Payanywhere’s guide to credit card decline codes.

For businesses of all sizes, the point of sale (POS) system is far more than a mechanism that reads credit and debit cards. Seemingly in the blink of an eye, a buyer can receive information on the exact amount they owe, can use any number of methods to provide a payment, and can be provided with a paper or electronic receipt that verifies the transaction. The POS system functions as the hub of many of today’s most successful companies, allowing for not only seamless customer payment experiences, but also facilitating smooth operations throughout your entire business.

Although the terminal and the card reader may be the most visible parts of the POS system, the payments software housed within is the true brains of the operation. It is the user interface that meshes all of the components into a smoothly running machine. This includes barcode scanners, card readers, cash drawers, and other third-party devices. A well-designed user interface will be configured to allow the cashier to exhibit maximum efficiency with minimal stress as they process multiple transactions per hour.

In addition, the system will come equipped with the capability for a business owner to initialize and maintain a database of customers and employees. This analytics-based data makes it possible for you to set up loyalty programs, schedule employee hours, and integrate with third-party accounting software like QuickBooks to streamline your payroll and tax information. These are just some of the managerial functions that the right POS system can simplify. In addition, it should allow you to set permission levels while providing mechanisms for checking individual productivity and progress over time.

This suite of software can be maintained in-house, giving you full control and customizability. However, the downside is that it leaves you with the burden of ensuring that all systems are secure and in compliance with industry standards. On the other hand, you can opt to have your software hosted by a company that specializes in this area. Although this can be more expensive, it leaves you with more time to run your business and shifts PCI compliance liability and responsibility for security to the outside vendor.

The traditional stationary countertop POS systems relied on a connection to a business’s landline to connect to the payment processing companies to finalize transactions. However, today’s systems utilize the speed and power of the internet. POS systems connect to it using an ethernet cable or wirelessly via wifi. Having a reliable connection to the internet is, therefore, a must for most modern merchants. An outage of even just a few minutes can result in major financial loss, as well as customer frustration.

The screen/monitor provides your cashier with an ongoing chronicle of the information necessary to process each transaction. Choosing a monitor that is easy to read can reduce eye strain as well as minimize the chance of human errors. Some monitor/screen configurations also feature displays that face the customer and make it easier for them to read the details of their pending payment. In recent years, touchscreen technology has become ubiquitous, and these POS monitor setups have followed the prevailing trend. While touchscreens are intuitive and usually lead to faster checkout experiences, some customers, particularly those with visual impairments, find them difficult to use. Consequently, you should train your cashiers to spot when buyers are having difficulties and provide them with protocols to help customers enter their information if they are unable to do so on their own.

Due to the scanners that come with most POS systems, barcodes are a business owner’s best friend. Thanks to this technology, you no longer need to spend endless hours manually entering item numbers into your inventory logs. Simply use your scanner that connects to the inventory function on your POS system, and the information can be entered in minutes. Best of all, the system automatically updates product counts whenever a sale is made, making reordering a breeze. In addition, the inventory function on your POS system can also let you know which products are not selling so that you can remove them from your offerings, replacing them with goods that customers really want.

Your POS solution’s receipt printer can provide your customer with a hard copy of their transaction. As an alternative, modern POS systems often allow you to also email this information. The side benefits to digital receipts include less paper waste, convenience, and the ability for you to capture the customer’s email address. Once you have it — along with the buyer’s permission, of course – it can be used to send promotional information in the future.

You’ll also have the option to include a cash drawer. This is the repository for all of your paper money and coins, checks, invoices, and receipts. Even if an increasing amount of your business is done electronically, you will likely always need a physical cash drawer to keep these important items.

