Seven benefits of using a mobile POS solution.

Traditional point of sale (POS) systems now face robust competition in the form of their more convenient mobile counterparts. Most compelling of all their numerous advantages, modern mobile point of sale (mPOS) solutions come packed with every employee, inventory, customer relationships management, and reporting capability that you need. Think you’re doing just fine with your current stationary POS system? Take a few minutes to look at all the advantages that a mobile payment app and mobile credit card readers can bring to your retail business.

Mobile POS systems defined.

In its simplest form, mobile POS systems are cash registers that let you process various forms of payment from your customers. These can include cash, credit and debit cards, and digital payments. The system should allow you to provide your shoppers with numerous payment choices, including buy-now-pay-later, electronic bank transfers or echecks, and recurring or subscription billing.

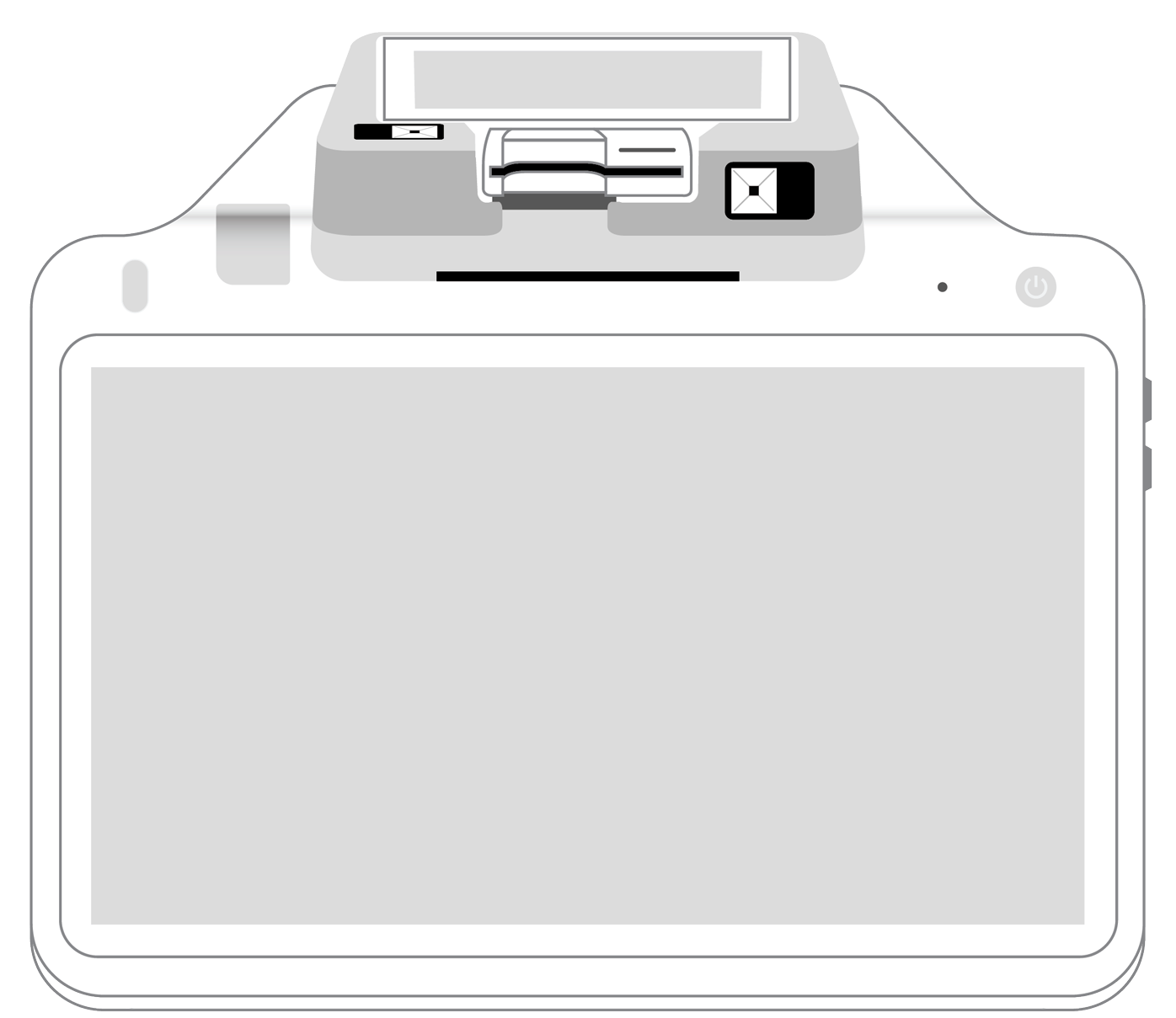

Today’s mobile POS solutions consist of a mobile payment app, and a credit and debit card reader. You can also bundle your mPOS with peripherals like barcode scanners and receipt printers to further streamline your operations. Here are just a few of the advantages that a mobile POS system can bring to your business.

1. Easy and stress-free checkout.

By their very nature, mPOS solutions are not tethered by wires to a physical checkout station. As a result, you can use them to accept payments from anywhere. Imagine completing a purchase right on the sales floor, out in the parking lot, at a customer’s home, or even across the country while you are exhibiting your wares at a product fair. Buyers no longer need to stand in long lines waiting for other people to fumble for cash or cards, and the process can be completed just as quickly or even faster than in the past.

2. Effective identity verification.

Whether it is with a PIN, facial ID, or fingerprint, consumers have become accustomed to authenticating their identity when using their smartphones. The process is fast and accurate, providing robust security throughout the payment process. As a result, you will experience lower incidences of fraud and other security breaches that can cost both time and money to resolve.

3. Easy setup.

Some mobile POS devices use no dedicated hardware other than a card reader. All you need to do is download the mobile payment app and attach your tablet or smartphone to an inexpensive card reader accessory. The mobile POS system’s cloud features ensure secure storage of sensitive data off-site to further enhance your security and keep you in compliance with the Payment Card Industry Data Security Standard (PCI DSS). Statistics about mobile payments bear out the popularity of this trend: Back in 2020, almost 54 percent of businesses had used a mobile POS system to process payments. Given the continued popularity of smart devices and the changes wrought by the pandemic, this trend shows no signs of slowing.

