Should you adopt tap-to-pay technology?

When you are a conscientious business owner striving for success, one of your main priorities should be to focus on providing your patrons with what they want. This philosophy not only extends to the products they are demanding and the excellent service they deserve but also to providing them with flexibility and innovation when it comes to how they make their payments. One of the simplest and most effective steps you can take to make this happen is to add a tap-to-pay reader to your point of sale (POS) configuration.

What is tap-to-pay?

The secret behind this touchless way to make and receive payments is near-field communication (NFC) technology, a set of short-range wireless protocols that allows two devices to communicate with each other. The inductive coupling on the two devices’ antennas allows for “dialogue” to occur in one or both directions. In the case of contactless payments, the two devices consist of the customer’s smartphone or wearable and the merchant’s NFC card reader.

Built into every modern smartphone is a digital wallet application that can serve as a repository for the user’s credit and debit card payment data. At the time of purchase, the customer simply opens the digital wallet application, and authenticates their identity with a PIN, facial ID, or fingerprint. Then they hold the device four centimeters or less from the merchant’s tap to pay card reader. The necessary information is transmitted securely from wallet to reader, encrypted and tokenized, and sent on to the payment processing company as well as the other players in the process. Within a matter of seconds, the transaction is complete.

Increasingly, consumers are adopting tap-to-pay, but should you? Given the factors involved in upgrading, is it worthwhile? Take a few minutes to see how the benefits of this mobile payments solution can work for your business and your valued customers.

Better affordability.

It might surprise you to learn that contactless card readers are widely available and can be obtained at a low cost or even for free from your payment processor. In fact, your current devices might even be capable of accepting touchless payments, needing only to be authorized and set up. Even if you do need to switch out your current hardware, doing so should not create a heavy budgetary burden.

Increased hygiene.

For generations, we have understood that germs and viruses can be spread in several ways, among them via touching contaminated surfaces and handling germ-ridden bills and coins. When the coronavirus pandemic hit, consumers and merchants alike became hyper-aware of these dangers and consequently began to embrace the contactless payment technology that already existed.

Over time, we have learned that COVID-19 is not primarily transmitted when we touch surfaces. Even so, the popularity of contact-free payments continues to rise to new heights. Buyers and sellers alike appreciate the added reassurance to be found when there is no physical contact between the parties involved in a purchase. Moreover, customers appreciate it when retailers make health and safety a priority by instituting these more hygienic payment options.

Added efficiency.

No one likes long lines at the checkout counter. They frustrate buyers, who would much rather be getting on with their lives. Furthermore, they aggravate staff, preventing your associates from completing other important tasks. These delays can happen when customers are fumbling for cash or credit cards or are painstakingly writing out checks.

Once a business incorporates tap-to-pay into its checkout, lines move much more quickly. That’s because most customers’ phones or wearable devices are readily accessible, and the payment process only requires a brief tap or wave.

Enhanced security.

Although touchless payments are incredibly fast, their security is of the highest standard. This is due to certified, point-to-point encryption and tokenization technology that renders the customer’s data unusable to hackers. When credit card data is sent from device to reader, it is converted into a single-use string of random digits and characters that, even if stolen, can never lead a criminal back to the actual number. Only the customer’s card company has the “key” to unlock the token and allow the funds to be transferred into the merchant’s account.

Seamless integration with other programs and systems.

When you upgrade to contactless readers, you shouldn’t need to sacrifice any of the other elements that already make your POS system so valuable to you and your customers. You’ll be able to keep your customer loyalty program strong while maintaining your existing accounting, inventory, and payroll practices. All that will happen when you update your hardware is that you will be able to offer additional (and popular) payment options to your customers.

Although the coronavirus seems to be gradually transitioning from pandemic to endemic status, its effects continue to reverberate through our culture. As a business owner, one of the easiest and best steps you can take to adapt your business is to adopt touchless payment technology. Add it to the array of payment alternatives available to your shoppers and you will soon wonder why you didn’t take this step sooner!

