Payments and the Internet of Things

There’s an internet meme that shows how far technology has come in the last few decades. It’s a photo of a man holding a boombox and a camcorder with a Walkman in his pocket and a voice recorder dangling from his wrist, standing behind a table full of electronic devices from the 1980’s, including a VCR, video game console, pocket TV, home computer, camera, calculators, CDs, VHS tapes, etc. The caption says, “20 years later and all of these things fit in your pocket.” And it’s true – our smartphones are capable of doing everything – and more – that we used to need several gadgets to do. Even though they are called smart phones, it sometimes seems that making phone calls is an afterthought. Plus, they’re connected to the internet 24/7, so everyone and everything is only a fingertip touch away.

There’s an internet meme that shows how far technology has come in the last few decades. It’s a photo of a man holding a boombox and a camcorder with a Walkman in his pocket and a voice recorder dangling from his wrist, standing behind a table full of electronic devices from the 1980’s, including a VCR, video game console, pocket TV, home computer, camera, calculators, CDs, VHS tapes, etc. The caption says, “20 years later and all of these things fit in your pocket.” And it’s true – our smartphones are capable of doing everything – and more – that we used to need several gadgets to do. Even though they are called smart phones, it sometimes seems that making phone calls is an afterthought. Plus, they’re connected to the internet 24/7, so everyone and everything is only a fingertip touch away.

But it’s not just our phones. Just about everything, from watches to the thermostat in your house, has the ability to be connected to the internet these days. According to a Cisco report, the number of devices connected to the internet will skyrocket to 50 billion by 2020. This constant, ubiquitous connectivity has a name – the Internet of Things (IoT). While it might be fun and cool and a bit “Star Trek”-ish to get phone calls and text messages on our smart watches, there is a practical side to the IoT, particularly when it comes to the payments industry. With the various Pays (Apple Pay, Android Pay and Samsung Pay) already standard features on most smartphones, it’s not much of a jump for that ability to pay for goods and services with a device instead of a payment card or cash. Taking payments from the smartphone to the wrist – or beyond – is a logical next step in the payments industry.

This logic means that the IoT has the potential to radically shift the way we transact from cash and plastic cards to payments through any number of objects, not just smartphones and smart watches. The Apple Watch has already ushered in the beyond-smartphone payments era, and other “wearable tech,” including other smart watches, wristbands and even rings and pendants currently on the market that can be connected to credit cards and bank accounts for hands-free (and hassle-free) payments. But there are other products that are quickly changing the game, such as Amazon’s Dash buttons that allow customers to reorder regularly used household items at the click of a button, and Echo, which is an electronic virtual assistant that can order a pizza or an Uber car as well as pay your Master Card bill.

Innovative and inherently “cool” items such as these are helping to increase mobile payment usage. Although mobile payments are currently used by a relatively small percentage of Americans, Visa estimates that by 2017, $721 billion worldwide will change hands via mobile payments, and that mobile payments will be the standard by 2020. Additionally, credit companies like Visa are taking steps to ensure any device that connects to the internet becomes a gateway for commerce. According to an article on LetsTalkPayments.com, “Integration of Internet (and connectivity) into increasingly more devices along with payment functionality will lead to greater numbers of payment endpoints. Card issuers like MasterCard, Visa and American Express will gain from increased non-cash transactions and the wide database of the customers. To be on top of the IOT technology, Visa has opened an office with over 500 employees to ensure that every device, appliance or wearable computer connected to the Internet can become a secure place for commerce.”

However, despite all these futuristic gadgets hitting the market, the smartphone isn’t likely to become obsolete any time soon; in fact, it will probably become more of a necessity, as it will be the master remote control for our homes and our finances. When it comes to payments, one thing is fairly certain – our wallets are probably history, soon to be replaced by not just a smartphone, but smart watches, smart rings and other wearable payment devices. Instead of swiping or dipping, we’ll be waving – to pay for goods and services, and to usher in a whole new era of the internet and payments.

