Simple, speedy, and fun: Contactless transactions are here to stay.

Not so long ago, paying for goods and services was slow and excruciating at worst and boring at best. However, today’s contactless card readers have turned that old-school tedious transaction into an almost magical dialogue that is intuitive, fast, and secure. Take a little time to understand contactless payments, and you will quickly recognize how they can take your retail operation to the next level with your valued customers.

What are contactless payments?

Readers, smartphones, and other devices that feature contactless capabilities can do so because of an innovation called near-field communications (NFC) technology. This radio-frequency identification antenna equipment enables devices to interact with each other at close range, no less than two inches apart.

Communication between devices can either be active or passive. An example of a passive transaction occurs when a customer places their credit card that has payment information embedded onto a chip near an active NFC reader. On the other hand, active NFC payments require that both of the involved devices supply power. An example is a payment that takes place between a smartphone and a seller’s NFC point of sale reader. In this case, both entities are passing data back and forth.

Contactless methods.

At this point, there are three main avenues that people can use in the contactless arena. They include the following.

- Debit and credit cards. Both the front or back of the credit or debit card and the merchant’s reader must be marked with a specific four-line radio wave symbol. To accept a payment, first, check that your reader and/or terminal contain the appropriate logo. The terminal will prompt the customer to pay, at which time they should bring their card within two inches of the terminal. Once the terminal beeps or shows a green check mark, the payment transaction is successful and complete.

- Mobile payment applications. Common examples are Apple Pay, Google Pay, and Samsung Pay. These transactions do not require the use of a plastic card but can occur simply via a smartphone or wearable device and an app. When the customer hovers their device over the merchant’s reader, the terminal activates the mobile app that contains the necessary payment details and passes them on to the payment terminal for processing.

- Wearables. Devices like fitness trackers and smartwatches are eliminating the need for shoppers to fumble for their phones in pockets and purses. Instead, a user first ensures that their device is equipped for contactless payments and, if it is, pre-loads their bank and card information into the digital wallet. At the time of purchase, the customer looks for the payment prompt on the merchant’s terminal and then brings their wearable one to two inches away from the contactless payment symbol on the terminal. The payment is complete when there is a beep, a green light or a check mark.

Why you should incorporate contactless payments into your brick-and-mortar business.

Your payment processor may have already introduced you to the possibility of incorporating contactless payments into your operations. Perhaps you questioned whether taking this step was worth the time and additional staff training that it would entail. The following benefits of this type of payment might help you to decide.

- Faster transactions. As the name implies, a customer only needs to tap or wave their card, smartphone, or wearable device near your contactless reader. Almost instantaneously, the necessary details are securely transmitted, the customer’s identity is authenticated, and the payment is either approved or declined. This entire process takes less time than a traditional credit card transaction and is definitely much faster than fumbling for cash.

- Enhanced security. Contactless payments may occur in a flash, but that doesn’t mean that the integrity of the exchanged information is compromised. In fact, security is safeguarded in several ways. First, the customer’s information is tokenized, a process that involves substituting bank information with a series of random digits and characters. The token is unique to the customer and useless to hackers. Second, data is encrypted such that it is only valid for that single transaction. Finally, the user may be asked to provide two-factor verification of identity via PIN passcode, fingerprint, or facial ID to provide yet another layer of authentication.

- Greater convenience. With every year that goes by, cash fades further into the background. At this point, many people even choose to leave their plastic behind in favor of paying solely via their smartphones and wearable devices. Going cashless is great for both customers and merchants, reducing the likelihood of becoming a victim of crime. Additionally, it causes a permanent electronic record of purchases to be kept that both parties can access at a later date.

- Popularity with younger shoppers. Gen Z consumers are all the more captivated when completing their purchase becomes fast, fun, and frustration-free thanks to contactless payments. Furthermore, proof of purchase can be emailed in an instant, eliminating the inconvenience and paper waste caused by standard printed receipts.

Given these many upsides, it’s no wonder that contactless payments are destined to become a fixture for today’s and tomorrow’s in-store purchases.