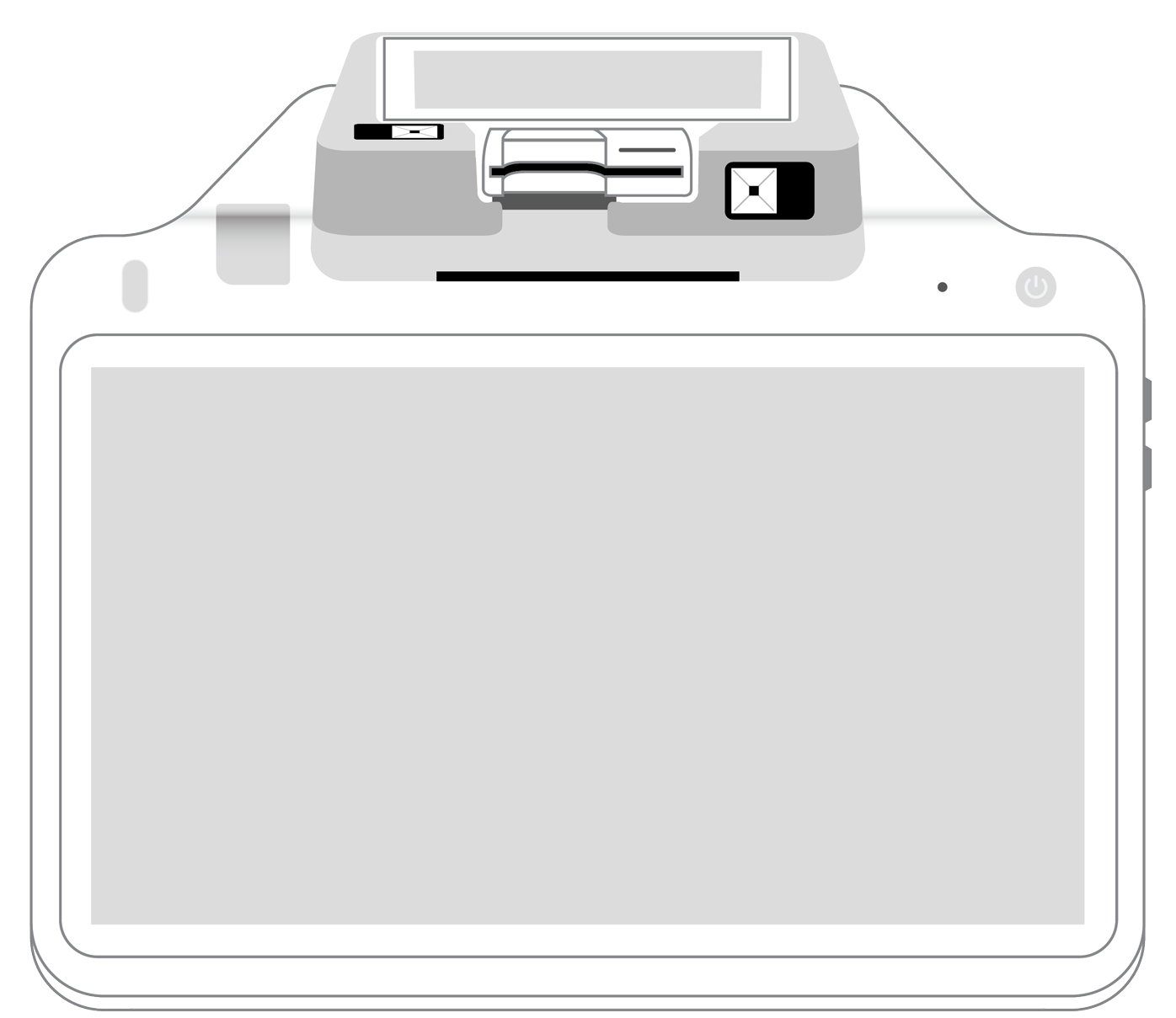

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||