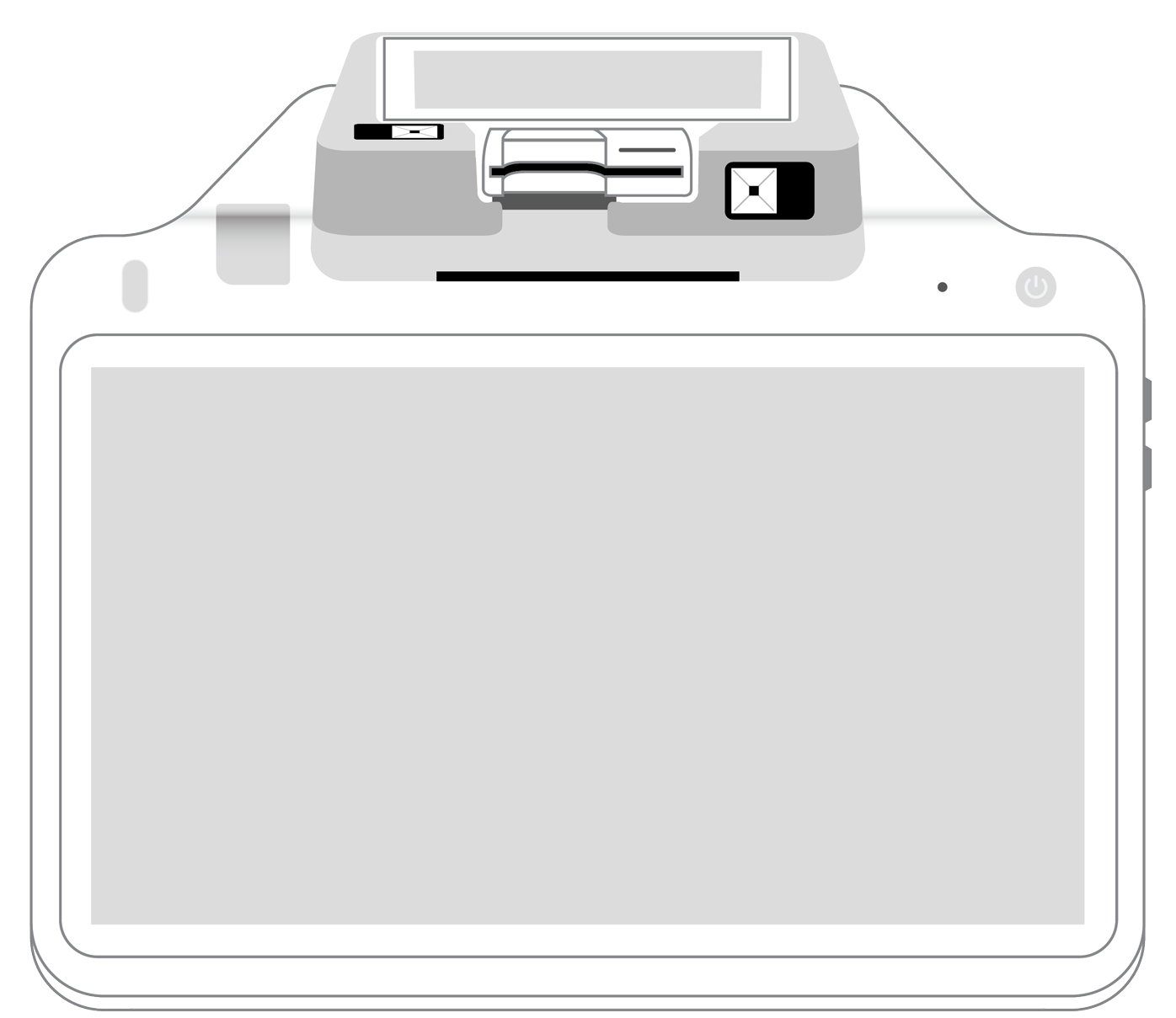

- Mobile credit card processing. This technology enables merchants to transform their smartphones or tablets into credit card terminals. All that is required is an attached reader and payment processing software that can be obtained from your merchant account or payment processing company.

How do mobile payments work?

The main technological driver behind mobile payments is near-field communications (NFC), although radio frequency identification (RFID) and QR codes are used to a lesser degree. When both a consumer’s smartphone and the merchant’s reader are equipped with NFC and are within close range of each other, they can transfer payment details back and forth. Even more importantly, they can do so in such a way that the information is protected from hackers.

How is this security possible? The key is tokenization, which generates a single-use string of digits in place of the customer’s credit card number. Because of this extra precautionary step, the merchant never actually sees or handles the customer’s real data, removing the burden of liability in the case of fraud from the seller.

Furthermore, most mPOS devices also require buyers to authenticate their identity before the payment goes through. This can happen via passwords or biometrics like fingerprint and facial recognition.

What hardware do you need to accept mobile payments?

Mobile payments are inherently easy and portable, and that translates into good news for you as a merchant. All you will need to get started with mobile payments is a credit card terminal with NFC capabilities. Once you have that hardware in place, you will be able to accept digital wallet payments such as Apple Pay, Samsung Pay, and Android Pay, which are the three current top contenders in the field.

Believe it or not, you might already have equipment that is ready to accept contactless NFC transactions. Many smart point of sale systems harness the technology needed to accept these types of payments. If you are unsure, ask your payment processing company about the status of your current POS devices, and don’t hesitate to seek out a bargain. After all, they too will benefit once you begin accepting mobile payments.

Why should you incorporate mobile payments into your business?

No matter the size of your business, you will undoubtedly benefit from accepting mobile payments. You might be wondering if taking this leap of faith is necessary, particularly in these difficult economic times. While each retailer is different, there are several compelling reasons why most merchants should consider making mobile payments a part of their daily operations.

- Maximum speed. When customers pay using wearables or phones embedded with digital wallets, the process is much faster than fumbling for cash or plastic. As a result, your checkout line can move more quickly, leading to greater customer and staff satisfaction.

- Enhanced security. The encryption, tokenization, and authorization that are built into the mobile payments process protect consumers from identity theft. Furthermore, since you never lay hands on or view sensitive credit card data, you cannot be held liable should a data breach occur.

- Greater versatility. With just a portable card reader and some software, you can take your sales floor to the local farmers market, technology fair, church bazaar, or pop-up store. As a result, you can bring your products directly to the customers who want them!

- Increased customer satisfaction. When you can accept payments quickly at the checkout counter or from anywhere on the sales floor using mobile payments, your buyers will leave with a positive attitude about your store.

- Streamlined operations. Mobile payment solutions can integrate seamlessly with accounting and other software that you already have in place. The result is easy, automated management of inventory, pricing, and restocking as well as analytics-based report generation that will help you better understand your customers and target your sales toward them.

The great news is that mobile payments technology provides all of the capabilities of old-school POS terminals along with a sleek, modern upgrade. Providing excellent, secure customer service needs to be one of your highest priorities in this age of constant hacking and data breach. With mobile solutions, you can have it all: flexibility, versatility, and security.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||