Protect your business from cyberattacks (5 secure payment processing tips).

Did you know that small businesses are the victims in 43% of data breach cases? At an average cost of $148 per lost or stolen record, a single breach can have devastating financial effects for your business. That’s why you’ll want to be sure to reduce your risk of cyberattacks with these five best practices for secure payment processing.

1. Assess payment processor security.

To protect customer data, your payment processor should have:

- Regularly updated software and systems.

- A commitment to PCI compliance and other data privacy regulations.

- Ongoing transaction monitoring and verification.

- Secure data transmission and storage.

- A detailed access control policy.

Weaknesses in just one of these areas can leave your network vulnerable to attack.

2. Encrypt payment information.

Your payment processor should use the latest in encryption and tokenization to protect sensitive card data during collection and transmission. Encryption locks the card data at the moment of a sale. Tokenization replaces the card number with a random token unique to the transaction. Because the information can’t be decrypted without a key, the data is useless to hackers should they gain access to your company’s systems.

3. Monitor purchases for unusual behavior.

Fraudulent activity could be a sign of unauthorized access to your business network. Make sure your payment processor is monitoring for:

- Failed address verifications.

- Multiple orders from the same person or IP address on the same day.

- Orders for large quantities of the same items.

- Unusual requests for rush orders.

- Orders from locations that you don’t serve.

Keep an eye out for these same red flags if you take orders over the phone or via mail order. Don’t hesitate to ask questions if anything about a purchase seems strange. When in doubt, wait to complete an order until and unless you can verify the cardholder’s identity. Report suspected fraud immediately to protect customers from financial complications.

4. Update your point of sale solution(s).

All business systems should be updated on a regular basis to address emerging security vulnerabilities and loopholes. If your payment processor or POS solution doesn’t offer automatic updates by default, either set them up yourself or commit to a regular update schedule.

Outdated hardware can also pose a real threat to data security. Manufacturers no longer release updates when they stop supporting old terminals or POS systems. That means known vulnerabilities are easy for hackers to exploit and can make your business a more attractive target.

5. Create a separate payment processing network.

You may choose to isolate your payment terminals or POS system from your main business network to minimize your PCI compliance scope and maximize your security. Handling payment processing on its own network protects customer data should a breach occur elsewhere in your company because hackers have to work harder to get at cardholder information after infiltrating the main system. Only those employees who need to use the payment network to fulfill their roles should be allowed access.

Protecting your customers’ data with secure payment processing keeps sensitive information out of hackers’ hands. Incorporate security best practices into your normal routine and continue to make improvements in card data security as your company grows!

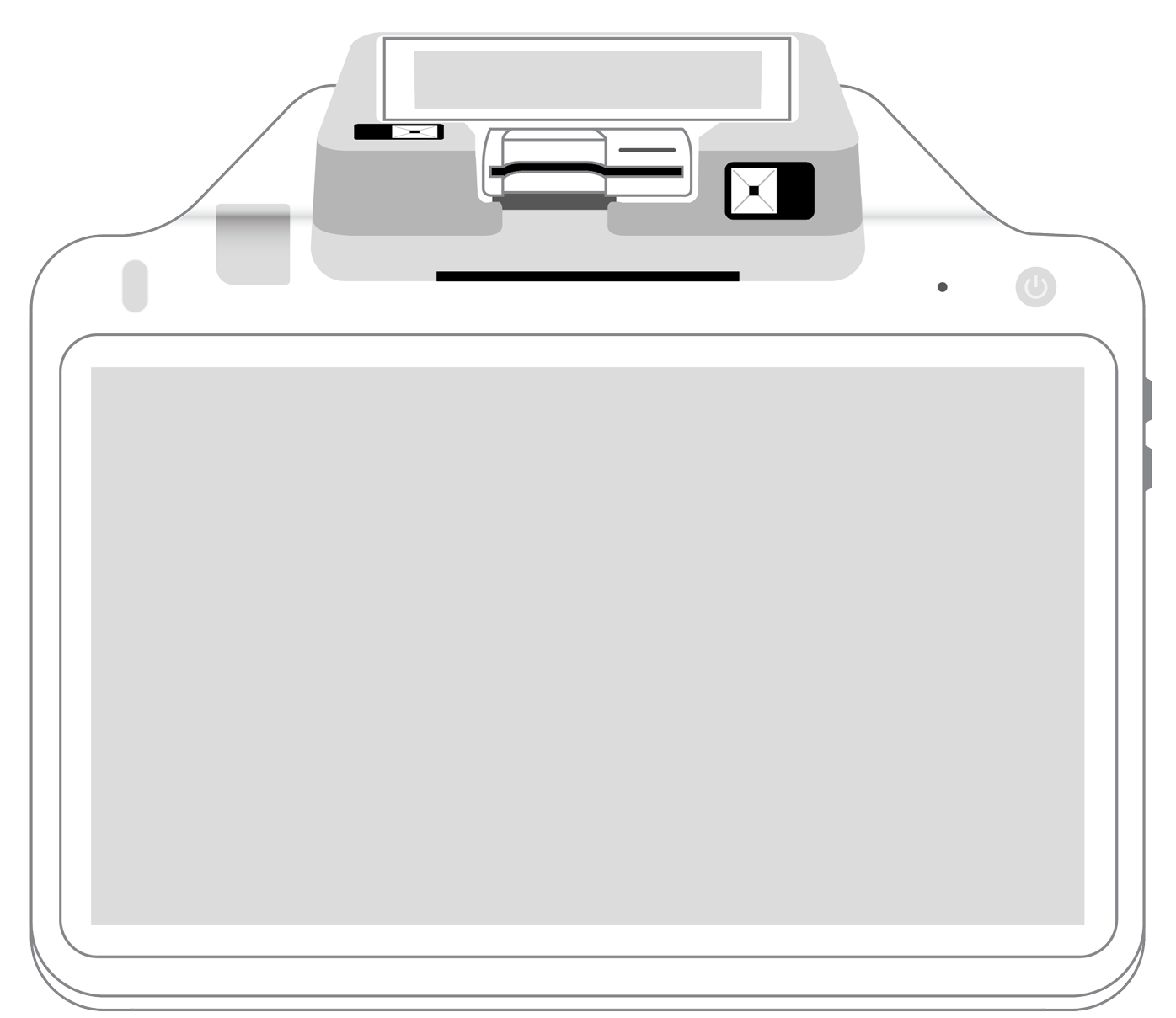

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||