4. Seamless integration with other systems.

A new mobile POS solution fits effortlessly into the peripherals and software you are already using. With very little time or training, you can connect it to your current inventory management, accounting, marketing, and customer relationships systems. As a result, you will not lose any of your previous capabilities while gaining additional flexibility, portability, and security.

5. Valuable customer information with just a few clicks.

Just as is the case with a standard POS device, your mobile version should automatically record all purchases. As a result, you’ll have immediate access to vital information about shoppers, including their loyalty points, demographics, and purchase histories. When you are crafting your next targeted marketing campaign, this data can prove to be invaluable. With it, you can provide a unique, personalized shopping experience to each and every customer.

6. Cost-effective technology.

Investing in a mobile POS solution is much more economically practical than what you may have already experienced with a traditional solution. No longer do you need to pay for software upgrades and maintenance requirements. Because mobile POS solutions are cloud-based, you can get everything you need via one subscription that can be scaled up or down as your business needs fluctuate.

7. Contactless options make transactions safer.

When the coronavirus pandemic swept the world in early 2020, customers became increasingly aware of the importance of cleanliness and hygiene. Even now, after we have learned that the virus is not transmitted from the touching of surfaces, buyers continue to prefer to keep contact between themselves and foreign objects such as cash and merchants’ credit card equipment to a minimum.

A mobile POS solution can come equipped with card readers that are outfitted with near-field communication (NFC) technology that communicates with consumers’ phones. As long as shoppers have entered their card payment information into their digital wallets, all they need to do is to place the device within a few inches of the merchant’s reader. Within a matter of seconds, the payment can then be securely processed without any physical interaction occurring between buyer and seller. Offering this contactless option to your customers shows them that you care about their well-being without compromising digital security.

Today’s technology helps to pack a great deal of power and flexibility into very small packages, and mobile POS solutions offer some of the most compelling proof of this fact. Incorporating these modern and mobile marvels into your business model is easy and affordable, and they can provide you and your customers with a wide array of advantages. Integrate the flexibility, scalability, security, and customer focus that a mobile POS system can bring to your business, and you and your valued customers will instantly enjoy the benefits.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||