Mobile Payments Get a Boost from EMV

Since the liability shift last October, a lot merchants have made the switch to EMV, installing equipment that enables their customers to use the embedded-chip payment cards now being issued by banks in the United States. However, recent data suggests many businesses have not made the switch, and some customers are still confused about how to use the cards and with the longer length of time it takes to complete and EMV transaction versus a traditional magstripe card transaction. Some EMV card transactions may take as long as 30 seconds to complete, especially if using chip-and-PIN (which is not in widespread use in the United States) and the card must remain in the terminal until the transaction is complete. However, traditional magstripe cards are going away, so customers will have to get used to EMV, and the card issuers will need to figure out ways to speed up transactions.

Since the liability shift last October, a lot merchants have made the switch to EMV, installing equipment that enables their customers to use the embedded-chip payment cards now being issued by banks in the United States. However, recent data suggests many businesses have not made the switch, and some customers are still confused about how to use the cards and with the longer length of time it takes to complete and EMV transaction versus a traditional magstripe card transaction. Some EMV card transactions may take as long as 30 seconds to complete, especially if using chip-and-PIN (which is not in widespread use in the United States) and the card must remain in the terminal until the transaction is complete. However, traditional magstripe cards are going away, so customers will have to get used to EMV, and the card issuers will need to figure out ways to speed up transactions.

EMV’s lack of merchant support, consumer confusion and longer transaction times have given rise to another type of transaction – the mobile payment transaction. Beyond Apple, Android and Samsung, many companies and banks have developed mobile payment platforms that allow consumers to use their smartphones or other connected devices, including watches and bracelets, to make purchases. While both EMV and mobile payments technologies are very safe and secure for consumers to use – much more secure than traditional magstripe card transactions – the “tap and go” function of mobile payments is winning favor with consumers as it is closer to the function and speed of a magstripe card transaction.

The biggest problem with EMV cards is that consumers are so used to simply swiping their cards in a terminal, and EMV transactions don’t function in that way. The card must be inserted in the terminal and left there for an indeterminate amount of time – as long as it takes for the transaction to be completed, and if the card is removed before the transaction is complete, it could result in a denial. This is a deviation from learned behavior and while it is not insurmountable, it will take time for consumers to get used to this new way of credit card functioning.

Adaption to mobile payment platforms, on the other hand, is proving to be easier, despite the completely foreign concept of using a phone to pay for goods and services. Once activated, mobile payment platforms like Apple Pay, Android Pay and Samsung Pay are easy and fast to use, offering the safety and security of EMV with the transactional quickness of magstripe cards. The Smart Card Alliance says that “Chase has reported that customer time at the POS is reduced 30-40%, and American Express has reported that contactless transactions are 63% faster than cash and 53% faster than using a traditional credit card.” The report also says MasterCard reported similar time savings for mobile payments vs. cash at drive through restaurants – 12 to 18 seconds were saved using mobile payments as compared to cash.

Beyond being an easier payment platform for consumers to use, mobile payments have many benefits for merchants, as well, and can help them create memorable experiences for their customers. Mobile payments allow merchants to track shopping trends and analyze the behavior, allowing merchants to target the right customers at the right time with merchandise, special sales, events, etc. Mobile payments also help merchants target customers whenever they are physically near the business. For example, if you own a restaurant, you could send a coupon to the customer’s mobile app as they approach the restaurant. Customers may also place an order and pay for it in one action, for a true “pick up and go” carryout service.

In addition, using mobile payment platforms is easy. Most terminals that accept EMV cards will also accept mobile payments, meaning there is no additional equipment required either of the customer or the merchant. Many people worldwide are using a mobile device that runs on either Android or iOS, meaning just about everyone has access to a mobile payment system.

For both merchants and customers, using mobile payments and other non-traditional payment methods can help with the transition to EMV, making its use feel more like a normal part of their everyday lives. With the recent announcements that Visa, MasterCard and American Express are developing ways to speed up EMV transaction processing times, this should also help consumer adoption of EMV, making the use of the embedded-chip cards feel more like a traditional magstripe transaction. Whichever payment platform consumers decide to use – EMV or mobile – the security provided by both far outweighs that of traditional magstripe cards, which helps to make the entire payments ecosystem safer for everyone.

