POS charges and fees explained.

As a business owner, you want to invest in a point of sale (POS) solution for any number of reasons. With the help of this integrated payment processing equipment, you can do much more than simply accept customers’ money. As it turns out, your POS system can be a crucial ally in numerous processes in your company, including inventory tracking and ordering, employee and customer management, and generating comprehensive reports. Considering all that this solution provides to you every day, it is probably no surprise that it comes with various costs. Understanding them can help you to put these charges into perspective.

Debit card purchase costs.

One source of POS expenses comes when your customer uses a debit card to make their purchase. Debit card charges fall into two types. In a signature debit card purchase, the buyer does not type a PIN into your keypad, instead simply signing the sales receipt. Since no PIN is provided, the transaction is processed through the Visa or Mastercard network, thus incurring interchange fees. These costs vary according to the size of the bank that issued the customer’s card, the transaction amount, and whether a card was present when the payment was made.

The second type of debit card payment happens when a customer completes a transaction by entering a PIN into the POS system without providing a signature on a sales receipt. As a merchant, you will be responsible for paying PIN debit network interchange and switch fees for this type of transaction. In many respects, these fees are similar in complexity to those you would pay for Visa and Mastercard interchange costs. The amount you will pay is determined by factors such as transaction size and merchant category code.

POS charges.

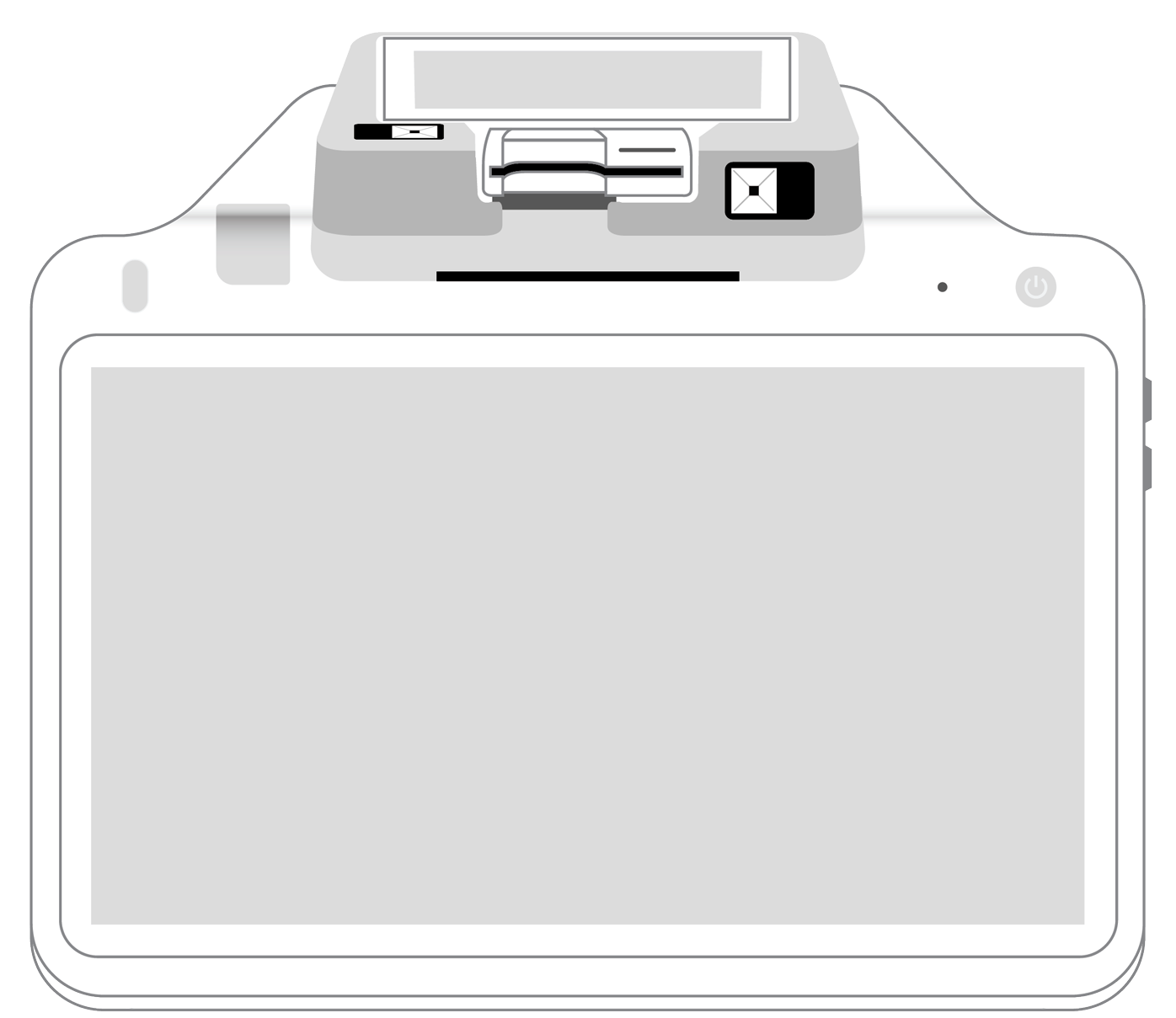

Your POS solution combines hardware such as credit card terminals, readers, cash drawers, and receipt printers with the software that enables you to process payments, track stock, manage employees, run your customer loyalty program, and simplify other parts of your business as well. It stands to reason that you will be expected to pay to buy or lease this technology. In addition, your POS company might expect you to pay additional costs that include the following:

- SMS messages. If your processor has chosen to contract with a third party to send email communications to your customers, you might be charged on an ongoing basis. Keep in mind that many companies build their SMS software from the ground up, which means that you will not be required to pay each time you reach out to your valued clients.

- Caller ID. Instead of being charged for the privilege of viewing your customer’s name and phone number when they call, find a POS company that integrates with all standard PC modems, including yours.

- Credit card processing. There is a complex array of charges and fees that are involved in accepting customer payments. Some of them, the ones that are dictated by the credit card industry, are non-negotiable. However, other charges are subject to provider costs, so it is important to understand these during onboarding.

Unauthorized charges.

Unfortunately, fraudulent and unauthorized charges can be a common occurrence in today’s payment environment. Although you can never totally eliminate the possibility that your store will be a victim, there are steps you can take to enhance your security and minimize the damage. These include the following:

- Training your staff to detect red flags that hint at possible fraud.

- Using an Address Verification System (AVS) that compares the numerical part of the address a customer has provided to information on file in the system.

- Upgrading your system to accept EMV chip cards if you have not done so already.

- If you have an ecommerce business, make sure your network is secure by using anti-malware software, encrypting data, keeping software updated, and limiting access to sensitive information on an as-needed basis.

- Using tokenization to convert customers’ sensitive data into a randomized series of characters and contacting the card issuer as soon as you suspect fraud.

- Always complying with the data security standards set forth by the Payment Card Industry, also known as PCI compliance. These mandate that merchants accept, transmit, and store sensitive customer data securely.

Perhaps most important of all, never underestimate the importance of keeping your ear to the ground when it comes to network security and fraud. Even if you are not a technological expert, paying attention to the headlines can help you to be proactive in the never-ending battle against cybercriminals and data breaches.

While your point of sale system brings inevitable security challenges, it can pay for itself many times over every day for your business. The reality is that fees are inevitable, but they do not need to be prohibitive. Do your homework, shop around, and ask questions. Your due diligence will help you obtain a solution that provides numerous vital services to you, your staff, and your customers.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||