Should you chase down overdue invoices?

When clients fail to pay their bills on time, it creates a negative snowball effect for your business.

While some tardy bills do get paid when a customer realizes that they have forgotten their obligations, many others require more direct and immediate steps from you in order to mitigate the situation.

Don’t just put these lagging invoices on the back burner, creating more budgetary strife and stress. Instead, follow some tried-and-true suggestions.

How late payments can drag down your business.

Late payments can severely impact your business by disrupting cash flow, leading to difficulties in paying vendors, suppliers, and employees, as well as risking missed loan repayments and damaged credit.

When customers’ bills are past due, you can experience many damaging consequences. These include being unable to pay your own bills to vendors and suppliers, problems making your payroll, missed loan repayments, and even the destruction of your credit over time.

It goes without saying that cash flow is the lifeblood of your business. When delinquent invoices block their smooth progress throughout your operations, problems quickly arise.

Before very long, you have fewer dollars in your purse, which means that you quickly start to have difficulty making good on your own bills. This affects not just payments to vendors and suppliers but also your own payroll.

If you have taken out any loans to shore up your operations or as part of your launch, making your required payments might start to become onerous. If the worst comes to worst and you miss a few, your credit will suffer.

If you are sick of late payments because of the burdens they are placing on your company, the time has come to take direct action to nip them in the bud.

The causes of late payments.

Late payments stem from several sources. These include inefficient collection processes by the business, shoddy record-keeping on the part of the customer, and inability to pay.

Before coming up with ways to reduce tardy payments and learning how to handle late-paying customers, it makes sense to understand where these tardy billing practices come from in the first place.

One of the most common sources occurs when the business receiving the payment has poor or inefficient processes. This usually manifests via a failure to send reminders of a bill that is due, a lack of various ways to resolve the invoices such as a payment link to streamline the process, and shortcomings in the customer service systems that should address questions and concerns expertly and promptly.

Another common issue occurs if your customers don’t have a reliable system for keeping track of what they owe. Whether your client is another business or an individual, attempting to manage invoices manually frequently leads to errors and oversights that ultimately mean that the bill remains unpaid until you make an effort to chase it down.

Finally, the fact is that customers can have financial problems of their own that force them to delay their funds transfer to you. Perhaps the client cannot pay the entire amount all at once, or maybe the two of you are in the middle of a dispute, meaning that the payment will not be made until the issue has been settled.

It is also possible that the customer would prefer to pay using a vehicle other than via check or credit card, i.e., payment link, ACH transfer, digital wallet, etc. No matter what the cause, these late payments need to be minimized as much as possible.

Methods to cut down late payments.

Bringing down your delinquent invoice levels is a necessity for your success. Do so by standardizing your accounts receivable procedures, automating payment reminders, furnishing various payment options, refining the credit process, and efficiently managing disputes.

Begin by firming up your accounts receivable infrastructure. Unify your practices, using the same collections process across the board. Bring an accounts receivable management solution on board to assist with sending customized messages to different segments of your customers based on risk, geography, or industry. These streamlined processes will lead to better communication and efficiency that will allow you to devote resources to other important tasks.

Another great strategy is to automate your payment reminders. This nudges customers to resolve their bills on time, preventing the need for implementing a late payment procedure for that person.

If this fails to work, and the invoices become past due, you can use the same systems to generate a series of bills that provide actionable solutions for resolving the bill in full or making other arrangements with your staff.

One way to make this happen is to offer several payment options. In addition to credit or debit cards and checks, choices can include ACH e-check transfers, digital wallets, and alternative methods such as recurring installment billing.

If your initial efforts to resolve a late payment fail to get a response, get personal. Via email or one-on-one, remind the client of their responsibility. Do so empathetically, stating that you understand how financial challenges and numerous responsibilities can lead to an unpaid bill. Demonstrate your compassion by offering several ways to ease the payment process, including installments, and an extension of the due date.

Next, late payments should be reduced by being careful about customer credit. Monitor it, giving it only to those who can demonstrate low credit risk. This can be done via automated systems that can accomplish the task with speed and accuracy.

Finally, make disputes as painless as possible. They are inevitable, but investing in an accounts receivable automation platform consolidates data, making it visible to everyone involved in the process. This leads to more efficient collaboration and speedier resolutions.