In today’s highly competitive and health-conscious commercial environment, payment speed, security, and safety are all vitally important. Contactless transactions check all of these boxes, providing merchants and buyers with everything they need. If you have not yet talked to your payment processor about updating to contactless card readers, the time has come to have this important, game-changing conversation.

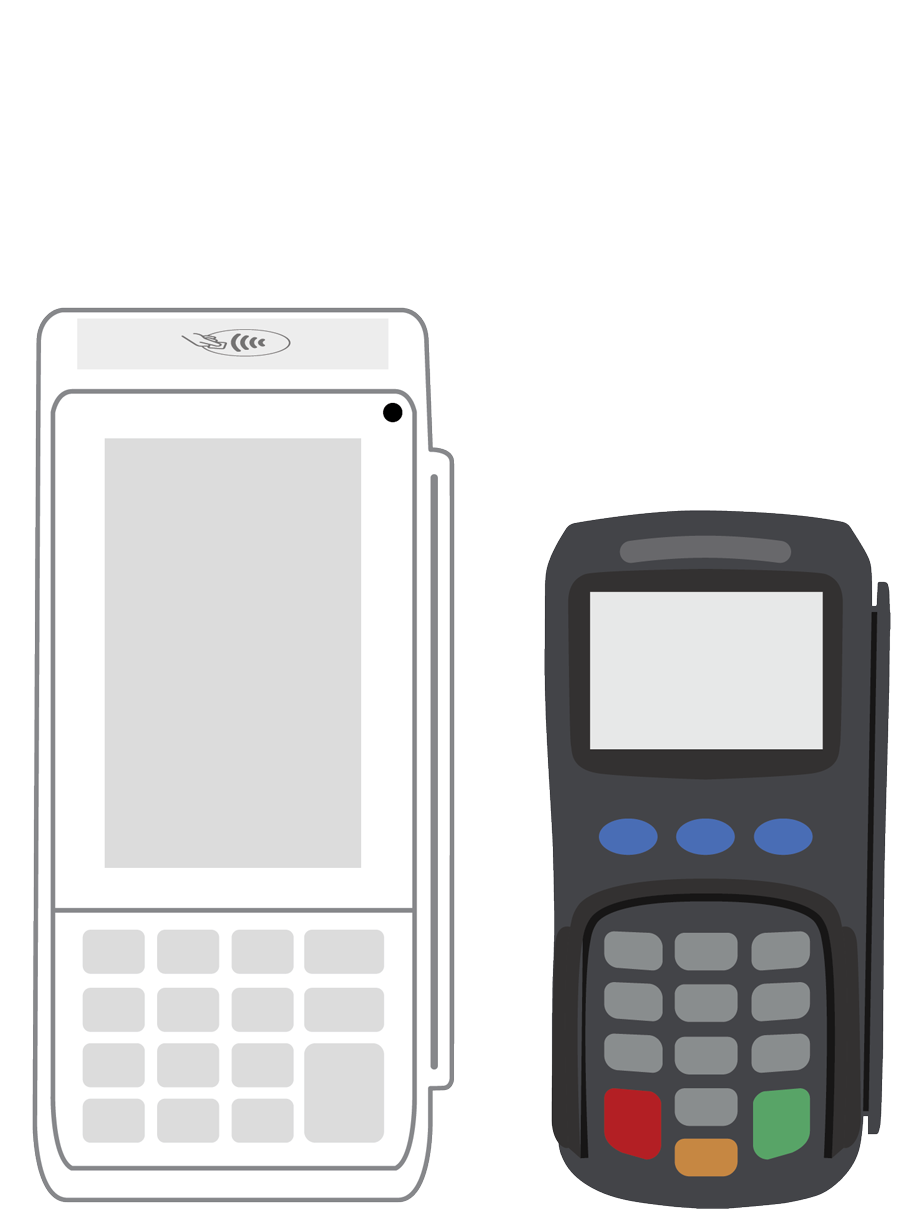

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||