POS 101: Integrating your credit card processing system.

Are you still wasting time reconciling payments from multiple systems and dealing with errors in your books as a result? If so, you need a better point of sale payment system. With today’s technology, it’s easy to set up integrated payments and start enjoying faster transactions while simplifying your bookkeeping.

Say hello to integrated Point of Sale (POS).

Imagine being able to process payments, monitor your inventory, keep track of invoices, and manage your employees from a single platform. Integrated POS systems make it all possible and are available with industry-specific settings and customizations. Setting up one of these systems quickly equips you to accept credit cards, debit cards, and online orders. Some POS solutions also include mobile payment options. Look for a provider offering hardware, software, and integrations to eliminate the need for separate accounts.

Get top-notch training and support.

Product demos give you a hands-on look at what you can expect from a POS system before you invest. If you’re not familiar with integrated payments, let a representative walk you through and explain every step of the process. Getting assistance with setup allows you to provide the best customer experience right from the start.

To maintain high-quality service, ensure consistent support is available. You should be able to call the customer support line to troubleshoot and fix problems at any time, including busy holiday seasons.

Make use of reports and analytics.

All data processed through an integrated payment system goes to the same place, which allows you to track trends in sales and cash flow, see which items are the most popular, monitor returns, and measure your promotional efforts. Using these reports, you can make strategic decisions about how to run your business, including the best way to adjust marketing tactics to bring in more customers and maximize your sales.

Mind your security and compliance.

Taking credit card payments means processing sensitive data. Remember, as a merchant, you’re responsible for your customers’ safety and privacy. Your integrated POS solution should never store customer information or credit card numbers on any device, nor should data be transferred without encryption. Your payments partner should be PCI-compliant and provide automatic updates and patches to address software vulnerabilities. Ask for details about security during the product demo and steer clear of any company unable to give you a clear overview of how it handles and protects data.

Integrating is a smart strategy for streamlining payment processing and creating an efficient accounting system. With an integrated point of sale payment system, customers are free to pay the way they want and you have all the data you need to better manage your entire business. Everybody wins!

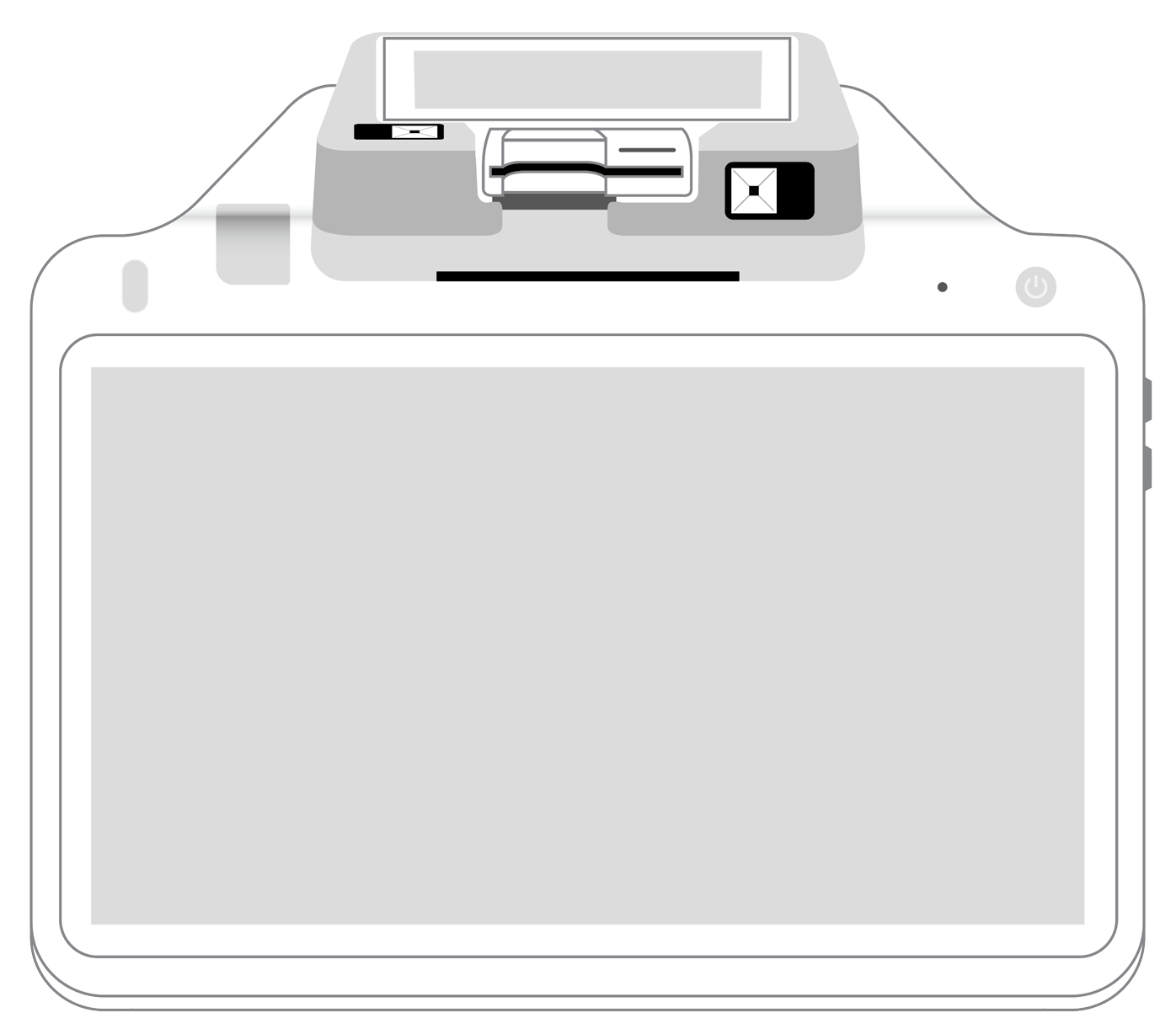

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||