Late payments can eat away at your time, rob you of vital resources, and damage relationships with vendors and customers. While you will never be able to banish them from your business altogether, implementing a series of prescribed, proactive measures can go a long way toward bringing them down to a very manageable level.

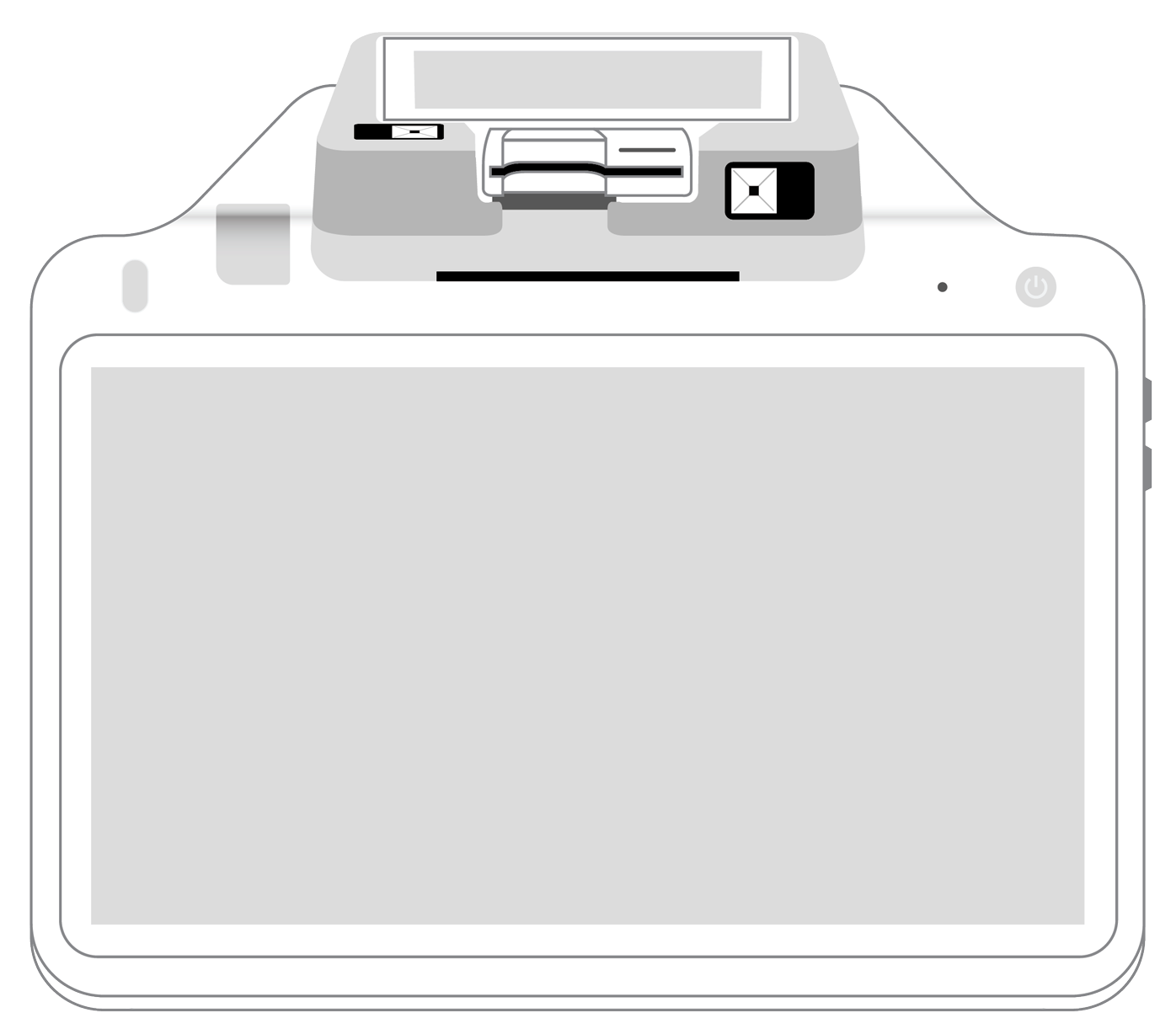

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||