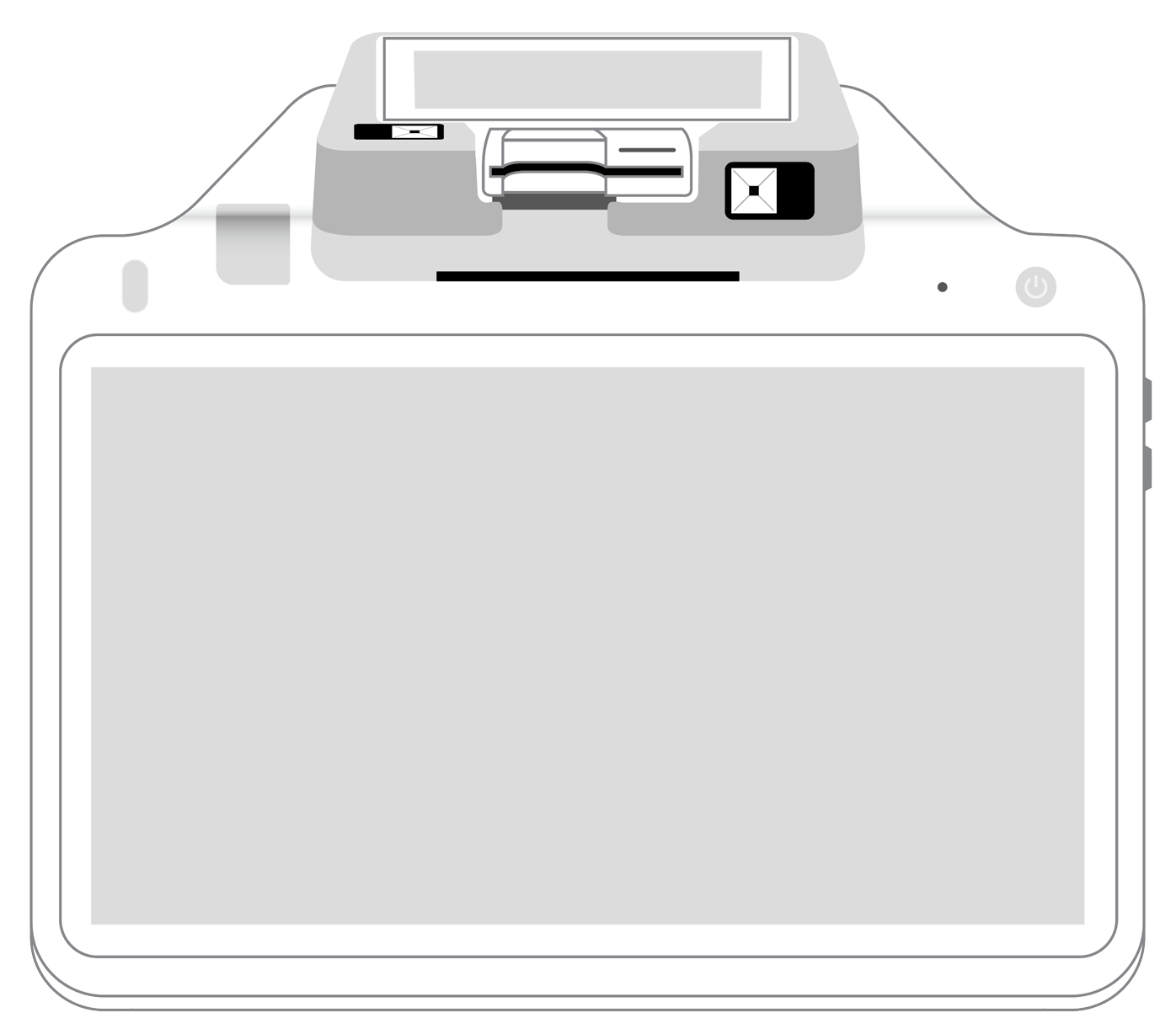

Of course, no POS system is complete without the card reader. Modern readers can process magnetic stripe and EMV chip cards, as well as debit and gift cards. Many readers also contain contactless capabilities, using near field communication (NFC) technology to accept payments from mobile phones that are equipped with digital wallet applications. Today’s updated EMV and contactless technologies boast the latest in security since payments are encrypted and tokenized. As a result, customers can not only check out quickly and efficiently but also can do so with the peace of mind that comes from knowing that their transactions are secure.

Twenty-first-century POS systems are designed to be nimble and to grow with your business. For that reason, adding supplementary hardware can be accomplished with ease. Should your company’s sales go through the roof, you can simply augment your existing POS system with more readers that enable your staff to accept payments from anywhere inside of (or even outside of) your store. In an era when waiting in line is the last thing that most people want to do, it makes sense to streamline the buying experience in this way.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||