Should Your Small Business Accept Mobile Payments?

Apple Pay has made mobile payments a mainstream form of payment, and you may be wondering, as a small business owner, if you should start accepting mobile payments at your business. Sure, it can be an added convenience for your customers, but do the benefits to your business outweigh the potential costs?

Apple Pay has made mobile payments a mainstream form of payment, and you may be wondering, as a small business owner, if you should start accepting mobile payments at your business. Sure, it can be an added convenience for your customers, but do the benefits to your business outweigh the potential costs?

In an article on Business News Daily, Gregory Mann, chief marketing officer for LoopPay, said he thinks mobile payments will, in the next few years, become a standard point of sale (POS) option.

“In [a small business], the decisions you make today affect you years from now," Mann said in the Business News Daily article. "You have limited funds and watch every dollar. You have to decide when and where to make an investment."

If you own a service-based business, accepting mobile payments, like Apple Pay or other form of NFC payments, may not make sense. However, if you own a brick-and-mortar shop – something like a clothes boutique, salon, coffee shop or bakery – mobile payment acceptance might bring in new customers and help increase your profits.

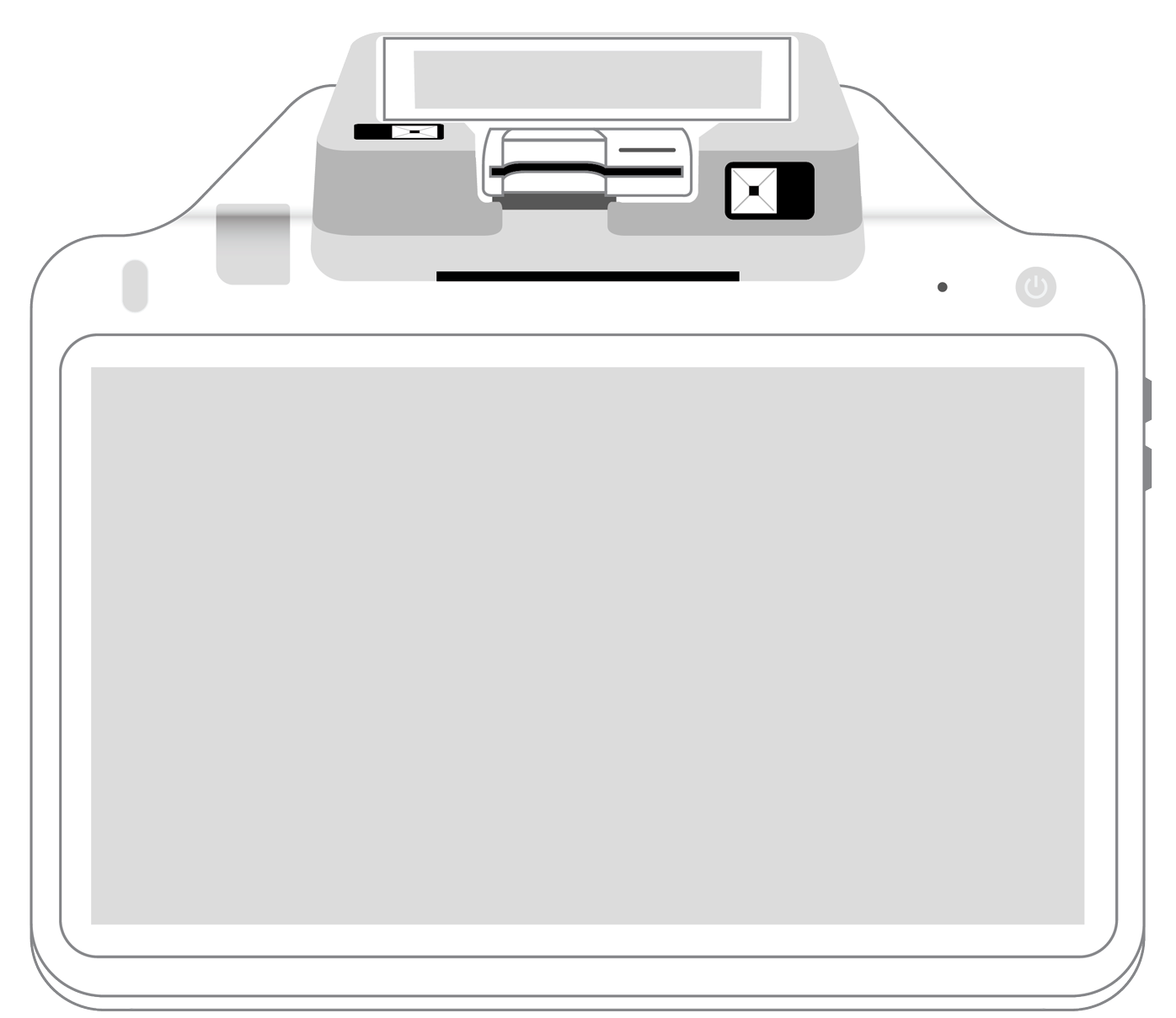

There are a variety of equipment options available at a variety of prices – all depending on your business needs. To figure out which is best for you, do your research and talk to companies that can help set you up with a machine tailored to your business. PayAnywhere offers a variety of options for a variety of business types. To learn more, visit www.payanywhere.com.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||