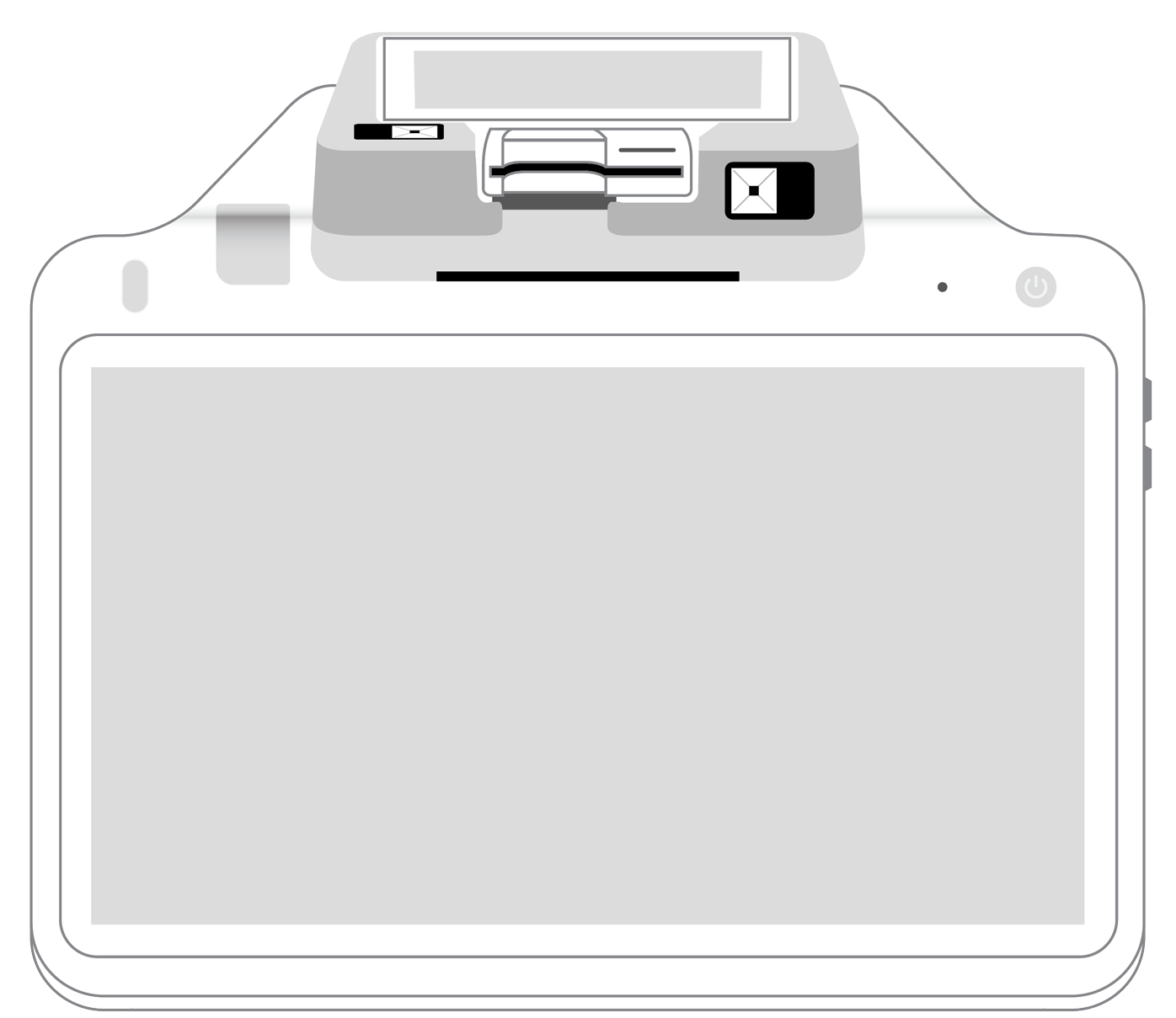

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||