Related Reading

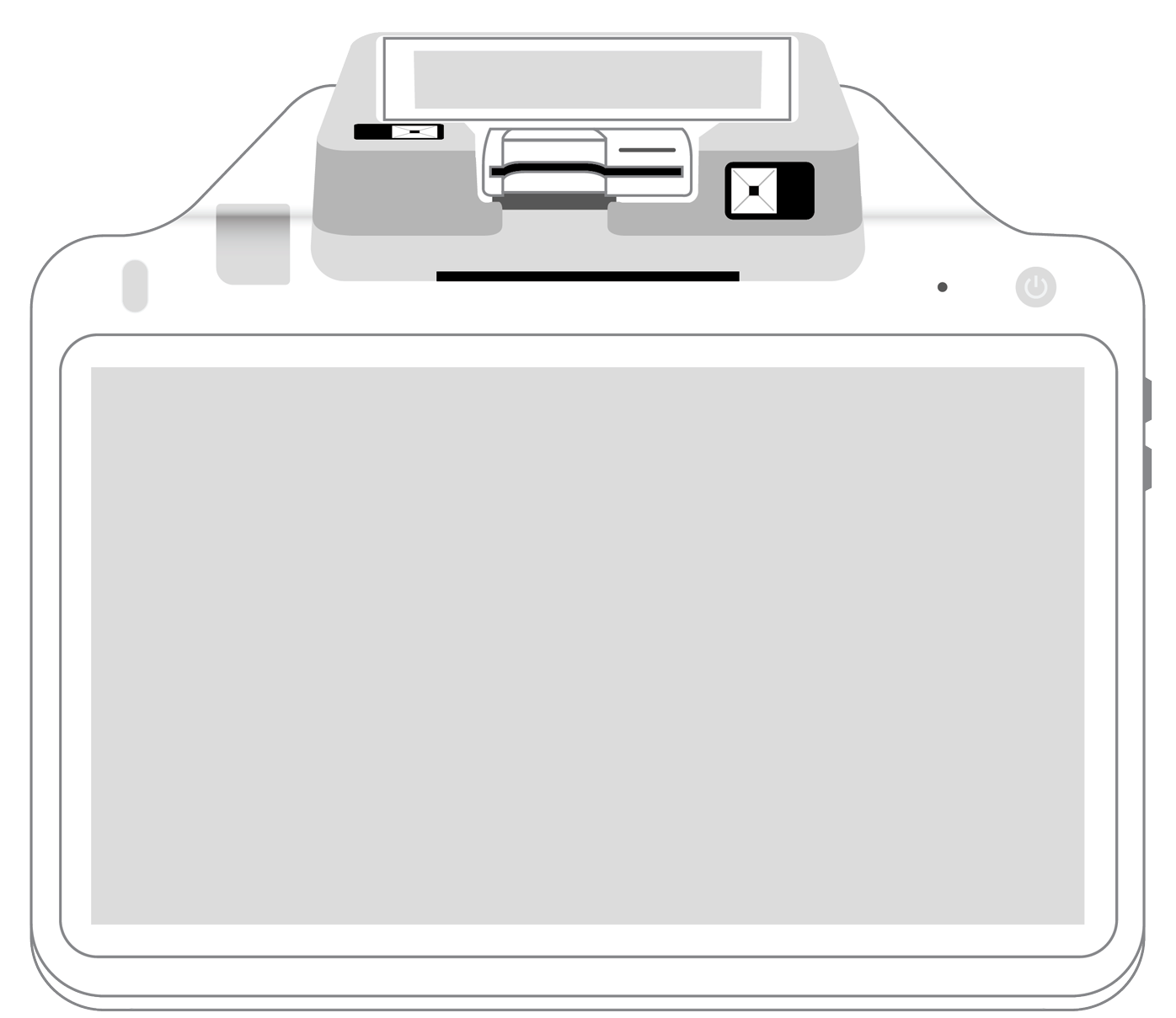

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||