Small Business Loan vs. Merchant Cash Advance

Small businesses often have a need for capital that they can’t meet on their own. Two financing options available are merchant cash advances and Small Business Administration loan guarantees.

Small businesses often have a need for capital that they can’t meet on their own. Two financing options available are merchant cash advances and Small Business Administration loan guarantees.

Merchant cash advances are available to most types of businesses with varying credit scores through a variety of companies, including Capital for Merchants. Here are seven facts about merchant cash advances from the AmeriMerchant blog:

- They are not loans, but advances against future receivables. Merchant cash advances give you capital and subtracts a percentage from your debit and credit card sales in order to repay the advance.

- You don’t need personal guarantees to qualify.

- You don’t need collateral.

- Approval is often granted within 24 hours.

- Money is usually transferred to your account in 7 to 10 days.

- You don’t need a business plan.

- There is no fixed monthly payment. Your monthly sales and cash flow determine payback, so you pay less when you earn less.

Small Business Administration (SBA) loan guarantees are bank-provided loans that are guaranteed by the SBA. Banks and other lenders are able to make loans they would not normally make because of the government guarantee in the event of default. Here are six things you need to know about SBA loan guarantees according to Microsoft Business:

- The process, which involves the government, involves paperwork and extra time. Mike Cafasso - Pueblo Bank & Trust president and chief executive officer - said, “If I have all the information on my desk that I require for approving a loan, I could do the loan the next day. With the SBA and its role in reviewing and guaranteeing the deal, that loan is likely to take a month or longer to be approved.”

- The full amount of money is not made available at once. You may need to provide purchase orders or invoices to receive funds. At times, the lender will make the check payable to your vendor. In some cases, you have to make payments from your existing funds and get reimbursement from the lender.

- SBA loans require personal guarantees from anyone owning 20% or more of the business. If the business assets cannot back the loan, your personal assets - including jointly owned assets - can be used. This means your spouse may have to sign on your loan.

- The interest rate on your SBA-guaranteed loan may be higher than that of a conventional loan. The real benefit of an SBA guaranteed loan is your ability to extend the term of the loan. A loan that may normally have to be repaid in five years could be extended to seven years with the SBA guarantee.

- There are fees attached to SBA guaranteed loans. There is an annual servicing fee on the outstanding balance of loans, and lenders are also charged a guarantee fee. On the other hand, SBA stops lenders from charging several fees including processing, application and brokerage fees.

- There is no special treatment for minority-owned businesses. While the SBA makes an effort to ensure that women and minorities are aware of SBA programs, money is not set aside specifically for those groups.

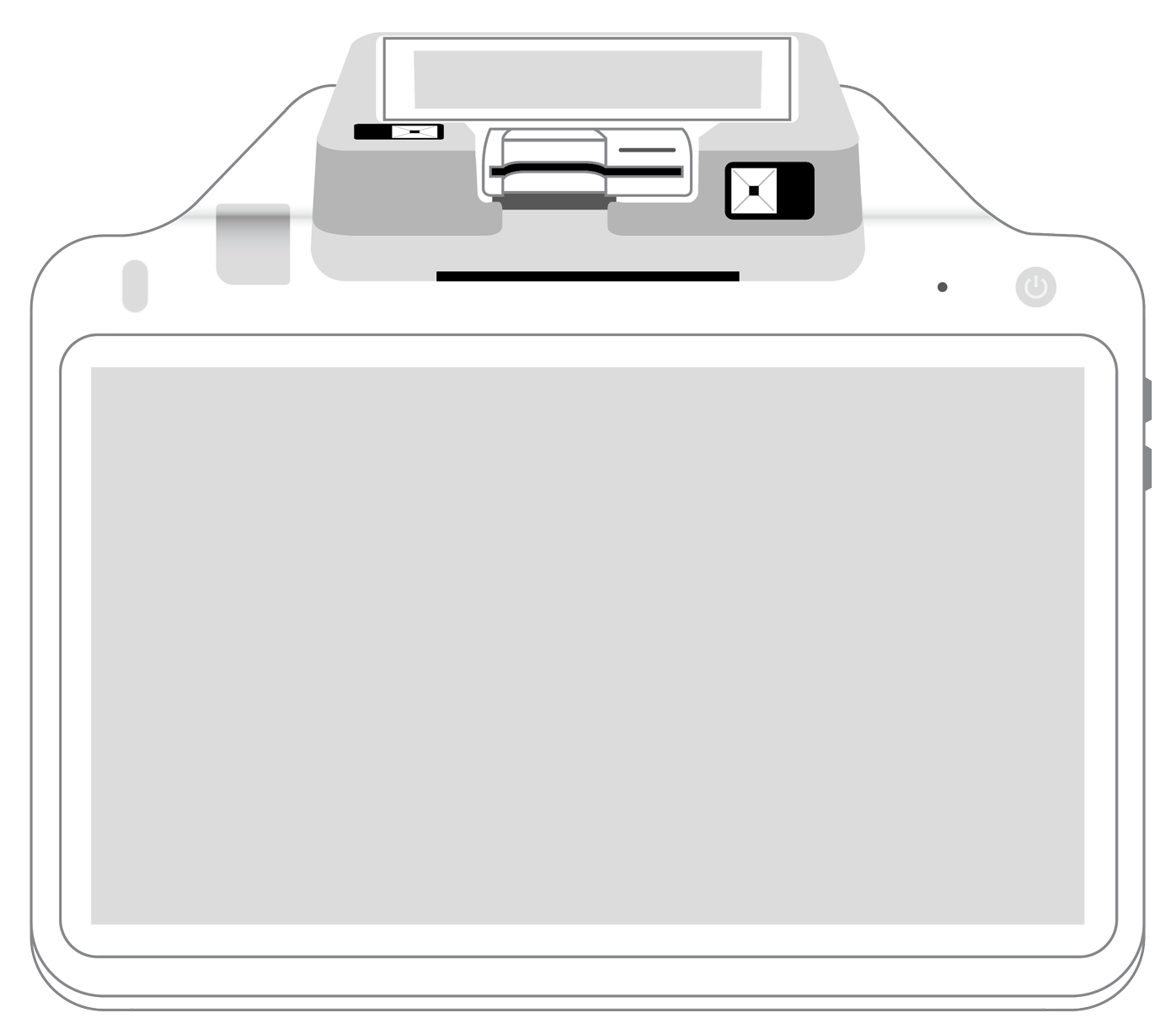

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||