No holds, delays, or headaches: The benefits of next day or same day funding.

Wouldn’t it be nice if you could have immediate access to the funds customers use to pay for your products or services? Instead, complex regulations in the banking industry have traditionally hampered those dollars from reaching you for days, sometimes even for up to a week. Fortunately, recent changes have allowed for the implementation of next day or even same day funding that can keep the cash flowing into your merchant account.

How next day funds work.

Not so long ago, banks put in place a mechanism designed to lower the risk profile they incurred from merchants. Instead of transferring the proceeds of purchases right away, they held onto them for one, two, or even a few days. According to their way of thinking, this strategy furnished a cushion of time during which fraud could be identified without the funds ever having been released.

Advantages of next day and same day funding.

Gaining faster access to funds provides merchants with what they are owed in a much timelier fashion. This is a huge plus at any time, but never has it been more important than now as we navigate a global pandemic. With next day funding, merchants who settle their daily batch before the evening cutoff time can receive their funds as early as the next morning (or the following Monday for weekend transactions.

Especially if you are a company that experiences heavy sales at specific times such as over the weekends, a significant delay in receiving funds can be extremely crippling. After all, cash flow is the lifeblood of any business.

Furthermore, the next day and same day funding structure does not usually limit the size of your batches. As a result, business owners don’t need to contend with delays or the headaches they cause. From a technological perspective, your staff does not need to do a thing if you want to add this feature; it will be integrated into your payment processing software.

Believe it or not, same day funding is even better, enabling you to request your money and receive it on that same day as long as you put in your request by a designated time.

Sure, you can continue to wait 72 hours or even five or six whole days before receiving your funds. However, next day and same day options give cash-strapped merchants an additional option during these challenging times.

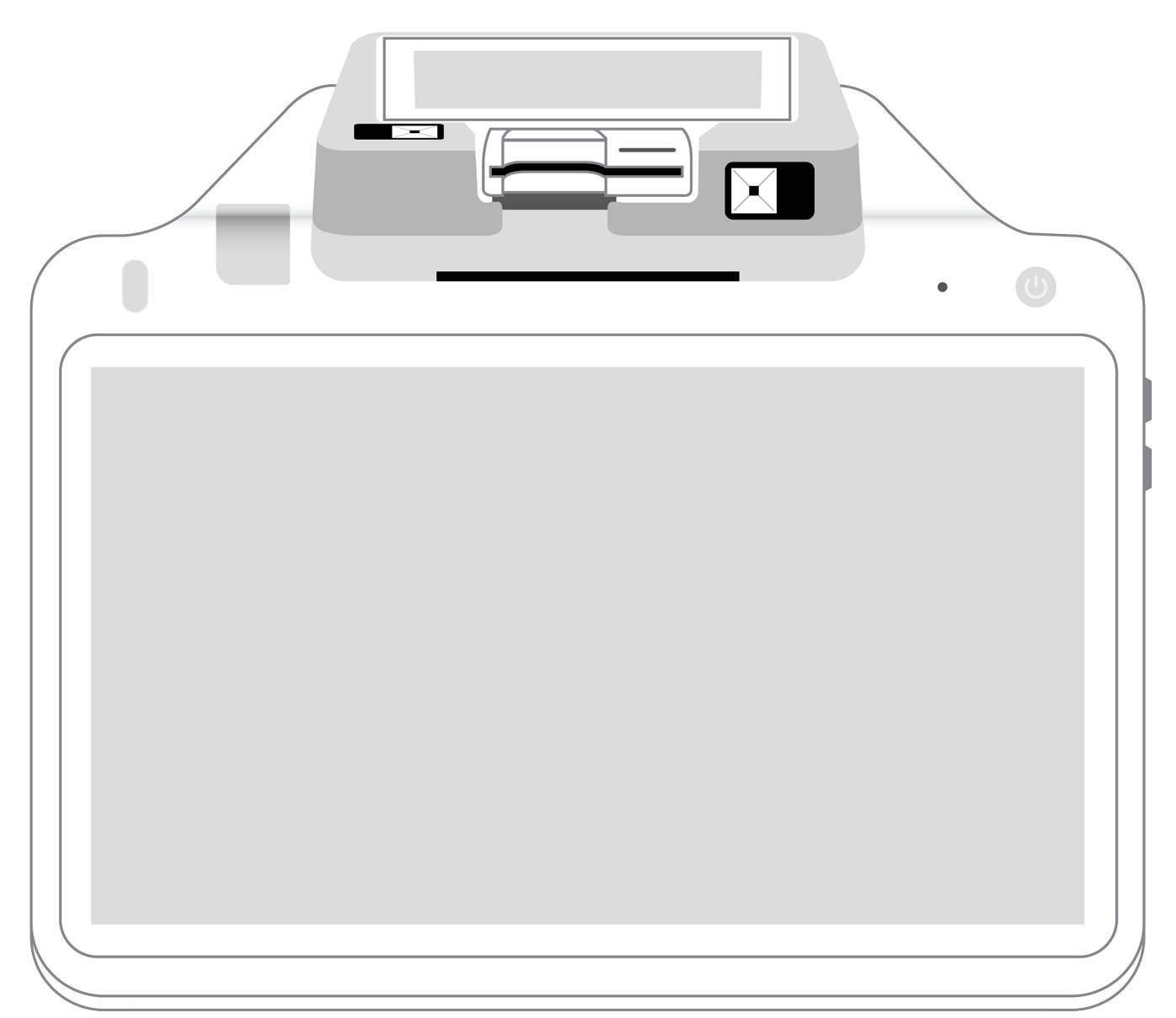

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||